Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

AI Automation First Client

1.2k members • Free

AI Automation (A-Z)

131.9k members • Free

AI Automation Agency Hub

293.9k members • Free

AI Automation Society

257.5k members • Free

38 contributions to AI Automation Society

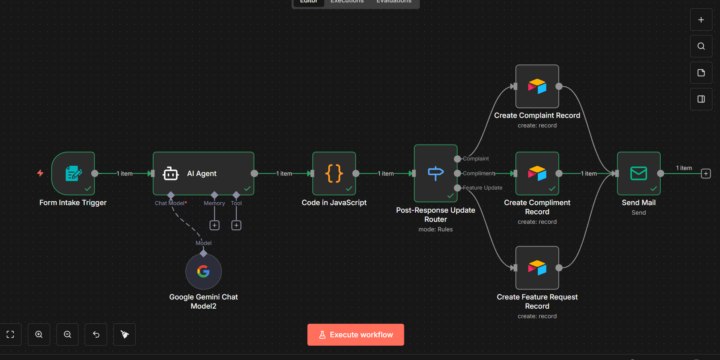

AI-Powered Customer Feedback & Support Automation System

Client: Sharda Fashion Mall Built with: · n8n · AI Agents (Gemini) · JavaScript Logic · Airtable · Email Automation Project Value: $300 Ongoing Maintenance: $50/month The Automation I Built (n8n + AI) Form Submission → AI Understanding → Smart Routing → Record Creation → Automated Response 1. Customers submit feedback through a form 2. AI Agent analyzes and identifies intent 3. Custom logic structures the data cleanly 4. Feedback is automatically categorized into: Complaints, Compliments, Feature Requests 5. Each category is saved as structured records in Airtable 6. A professional email response is sent instantly to the customer Key Use Cases ✅ Customer support automation ✅ Complaint tracking system ✅ Product improvement feedback ✅ Service quality monitoring ✅ Faster and consistent responses ⚡ Business Outcomes ✔ No manual sorting of feedback ✔ Faster customer communication ✔ Centralized feedback database ✔ Better customer experience ✔ Scalable support process Why This Matters for Retail Businesses Retail brands like Sharda Fashion Mall depend heavily on customer experience. This automation ensures every customer voice is captured, acted on, and responded to professionally — without increasing operational workload.

Said No to 10% Equity - Took 3% Revenue Share - Made $168K Year One 🔥

Healthcare startup offered 10% equity valued at $300K on paper. Took 3% revenue share instead. Made $168,000 cash year one. Still collecting monthly. No vesting. No exit dependency. THE OFFER: Building clinic management platform. Needed patient intake automation built. Founder pitch: "We're raising Series A next quarter at $3M valuation. 10% equity for you. That's $300K value for the automation work." Sounded amazing. Until I did the math. THE EQUITY MATH: 10% of $3M = $300K valuation But: - IF they raise at $3M (valuations fluctuate) - IF I vest (2 year cliff, 4 year total) - IF they exit (5-7 years minimum, 50% of startups fail) - IF my shares aren't diluted (Series B, C will dilute heavily) My cash flow year 1-2: $0 My guarantee: Nothing THE ALTERNATIVE I PROPOSED: Me: "What if I take 3% of revenue from the intake automation feature instead?" Them: "Revenue share? That's unusual for contractors." Me: "Your intake volume is going to 10X this year as you add clinics. 3% of growing revenue beats static equity. Plus I need cash flow, not lottery tickets." THE DEAL STRUCTURE: Payment terms: - $10,000 upfront for initial build - 3% of monthly intake automation revenue (billed monthly) - Tiered scaling as volume increases - No equity, no vesting, no exit dependency YEAR ONE PERFORMANCE: Upfront payment: $10,000 Revenue share monthly: - Month 1-3: $4,200/month (initial rollout to 2 clinics) - Month 4-8: $12,400/month (expanded to 8 clinics) - Month 9-12: $18,600/month (full 15-clinic deployment) Total year one: $168,000 cash collected Their equity: Still private company. Still worth $0 in cash terms. YEAR TWO (CURRENT): Revenue share: $18,800-$19,000/month (at my cap, maintaining) Total collected over 2 years: $336,000+ That "small" revenue share already paid more than most equity would in 10 years. THE PROTECTION CLAUSES I NEGOTIATED: - Monthly payment (not annual lump sum - maintains steady cash flow) - Revenue-based calculation (not profit-based - can't hide in accounting)

🔥

1 like • 12h

This is a great real-world example of why cash flow often beats paper equity for service providers. The way you structured revenue share with protections makes it both scalable and low risk, and the year-one numbers speak for themselves. Smart negotiating and even smarter thinking long term.

🚀New Video: The Only Cold Email You Need to Get AI Clients

In this episode, I brought on Suvam. He generated over $500,000 in sales opportunities in six months using cold email as a beginner. The core lesson is to sell the outcome first and build after commitment. Suvam overcame the trust barrier with a zero-risk offer: doing the work for free in exchange for a case study reference. This worked so well that one free client became his first paying client and the social proof nearly doubled his reply rates. His playbook uses AI to find pre-filtered niche databases, not massive lead directories, and employs a simple 4-step automation for personalization at scale.

