Buy-Box Criteria (CT) 📍

New Haven county; Harvey county; 15% COC after all exp; - creative - DSCR - BRRR

2

0

Buy-Box Criteria (IL) 📍

‼️ Urgent Demand : Downers Grove, Arlington Heights, Palatine, Wheeling, Buffalo Grove, Mt Prospect Specific Criteria: up to $450,000 (can be rehabbed) ❗️High Demand: Chicago & surrounding suburbs (70% ARV - Repairs)

Happy New Year Everyone! 🎉

I hope 2026 and beyond is amazing for everyone here! Wishing you all the best!

$15k from a Dead Deal 💸

This check is from a deal I closed yesterday. What makes it interesting is that this deal had died over a year ago (or so it seemed) Back in 2024, I had this property under contract and was lined up to make a $36k assignment fee. On the actual day of closing, the seller backed out. Instead of getting emotional or walking away, I did something some people don’t think about… I protected my position. I filed a memorandum (clouded the title), which meant that whenever the owner decided to move forward in the future, I would be part of that conversation. Fast forward one year later ⏩ The seller reached back out. They offered me $10k to release the cloud. I countered at $20k. We settled at $15k. Here are the biggest lessons I learned from this deal: 💡 Lesson #1: Double Closing Matters • In certain situations, double closing is the better play • Had we double closed originally, the $36k spread would not have been visible to the seller or end buyer • Less transparency = fewer emotional decisions = smoother closings 💡 Lesson #2: Due Diligence Is Non-Negotiable This deal fell apart because of back taxes that weren’t fully understood upfront. • Taxes appeared paid, but they were actually paid by a tax lien investor, not the seller • Those taxes still needed to be redeemed before closing • The seller purchased the property via quit claim deed, not a warranty deed—meaning the back taxes were already attached when she bought it (and she didn’t know) If we had uncovered this earlier, expectations would’ve been set properly and the deal likely would’ve closed the first time. 💡 Lesson #3: Know Your Legal Rights • Filing a memorandum / clouding title protects you when you are not in breach of contract • If a seller backs out without cause, you may legally cloud the title for a small fee • This ensures that when the property sells, you’re not cut out of the deal This post isn’t to flex. It’s to show what’s possible when you: • Stay patient • Understand the paperwork

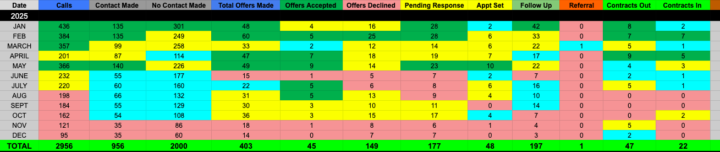

KPI Metrics - 2025

📊 These are my personal KPI numbers from 2025. When I first started, I didn’t track data at all—I didn’t fully understand how critical it was. After running a real business for several years, I’ve learned that knowing your numbers = knowing your business. If you’re not tracking, you’re guessing. 📈 KPIs create accountability. If you want better outputs (more deals closed), you must improve your inputs and make sure everything is aligned. 🏡 This applies to any business, but it’s especially important in real estate. 🚀 Moving forward, my focus is on improving these numbers while building stronger systems, processes, and strategies so the business continues to scale year after year. Hope this gives you insight into why tracking KPIs actually matters

2

0

1-30 of 45

skool.com/vision-6355

Helping investors close their first & next deal 💰

Powered by