Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Robert

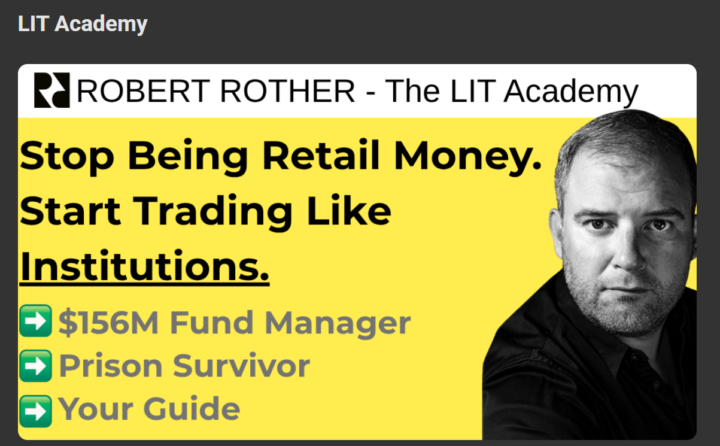

30 Jahre Trading, 7 Jahre chinesisches Gefängnis. Gemeinsam Erfahrungen teilen für finanzielle Freiheit durch Trading & Investments! Begleite uns 🙌

💵 Learn to trade like institutions, not retail. 3 paths: Prop firms, personal capital, copy trading. 90 days to profitability guaranteed. 🚀

Memberships

Trading Signals

38 members • $59/m

Digital-Trader

23 members • $59/m

Traders' Mindset

1.4k members • Free

Skoolers

189.9k members • Free

Prop Firm GOAT

7 members • Free

271 contributions to Traders' Mindset

🚀 4 Days. Complete Prop Firm Mastery.

I just uploaded my most comprehensive prop firm course I've ever created. What makes this different? - Recorded over 4 intensive days - Includes actual live trading sessions - Zero fluff, 100% actionable content - My personal strategies that work TODAY Inside LIT Academy, you'll discover: 🎯 How to pass prop firm challenges consistently 🎯 My scaling strategy for growing accounts 🎯 Risk management that keeps you profitable 🎯 Live examples of real trades 🎯 The psychology behind successful prop trading Limited Time: $49 / month (increases to $199 soon) This isn't just another course. It's 4 days of concentrated knowledge that could transform your prop firm journey. Ready to join the LIT Academy? 👇 Get instant access now https://www.skool.com/lit-academy/about

Bookmap Live Trading @3 PM CET / 9 AM EST TODAY

Join me for real-time market analysis and trading insights using Bookmap. https://www.youtube.com/watch?v=6lcyy0LidW0 New to prop firm trading or want to learn my approach? Join our LIT Academy: https://www.skool.com/lit-academy/about Perfect for sharpening your order flow skills! Ready to Start Your Prop Firm Journey? 📈 Apex: https://apex.robertrother.com (Use code: SAVE90) 📈 Bulenox: https://bulenox.robertrother.com (Use code: DPDY7) Want personalized guidance? Book a free consultation: https://contact.robertrother.com See you live! 💪 https://www.youtube.com/watch?v=6lcyy0LidW0 #PropFirmTrading #Bookmap #LiveTrading #TradingEducation

1

0

Bookmap Live Stream - 3 PM CET / 9 AM EST

Join me for real-time market analysis and trading insights using Bookmap. https://www.youtube.com/watch?v=kobBJkOjePE New to prop firm trading or want to learn my approach? Join our LIT Academy: https://www.skool.com/lit-academy/about Perfect for sharpening your order flow skills! Ready to Start Your Prop Firm Journey? 📈 Apex: https://apex.robertrother.com (Use code: SAVE90) 📈 Bulenox: https://bulenox.robertrother.com (Use code: DPDY7) Want personalized guidance? Book a free consultation: https://contact.robertrother.com See you live! 💪 https://www.youtube.com/watch?v=XquwlLBCpyw #PropFirmTrading #Bookmap #LiveTrading #TradingEducation

2

0

Bookmap Live Stream - 3 PM CET / 9 AM EST

Join me for real-time market analysis and trading insights using Bookmap. New to prop firm trading or want to learn my approach? Join our LIT Academy: https://www.skool.com/lit-academy/about Perfect for sharpening your order flow skills! Ready to Start Your Prop Firm Journey? 📈 Apex: https://apex.robertrother.com (Use code: SAVE90) 📈 Bulenox: https://bulenox.robertrother.com (Use code: DPDY7) Want personalized guidance? Book a free consultation: https://contact.robertrother.com See you live! 💪 https://www.youtube.com/watch?v=XquwlLBCpyw #PropFirmTrading #Bookmap #LiveTrading #TradingEducation

1

0

Live Trading Starting Again! Today at 9 AM EST!

Bookmap Live Stream - 3 PM CET / 9 AM EST Join me for real-time market analysis and trading insights using Bookmap. New to prop firm trading or want to learn my approach? Join our LIT Academy: https://www.skool.com/lit-academy/about Perfect for sharpening your order flow skills! Ready to Start Your Prop Firm Journey? 📈 Apex: https://apex.robertrother.com (Use code: SAVE90) 📈 Bulenox: https://bulenox.robertrother.com (Use code: DPDY7) Want personalized guidance? Book a free consultation: https://contact.robertrother.com See you live! 💪 #PropFirmTrading #Bookmap #LiveTrading #TradingEducation

1-10 of 271

@robert-rother

As an investment veteran with 25+ years leading two successful firms, I'm a savvy trader, investor, and entrepreneur. My expertise delivers results.

Active 4h ago

Joined Feb 7, 2024

Wangerooge, Germany

Powered by