Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

The Code Zone

207 members • Free

CFO Skillsets

44 members • Free

Financial Management Academy

40 members • Free

Skool of Finance

469 members • Free

AI CodeForge

84 members • Free

AI Cyber Value Creators

7.5k members • Free

Vibe Coders

640 members • Free

Carline Dad Codes

20 members • Free

Cyber Careers Community

2.6k members • Free

23 contributions to Energy Data Scientist

Commodities Report: Copper Prices Are Rising

A new Energy Industry report has been uploaded to the Classroom section (6.2 - Industry Reports). This report examines the growing gap between copper supply and demand, driven by AI data centers, renewable energy grids, and military spending, while existing mines age and new deposits become increasingly rare and difficult to develop. Sources: My commentary combined with the following: [1] The Economist: https://www.economist.com/science-and-technology/2025/02/26/the-skyrocketing-demand-for-minerals-will-require-new-technologies [2] Financial Times: https://www.ft.com/content/ed785287-c4db-4840-a90b-426fbd41bb5b [3] Wall Street Journal: https://www.wsj.com/finance/commodities-futures/mining-megadeal-shows-the-world-is-crazy-for-copper-3829316f [4] Investors Chronicle: https://www.investorschronicle.co.uk/content/c34da52d-7a54-46f5-aa36-0daae29587cd

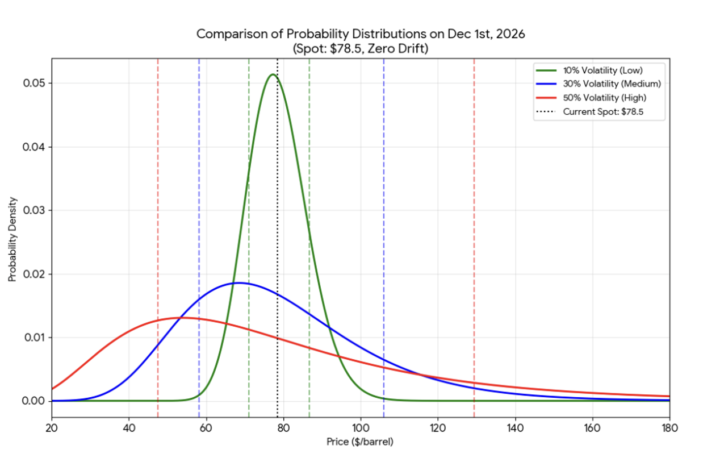

New Video: Volatility in Option Pricing for Crude Oil

A new video has been uploaded in the Online Course 5.20 in the Classroom. This course focuses on option contracts for crude oil, where the underlying asset is the spot price. An option contract is signed between two parties/ companies . Every option contract applies to an asset . This asset is known as “underlying”. So this course is about option contracts that have the crude oil as their underlying asset. The company that owns the option contract can exercise it until it expires. There is no obligation to exercise it. This is why it is called “option contract”. The company will exercise it only if it makes economic sense ie if it makes a profit. The video focuses on the “volatility” concept of option contracts . The video explains that the spot price of crude oil follows a probability distribution called : lognormal distribution. The attached plot, explained in the video, visualizes this concept. It shows how higher volatility (the red line) creates a much wider range of possible spot price outcomes compared to lower volatility (the green line). So a higher volatility means that in the future , the spot price of crude oil is more uncertain than if the volatility was lower. So volatility is similar to uncertainty . And it is visualized as a probability distribution that is wider. This plot shows the spot price of crude oil one year from today. One year from today this price is uncertain . The spot price of oil follows the log normal distribution . This distribution has a different shape depending on the volatility . Here we look at values for volatility of 10%, 30% and 50%. This is a fundamental plot and analysis for any quantitive finance / energy career . This specific plot has been part of multiple interviews for years . This plot is analyzed in the video using simple language. If you have any questions please contact me. I want this concept to be as clear as possible .

The Oil Forward Contract Saudi Aramco - Sinopec Explained

The video below describes how the companies 'are thinking' before signing a forward contract. This video has also been added to the online course 5.19 in the Classroom. This process is very simple. This is also an interview question for energy + economics + finance roles of various levels. From commodities trading, to investment banking, and from energy consultants to energy quants and energy data scientists. It is a very popular question. Interview Question and an interesting case study to know: The Saudi Aramco - Sinopec crude oil forward contract. Beginner-friendly explanation (no 'scary' jargon used . No prerequisites needed). The video focuses on the forward contract that Saudi Aramco signed with Sinopec. The details of the contract are private so we are using example dates. On the 1st of December 2025 , the two companies signed a forward contract on crude oil , where Saudi Aramco agreed to produce and sell 250 000 barrels of crude oil and ship it from Saudi Arabia to China, where Sinopec is. The delivery date will be months into the future i.e. 1st of September 2026. Sinopec needs crude oil because it has refineries. These are facilities that use crude oil to produce diesel, jet fuel and other 'refined' products. Siniopec needs crude oil therefore. So they decided on the price of $77.5 / barrel. Here is how they decided on this price: a) They used machine learning to find a reasonable upper bound (maximum value) and lower bound on the spot crude oil price on the delivery date i.e. 1st of September 2026. b) In between these two bounds, they assume possible values for the spot price of crude oil. For each value they calculate the PnL index (profit and loss). PnL = (spot price - forward price)* quantity of crude oil.So if spot price on delivery date is $60/barrel and forward price is $77.5 , then we find the spread (difference) and multiply it with the 250,000 barrels of crude oil agreed in the forward contract. This is the PnL for the buyer (Sinopec) ,and it is negative (bad deal).The whole process is described in this video.

Materials needed on Intelligent Automation of Energy Audit with AI

Good morning all, Please I need any materials, suggestions and if possible some past Energy Audit reports for buildings or data centers or hospital or commercial facilities etc. That will give an idea on how the manual/traditional way works so that I can use AI Thank you

1 like • 17d

I searched before! They don't publish it ! getting raw, recent reports from private companies is difficult because they contain sensitive operational data and billing info. You are better off looking for open-data portals, which will give you the numbers you need for AI training without the legal stuff . Like the above links !

Nuclear Outlook

Are there any reports, current documents, and reports related to the nuclear sector and SMR that you can recommend, as well as a synthesis of the nuclear situation within WEO 2025?

1-10 of 23

Active 11h ago

Joined Sep 23, 2025

ESFP

Asunción