Write something

📊 SETUPS TO WATCH - 2/13/2026

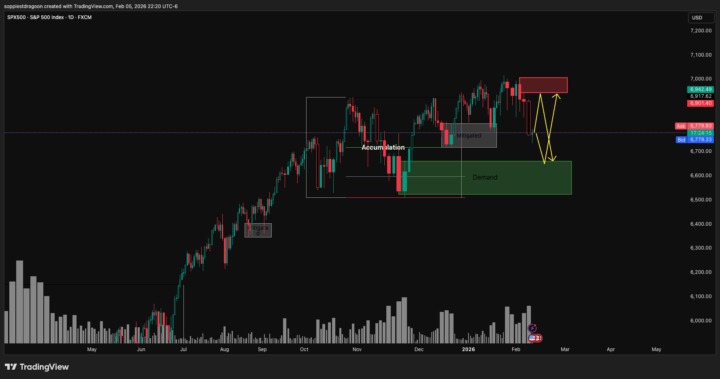

Here are 2 index short setups I'm tracking. Post your plans below if you're taking either. SETUP 1: NQ (US 100) — BEARISH — Swing ⚡ EXECUTION PACKAGE - Entry Zone: 25239-25339 (on LTF distribution confirmation) - Stop Loss: 25350 - Target 1: 24200 — Take 50-70% profit - Target 2: 23828 — Manage remainder or full exit - Risk Sizing: $50-$100 per setup - Invalidation: Acceptance above 25339 (daily close above) 📋 GAME PLAN IF price trades into 25239-25339 AND shows 5m/15m distribution → THEN enter short IF stop hit at 25350 → THEN exit completely, thesis wrong IF T1 reached at 24200 → THEN take 50-70% profit, trail remainder IF T2 reached at 23828 → THEN exit remaining position IF price accepts above 25339 → THEN thesis invalidated, exit if still in 💡 SETUP CONTEXT Structure: Supply zone at 25239-25339, waiting for retest Edge: LTF distribution at supply = rejection and continuation lower Why This Works: Internal swing low at 24200 gives logical first target, 23828 is ultimate structural target Conviction: 6/10 — Need to see the LTF distribution confirmation first ________________________________________________________________________________________________ SETUP 2: SPX 500 (ES) — BEARISH — Swing ⚡ EXECUTION PACKAGE - Entry Zone: 6945-6977 (on LTF distribution confirmation) - Stop Loss: 6985 - Target 1: 6735 — Full exit or take majority - Risk Sizing: $50-$100 per setup - Invalidation: Acceptance above 6977 (daily close above) 📋 GAME PLAN IF price trades into 6945-6977 AND shows 5m/15m distribution → THEN enter short IF stop hit at 6985 → THEN exit completely IF T1 reached at 6735 → THEN full exit (or take 70% and trail) IF price accepts above 6977 → THEN thesis invalidated, exit 💡 SETUP CONTEXT Structure: Supply at 6945-6977, single demand target at 6735 Edge: Cleaner structure than NQ — binary setup with one clear target Why This Works: Simpler management, less decision-making mid-trade Conviction: 7/10 — Cleaner structure than NQ, prefer this setup

0

0

Weekend S&P / US100 Plan → Live Price Action (Textbook No‑Chase Example)

Let’s follow up on the weekend market context for S&P 500 / US100. Here’s what we were watching: - The daily gave us a clear bearish impulse, showing initiative from sellers - The most recent demand zone was already partially mitigated, which reduced its reliability - We marked 6945–7006 as the key supply zone to watch on any retrace - We identified 6524–6662 as the next valid demand zone where further downside would make structural sense What actually happened: - Price retraced into the 6945–7006 supply zone - On lower time frames inside that zone, we saw: - - Distribution - - A liquidity sweep of recent highs - - A break of structure to the downside, remitigating lower TF supply That sequence is exactly what we look for with the No‑Chase Swing Method: 1. Higher‑time‑frame zone: a clear area where it makes sense to look for sellers 2. Lower‑time‑frame confirmation: distribution + liquidity sweep + break of structure 3. Defined risk: clear invalidation and asymmetric R:R if you execute Full transparency: I did not take this trade live. I wasn’t at the screens when the confirmation completed. But for us as a group, this is still a win, because: - The zones were clean - The story made sense ahead of time - The market respected the structure we mapped out How to turn this into a practical edge for you as a 9–5 trader: - Study the before/after charts for this move - Pay attention to how price behaved inside 6945–7006 supply - Using our rules, ask: - - “Where would my entry have been?” - - “Where does my stop belong?” - - “Where’s a logical first target?” If you’re not sure, do this: 1. Mark up your chart with your proposed entry, stop, and target. 2. Post it in Trade Reviews & Help with a short written plan. 3. Tag me, and I’ll review it with you so you can tighten your execution. Even when we personally miss individual trades, reps like this are how we: - Build conviction in the method - Strip out emotional decision-making - Get ready to execute cleanly the next time this pattern shows up

