Step Up Your Trading Game with Smarter Strategies

Successful trading isn’t only about entering the market—it’s about doing so with clarity, discipline, and strategy. To elevate your performance, you need a strong balance of risk management, technical analysis, and market psychology. 1:Have a Clear Strategy Entering trades without a plan is like sailing without a compass. Whether you prefer day trading, swing trading, or long-term investing, define your entry and exit points before placing an order. 2:Use Technical Analysis Tools Charts are your best friends in trading. Learning how to interpret candlesticks, moving averages, and RSI indicators gives you a clear advantage. 3:Risk Management No strategy works without proper risk management. Always use stop-loss orders and avoid risking more than 1–2% of your capital on a single trade. 4:Stay Disciplined The market is unpredictable, but discipline keeps you consistent. Avoid emotional trading and stick to your strategy even during market volatility. 📊 Trading Chart Example – BTC/USD (Looks at how Bitcoin reacts to support & resistance levels with a moving average line. import matplotlib.pyplot as plt import pandas as pd import numpy as np # Example synthetic BTC/USD data dates = pd.date_range(start="2023-01-01", periods=60) prices = np.cumsum(np.random.randn(60)) + 22000 # random BTC price around 22k moving_avg = pd.Series(prices).rolling(window=10).mean() plt.figure(figsize=(10,6)) plt.plot(dates, prices, label="BTC/USD Price") plt.plot(dates, moving_avg, label="10-Day Moving Average", linestyle="--") plt.title("BTC/USD Trading Strategy Chart") plt.xlabel("Date") plt.ylabel("Price (USD)") plt.legend() plt.grid(True) plt.show()

“The Power of a Trader’s Daily Mindset”

Every day in the market is a new opportunity, but it requires the right mindset to approach it effectively. As a trader, your greatest strength is not just your strategy or tools, but your ability to remain disciplined, patient, and focused. The market will always move with or without you—your job is not to predict every move but to prepare for what is possible and respond with clarity. Start each day with a plan: know your goals, identify your levels, and set your risk limits. Respect your stop-losses, and remember that protecting your capital is more important than chasing quick profits. Some days will bring wins, some will bring losses, but both are part of the journey. Accept losses as lessons rather than failures, and never let a single trade define your worth or direction. Keep your emotions in check—avoid fear when the market moves against you, and avoid greed when trades go in your favor. Stay patient and wait for setups that align with your strategy, because forcing trades often leads to mistakes. Remind yourself that consistency is built one disciplined decision at a time, not through impulsive actions. Most importantly, stay resilient. Trading is not about winning every trade—it’s about surviving long enough to let your edge play out. Treat each day as practice for mastering your craft, sharpening your focus, and building emotional strength. Stay calm, stay disciplined, trust your process, and remember: your mindset is your edge.

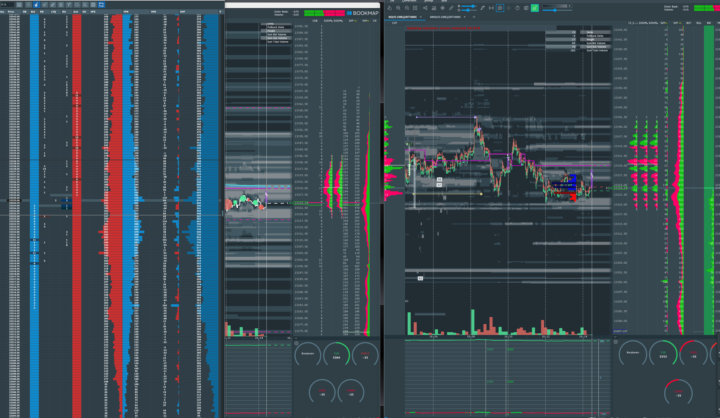

I gave in and got a large screen to make better trade decisions

I watch Robert's livestreams all the time and I logged into this network to see what LIT was about and I see that there is a discount if I reach level 4 so I can use this network to express myself. fair reward. hopefully this platform recognizes the HEIC file format...

1-7 of 7

skool.com/traders-mindset

Learn how to make 10K+ per month day trading

Powered by