Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Viral Ai Video Wizards

1.8k members • $9/month

AI Automation Mastery

10k members • Free

LIT Academy

73 members • $49/m

Traders' Mindset

1.3k members • Free

7 contributions to Traders' Mindset

Connect: Share Your Trading Story 📈

Welcome to an exciting exchange in our community. It's time for us to get to know each other better and grow together. Tell us about yourself: - Your Background: A brief introduction to you and your trading level 🚀. - Your Markets: Which markets fascinate you? 🌍 - Your Experience: How long have you been trading? ⏳ - Your Tools: What software do you use? 💻 - Your Goals: What are you looking for here? What are your aspirations? Who would you like to meet? 🎯 Every contribution is a building block of our collective success. Share your story and let's learn from each other 🤝. I look forward to your stories and pictures! 📸 Best regards, Robert

2 likes • May 13

Hello everyone, my name is Adekoye and I have been trading for what seems like 1-2 years. I started in crypto and found myself drawn to futures. I have a topstep account and I am learning the values and virtue of scalping minis with a tight stoploss. I’m from the US and I’m actually a creative who found fascination in the market and I was always told that I didn’t have what it takes to do this kind of work and one day I woke up and said no one has the right to tell me what I can or can’t do, and if I found the right tools and community then I could learn what to look for and make the appropriate decisions to succeed or to learn from my errors and make the adjustments and engineer my own path to success. I used to trade us30 but I have since switched to ES. Anyhow I listened to Robert’s story and I realized how much I had to be grateful for and I am looking forward to learning. I’m also a self starter so I bought as many books that made sense to me. I’m currently reading Al Brooks “trading ranges” Apart from that I also stay creative with weird calligraphy, synthesizers and drum machines. I pledge to use this resource to better myself and to return the favor. Thank you.

3 likes • Aug 23

Hello my name is Adekoye and I am 53 years old. I got more serious into trading since January last year and it has been quite a journey. I come from a creative background and I started learning how to use trading view a couple of years ago and it felt like photoshop or illustrator. As time went on I found that I liked the idea of it...and I would look at podcast and streams and people all trying to do the same thing. Instead of going out or spending anything for leisure I pushed all my resources into my studies and grew. I got a license to bookmap and I had to learn all of it because I was seeing it from a different angle...I was witnessing orderflow. at first I immersed myself in the idea of it because I had to learn what why and how...I even had to buy another computer and upgrade my internet. The issue I had was that from the perspective of VWAP, people tend to be positional traders and to me, I feel that if I am in a trade for longer than ten minute then I'm fighting anxiety. I want to get in the market and out of the market with size as quickly as possible. Some people say that you can't beat the algos and I do not want to agree with them. I had to learn different setups from people with different trading philosophies. So I joined this group and another where VWAP was the focus and scalping was seen as an acceptable means to win at trading. After a couple of weeks in these groups I also learned to read the market profile and also how to read composite profiles. I'm happy to have the opportunity to learn from Robert