Rejected 73 Prospects Year One - Built Business on the 10% 😱

Said yes to everyone year one. Any industry. Any problem. Any budget. Result: $27,600 revenue, burned out by month 6. Year two: Rejected 73 prospects. Focused on 10%. Revenue: $51,200. THE MISTAKE EVERYONE MAKES: Desperate for revenue. Said yes to everything: - Podcast workflow automation - Social media scheduling - E-commerce inventory - Newsletter tools - CRM setup - Random Zapier requests 11 different industries. 23 clients. Generic solutions. Price competition. Constant context switching. THE MOMENT THAT CHANGED EVERYTHING: Tuesday morning. Email: "Can you automate our podcast editing workflow?" Me internally: "I have zero experience with podcast production." Me externally: "Sure, I can figure it out." Spent 40 hours learning podcast tools. Built mediocre automation. Made $800. Got zero referrals (wasn't actually an expert). Same week: Turned down invoice processing inquiry. "Too busy with podcast project." That invoice inquiry went to competitor. Became $18,000 annual contract. I chose $800 podcast project over $18,000 invoice contract because I couldn't say no. THE NEW CRITERIA: I ONLY say yes to: - Document-heavy workflows (my actual expertise) - Recurring monthly volume (ongoing revenue, not one-time projects) - Industries with tight networks (healthcare, legal, accounting, real estate) - Budgets over $3,000 setup (serious buyers, not tire-kickers) Everything else: Polite decline + referral to better-fit consultant. THE RESULTS: YEAR 1 (saying yes to everything): - Clients: 23 - Average project value: $1,200 - Industries: 11 different - Referrals generated: 3 total - Revenue: $27,600 - Mental state: Burned out YEAR 2 (rejecting 90%): - Clients: 8 - Average project value: $6,400 - Industries: 3 focused (healthcare, legal, real estate) - Referrals generated: 19 total - Revenue: $51,200 - Mental state: Sustainable WHAT HAPPENED WHEN I SPECIALIZED: Referrals exploded: - Healthcare attorney → referred 3 other healthcare attorneys

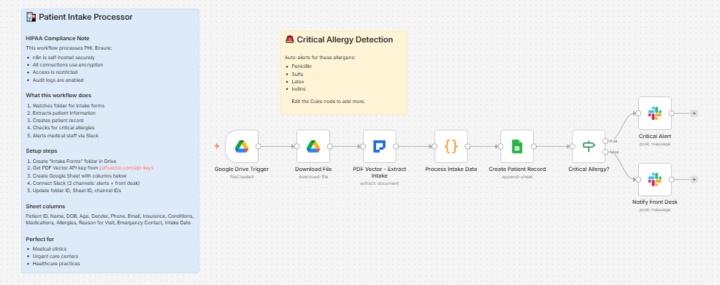

Patient Intake Processor Alerts on Critical Allergies Instantly (8 Nodes) 🔥

Medical clinic. Patient fills intake form. Someone types it all into system. Allergy information buried on page 3. Built intake processor. Critical allergies trigger instant alert. Different Slack channel. Staff knows immediately. THE HEALTHCARE DOCUMENTATION RISK: Penicillin allergy on form. Nurse doesn't see it until patient is in room. Doctor almost prescribes it. Near miss. Documentation existed. Wasn't surfaced fast enough. THE DISCOVERY: Document extraction pulls complete patient information. Code checks allergies against critical list. Different routing based on severity. Critical allergies go to urgent channel. Everyone sees it. THE WORKFLOW: Google Drive trigger watches intake forms → Download PDF → Document extraction pulls patient info, insurance, medical history, medications, allergies → Code processes and checks for critical allergens → Sheets creates patient record → IF checks critical allergy → TRUE: Slack urgent channel alert → FALSE: Slack routine intake notification. 8 nodes. HIPAA-aware design. THE CRITICAL ALLERGY DETECTION: Code maintains critical allergen array: penicillin, sulfa, latex, iodine, aspirin, nsaids. Patient allergy list checked against array. Any match triggers urgent routing. Different Slack channels: #critical-alerts vs #patient-intake. Staff knows the difference. THE DATA EXTRACTION: JSON Schema captures: Patient info (name, DOB, contact), insurance details, medical history, current medications with dosages, allergies with reaction severity, emergency contact, reason for visit. Code calculates age from DOB. Formats medications list. Flags "NKDA" if no allergies. THE TRANSFORMATION: Before: Manual data entry. Allergy information buried. Near misses happen. After: Automatic extraction. Critical allergies surfaced instantly. Staff prepared. THE NUMBERS: 200 intake forms monthly 6 critical allergens monitored Instant alert on match Data entry: 15 minutes → 2 minutes review HIPAA NOTE: Self-hosted n8n recommended for PHI.

1-10 of 38

🔥

@anish-khan-1984

Curious learner, exploring the world of tech, data, and innovation. Always looking to learn and grow

Active 1h ago

Joined Nov 6, 2025

Powered by