Write something

Mareting materials access

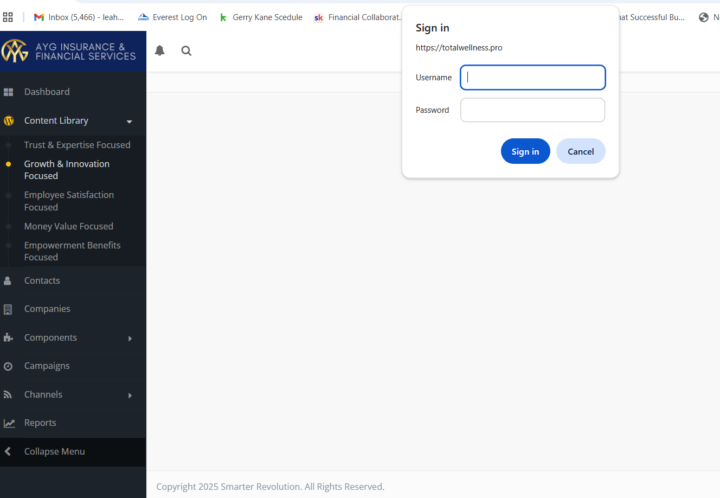

Is anyone else getting a message requiring a user name a password in order to access the marketing materials?

0

0

Decoding Section 125 Cafeteria Plans: Beyond the Basics

The foundation of modern benefits strategy often overlooks the full potential of Section 125 Cafeteria Plans. While most HR professionals understand the pre-tax advantage, there's a deeper layer of opportunities that many organizations miss. Core Components That Drive Value: Premium Only Plans (POP) These plans reduce both employer and employee tax liability on insurance premium payments. What's often overlooked is how POPs can be structured to accommodate various insurance types beyond basic health coverage. This includes dental, vision, and even certain supplemental policies. Flexible Spending Accounts (FSAs) The evolution of FSAs has introduced new flexibility in plan design: - Healthcare FSAs can now offer grace periods or carryover options - Dependent Care FSAs help attract and retain working parents - Limited Purpose FSAs complement HSA strategies Health Reimbursement Arrangements (HRAs) Modern HRA designs have expanded beyond traditional models: - Individual Coverage HRAs (ICHRAs) offer new market solutions - Qualified Small Employer HRAs (QSEHRAs) provide options for smaller businesses - Excepted Benefit HRAs add flexibility to existing plans Compliance Framework: Recent IRS guidance has clarified key areas: - Non-discrimination testing requirements - Documentation standards - Election change rules - ERISA interaction guidelines Implementation Best Practices: - Start with a comprehensive needs assessment - Document all plan components clearly - Establish clear communication channels - Create measurable success metrics - Regular compliance reviews Understanding these components allows organizations to build more sophisticated benefits strategies that serve both employer and employee needs while maintaining full compliance. 💡 Which Section 125 component have you found most valuable in your client solutions? Share your insights.

1

0

"The Hidden Economics of Employee Wellness Programs"

Recent studies from the Society for Human Resource Management reveal a compelling shift in workplace wellness economics. While traditional ROI metrics focused solely on reduced healthcare costs, modern analysis shows a much broader economic impact. Key Financial Impacts: - Reduced Absenteeism: Companies with comprehensive wellness programs report 27% lower unplanned absence rates - Enhanced Productivity: Wellness program participants show 31% higher productivity scores - Improved Retention: Organizations see a 48% reduction in turnover among employees actively using wellness benefits - Lower Insurance Claims: Preventive care access reduces catastrophic claims by 35% Beyond these direct metrics, there's a multiplier effect in organizational culture. When employees feel supported in their health journey, they become more engaged, innovative, and committed to company success. The New Wellness Economics Framework: 1. Prevention vs. Treatment Modern wellness programs focus on preventing health issues rather than just treating them. This shift alone generates 3x better return on benefit investment. 2. Holistic Health Integration Mental health support combined with physical wellness programs shows a 40% better outcome than standalone programs. The synergy between different wellness components creates exponential rather than linear benefits. 3. Technology-Enabled Access Digital health platforms reduce access barriers by 65%, leading to higher utilization rates and better health outcomes. When employees can access care instantly, small health issues don't become major problems. Understanding these economics helps frame the conversation with decision-makers. It's not just about offering benefits – it's about strategic investment in organizational health and sustainability. 💭 What economic benefits have you seen wellness programs deliver in your client organizations? Share your observations below.

1

0

The Power of Simple Questions: A Guide to Deeper Client Conversations

Yesterday, I walked into a prospect meeting with just one question: "How are your employees handling their healthcare costs right now?" The business owner paused, looked down at his desk, and shared how his best manager had been quietly dealing with chronic health issues but couldn't afford proper care. One authentic conversation later, we had our next enrollment scheduled. Here's what I've learned about asking powerful questions: 1. Hit the Heart First Instead of "Would you like to save on taxes?" try: - "What's your biggest challenge in supporting your team's wellbeing?" - "How do healthcare costs impact your employees' lives?" - "What would it mean if every employee had guaranteed access to care?" 2. Listen for the Signals When clients mention: - Rising healthcare costs - Employee turnover - Difficulty competing for talent - Staff struggling with medical bills These are golden opportunities to showcase our solution. 3. The Follow-Up Magic After their initial response, go deeper: - "Tell me more about that..." - "How long has this been a concern?" - "What solutions have you tried?" - "How is this affecting your business?" Remember: People don't buy programs. They buy solutions to their problems. Our job is to understand those problems deeply. Pro Tip: Keep a small notebook of powerful questions that have worked for you. Review and refine them. Great questions are like good wine - they get better with time. 💭 Share below: What's the one question that consistently opens meaningful conversations for you? Let's build our collective wisdom and help more businesses understand the power of our program.

0

0

1-4 of 4

skool.com/total-wellness-academy-6031

Empowering AYG affiliates to revolutionize employee wellness while building successful, purpose-driven businesses. Learn, connect, and grow!

Powered by