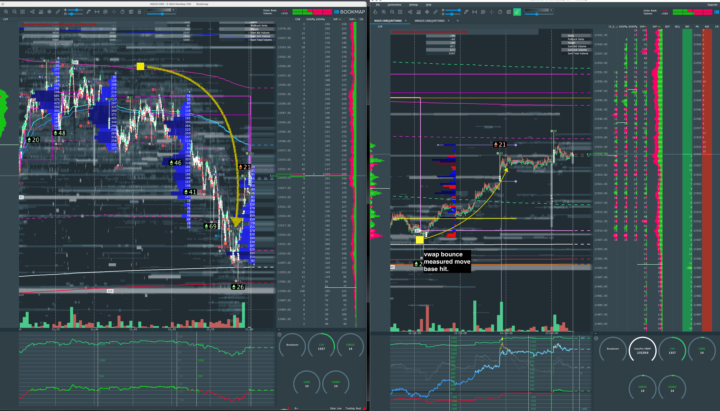

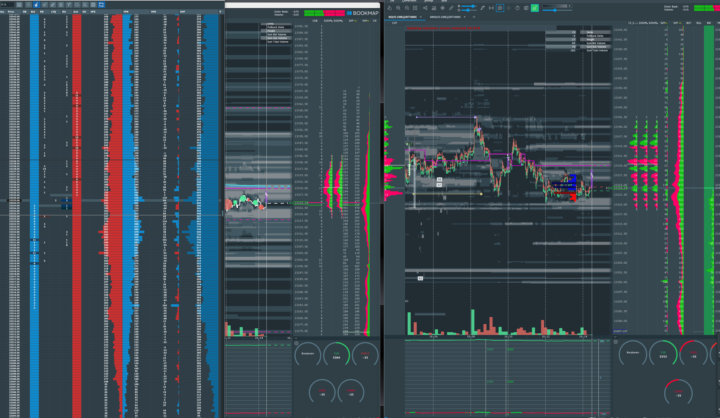

One of today's trades: VWAP Bounce

I did the Vwap bounce dance. I wanted to short more but the price action was a little too spicy for me because I didn't want to lose my gains. I made a measured move instead and on these I use Bookmap's ExecutionPro BreakEven + offset setting to make sure that if I am more than 60 ticks in profit my breakeven is set to 50...which ensures a measured move. I also keep my TP and SL wide because I place my sell stop and my buy stop before I place my limit entry. I do this because NQ can be volatile and sometimes I need room or other times I need less because I am looking at RTH structure and order flow. In Bookmap I came up with a twin screen for a large television out of necessity. Bookmap has a footprint tool that many would say is underdeveloped when compared to ATAS. MotiveWave. Sierra Charts, etc...and I'm ok with that because I was able to work around the relatively restrictive implementation by using the instrument copy add-on. So instead of viewing a volume footprint as intervals of time or range...I look at a footprint as an interval of contracts accumulated. On the left hand side I set that to a histogram of sum total contracts...and if its RTH I set it to 5000 and if in Globex 1500. One the right hand side I set to histogram delta(2500 in RTH and 750 in Globex). This dual layout provides an important edge: I can observe two vantage points of time, price. volume and liquidity simultaneously. the session profiles on the left are also set to sum total and the right are all set to delta. The reason I joined this group is because I want to learn to think like the algos and the market makers and I am a scalper who is invested in learning about Vwap trade setups as much as possible. as I gain confidence I look forward to adding more contracts...but first I have to learn the dynamics and the trade setups.

1

0

How to trade the Settlement Price? August 18th

Summer holidays are almost open and we are ready to continue trading! 😎🥵 Did you checkout LIT Academy? My 90 Days Trading Course including money back guarantee! ➡️ https://www.skool.com/lit-academy/about Do you want to become a Prop Firm Trader too? 🎯 Then you can join our LIT Day Trading Community or try it directly yourself. Just use these links: - Apex: https://apex.robertrother.com (CODE: SAVE90) - Bulenox: https://bulenox.robertrother.com (CODE: S8MRK) ►My Trading Software: ➡️ Best Scalping Software: Bookmap: https://bookmap.robertrother.com (Up to 30% off) ➡️ First AI Chart Software available! https://www.vuetra.com?ref=nzc0otm ➡️ Best Journaling TraderSync: https://tradersync.com?ref=rrtrader (Up to 60% off) ➡️ With BlackBull Trading get Trading View Free: https://bb.robertrother.com If you've become curious, then book a free call with us at: https://contact.robertrother.com 📞

I gave in and got a large screen to make better trade decisions

I watch Robert's livestreams all the time and I logged into this network to see what LIT was about and I see that there is a discount if I reach level 4 so I can use this network to express myself. fair reward. hopefully this platform recognizes the HEIC file format...

0 likes • Aug 20

I use AVWAps and volume footprints in bookmap. Not the time based or range based. I just want to see how each body of x amount of contracts were distributed. I think that this way is better for me because now almost all indicators are based on volume, delta and liquidity...and how they affect price..

Timing

Im still new to book map but wish this was nearer to cash open on the nq, sadly it was the closing hr.

1-7 of 7

@adekoye-adams-9997

Here to learn how to trade from experts. I love scalping. I have a lot to learn and I use bookmap.

Online now

Joined May 12, 2025

Powered by