Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Owned by Chris

All things Multifamily, otherwise known as Apartment Buildings: investing, managing, owning, financing, raising capital, partnerships, legal, debt.

Memberships

Multifamily Strategy Community

2.5k members • Free

Skoolers

181.1k members • Free

Multifamily Off-Market Club

569 members • Free

Max Business School™

261.7k members • Free

Commercial Real Estate 101

4.4k members • Free

Apartment Investors Club

200 members • Free

Stoic Training Systems

33 members • Free

66 contributions to multifamily

Multifamily Supply Overhang Begins to Ease

📊 Multifamily Update: The Supply Wave Is Finally Starting to Ease One of the biggest questions investors have been asking the past 18–24 months is: When does the supply pressure let up? We’re now starting to see the first real signs of that shift. According to new CoStar data, the national multifamily market is actively working through the historic wave of deliveries from 2022–2025. While vacancies remain elevated in newly delivered properties, the overhang itself is shrinking as absorption improves and new deliveries slow MultifamilyUnits. Key national takeaways: - Roughly 353,000 recently delivered units still need to lease up to reach equilibrium, but that number is declining MultifamilyUnits. - The drawdown of excess vacant inventory accelerated in Q4, with over 100,000 units absorbed year-to-date MultifamilyUnits. - Demand for higher-quality, stabilized assets remains strong, with properties built 2017–2021 operating below the national vacancy average MultifamilyUnits. - The challenge today is volume timing, not renter demand. In short: the market is digesting supply, not breaking under it. 📍 Kansas City Focus: A Faster Reset Than Most Markets Kansas City is actually ahead of many metros in this cycle. CoStar data shows that KC’s apartment construction pipeline has shrunk to its lowest level in nearly a decade, driven by higher borrowing costs, tighter equity requirements, and slower rent growth KCMultifamily. Kansas City highlights: - Only ~5,300 units currently under construction, representing just 2.9% of total inventory, the lowest level since 2018 KCMultifamily. - This is down sharply from the 2021 peak, when nearly 9,000 units were underway KCMultifamily. - 2026 deliveries are projected at ~2,900 units, the lowest annual total since 2019, aligning new supply much more closely with demand KCMultifamily. - Several submarkets, including parts of Cass County, now have zero units under construction. What this means: - KC is likely to see supply pressure ease sooner than many Sun Belt markets - Stabilized assets should benefit first - Rent growth doesn’t need to surge for fundamentals to improve — simply less competition helps

2

0

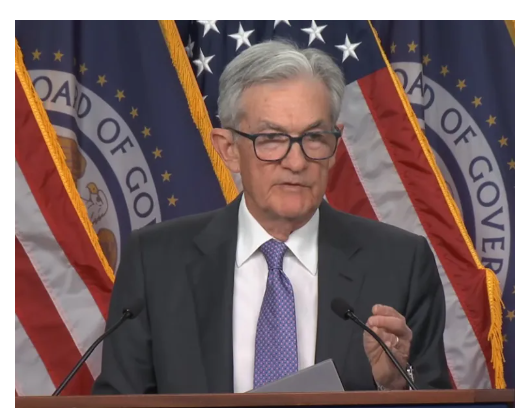

Fed lowers rates by .25 (25 bps / 25 bips)

https://www.commercialsearch.com/news/fed-cuts-rates-yet-again/ Check out BIPs on my How to NOT Sound like and Idiot series https://www.skool.com/multifamily/classroom/1987cf64?md=04cd7fdbf7054597865bc6203a0c61a2

