5d • General discussion

My brother’s(sister) keeper

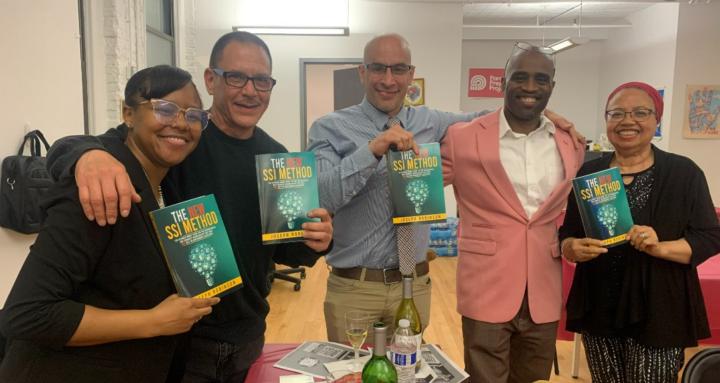

Just thought I’d share this as a reminder of what I’ve learned from participating in the SSI method finance class:

- Portfolio diversification is a key to long-term investment success. (This is important to me because it helps to protect my principal)

- A well-diversified portfolio includes a mix of stocks, bonds, and potentially, alternative investments across various sectors, company sizes, and geographic regions.(I must do this because I don’t like talking financial losses)

- The right asset allocation depends on your individual risk tolerance, time horizon, and financial goals.(This helps me to make my decisions based on my goals instead of just focusing on numbers)

- Mutual funds and ETFs (exchange-traded funds) offer ways to achieve the benefits of portfolio diversification.(As a beginner investor I find this to be the best approach for me)

- Regular portfolio rebalancing is crucial to maintaining a diversified portfolio over time.(When I get to this point I’ll have some understanding of what to do because I’ll have some experience on my side)

Like Joe Robinson always say in the SSI method we have to focus on our Investment strategy.

1

1 comment

skool.com/think-outside-the-cell-comm

A global community for and by justice-impacted people (and allies) to transform mindsets, build wealth, and reclaim our futures—together.

Powered by