0

0

🚨 Multifamily Market Update — December 2025

📉 Rents & Vacancy - National rents continue to soften — 4th straight month of declines, now averaging $1,740. - Vacancy rates are hitting record highs across many metros due to heavy new supply. - Early 2025 showed a brief rent uptick, but momentum faded quickly. Sources: - Rent declines & vacancy spike:https://www.credaily.com/briefs/multifamily-rents-slide-as-demand-lags-supply-in-key-us-markets/?utm_source=chatgpt.com - Rent growth snapshot:https://www.multihousingnews.com/rent-growth-20/?utm_source=chatgpt.com - Vacancy hitting record highs:https://www.credaily.com/briefs/rent-decline-deepens-as-vacancy-rates-hit-record-high/?utm_source=chatgpt.com 🏗 Development Trends - Construction starts are down ~74% from 2021 peaks, signaling a major slowdown. - Developers shifting toward middle-income and affordable housing as luxury oversupply weighs on absorption. - Colorado issues its first Middle-Income Housing Tax Credit (MIHTC) — a sign of national policy direction. Sources: - Development slowdown (CBRE 2025 Outlook):https://www.cbre.com/insights/books/us-real-estate-market-outlook-2025/multifamily?utm_source=chatgpt.com - Supply snapshot (Arbor):https://arbor.com/blog/u-s-multifamily-market-snapshot-november-2025/?utm_source=chatgpt.com - MIHTC announcement:https://yieldpro.com/2025/12/mihtc/?utm_source=chatgpt.com 🏢 Investor Behavior - Investors are cautiously coming back as values begin to stabilize. - Sales volume fell 28% YoY, showing many are still hesitant to transact. - Sellers continue to chase 2021-style peak pricing despite softer fundamentals. - Toll Brothers is exiting multifamily, selling its portfolio to Kennedy Wilson for $347M.

1

0

We Almost closed on an $18M Deal — here's why we walked away.

It was the end of August. We spent about 6 months working on a deal. Got it under contract. It looked like a home-run. $18M purchase price. 104 doors. Great submarket in Phoenix. Numbers lined up. We toured the property in person, walked every building. Everything looked good. But during due diligence, we found out the roofs the seller said were "brand new" weren't. They were shot. Full replacement needed. That changed everything. We went back to the seller and asked for a credit to cover the cost. They said no. We tried to make it work, but at the end of the day, it just didn't make sense. Moving forward would've meant putting our investors' capital at risk and hoping we could make up the difference later. That's not how we operate. So we walked away. Was a tough pill to swallow. We'd spent hundreds of hours on that deal and paid for all the third-party reports. But it was the right call. Sometimes protecting capital means walking away from a deal you really wanted. Here's what that experience reminded me of: - Don't fall in love with a deal. Fall in love with your standards. - Due diligence isn't just paperwork. It's how you protect your people. - And when in doubt, choose discipline over emotion. We lost some time and money on that one, but honestly it made us sharper. Our process is tighter, our team's stronger, and our conviction in what we stand for is even clearer. Sometimes the best deals are the ones you don't close.

Creating a Treasury Engine for Multifamily Assets — Looking for Operator Input

Hi everyone — I’m building a Fintech system specifically for multifamily owners/operators that does 3 things: 1. Gives you a real-time, accurate cash picture— rent coming in— payables due— timing gaps— when you’ll run tight 2. Helps you optimize vendor payments— which invoices to pay today— which to defer (safely, without damaging vendor relationships)— how to stretch liquidity during capex or unexpected expenses 3. Predicts delinquency earlier— identifies tenants who are likely to pay late next month— gives you a simple intervention workflow Long-term vision:A treasury/credit engine for property operators, not a rent-app clone. - No gimmick rewards. - No “earn crypto on rent.” - No consumer fintech distraction.Just tools that make properties financially stronger. Before we finalize our build:Which problem costs you the most time or money today? A) Delinquent tenants B) Vendor payments and liquidity timing C) Not knowing your real cash position at any moment Any feedback is massively appreciated — this is 100% for product validation before engineering.— Nickson (Naltos)

1-10 of 66

@christopher-jackson-8460

Multifamily Operator and Investor

- Sharpline Equity Managing Partner - SharplineEquity.com

- TheMultifamilyAnalyzer.com creator

Active 21h ago

Joined Jul 29, 2024

Kansas City

Powered by