0

0

NFLX — Bearish — Swing

⚡ EXECUTION PACKAGE - Entry Zone: 82.48-84.66 (fresh supply + key level confluence) - Stop Loss: 85.25 - Target 1: 80.00 — Take 50% profit, move stop to breakeven - Target 2: 78.00 — Inefficiency fill, manage remainder or full exit - Risk Sizing: $50-$100 per setup - Invalidation: Acceptance above 84.66 (daily close above supply) 📋 GAME PLAN IF price retraces into supply (82.48-84.66) → THEN look for short entry with rejection at key level 82.30 IF stop hit at 85.25 → THEN exit completely, no re-entry without new plan IF T1 reached at 80.00 → THEN take 50% profit, move stop to 83.00 (breakeven) IF T2 reached at 78.00 → THEN take remaining 50% or hold for swing low IF price accepts above 84.66 → THEN supply invalidated, exit if still in 💡 SETUP CONTEXT Structure: Fresh supply created today after rejection at key level 82.30 Edge: Confluence of HTF key level + new supply zone - waiting for retrace into this area Why This Works: Today's rejection confirms resistance; retrace gives high-probability short with swing low targets

0

0

DUOL — Bearish — Swing

⚡ EXECUTION PACKAGE - Entry Zone: 118.90-125.80 (HTF supply) - Stop Loss: 126.50 - Target 1: 107.00 — Take 50% profit, move stop to breakeven - Target 2: 100.00 — Psychological level, manage remainder or full exit - Risk Sizing: $50-$100 per setup - Invalidation: Acceptance above 125.80 (daily close above supply) 📋 GAME PLAN IF price re-mitigates supply (118.90-125.80) → THEN look for short entry with rejection confirmation IF stop hit at 126.50 → THEN exit completely, thesis invalidated IF T1 reached at 107.00 → THEN take 50% profit, move stop to 122.00 (breakeven) IF T2 reached at 100.00 → THEN take remaining 50% or hold for further structure break IF price accepts above 125.80 → THEN distribution thesis broken, exit if still in 💡 SETUP CONTEXT Structure: Small distribution pattern with Point of Control at 120.50 Edge: HTF supply zone 118.90-125.80 currently in price imbalance - waiting for re-mitigation Why This Works: Clean supply retest opportunity targeting lower swing structure with defined invalidation

0

0

ORCL — Bullish — Swing

⚡ EXECUTION PACKAGE - Entry Zone: 121.24–139.00 (key level: 127.54) - - Stop Loss: Below 121.24 - - Target 1: $195 (POC) — take 50%, move stop to breakeven - - Target 2: TBD — holding remainder for structure above POC - - Invalidation: Acceptance below 121.24 (daily close below) 📋 GAME PLAN IF price retraces into demand → THEN looking for entry near 127.54 or lower IF stop hit below 121.24 → THEN exit completely, thesis invalidated IF T1 reached at $195 → THEN take 50%, move stop to breakeven IF price rips without pullback → THEN no chase, let it go 💡 SETUP CONTEXT Structure: ORCL retraced the entire run from ~340 back into HTF demand at 121.24–139. This is the original accumulation range — the same zone that launched the move to all-time highs. Edge: Last week printed heavy volume with a doji-like weekly candle — wicks on both sides right at the 200 WMA inside demand. That kind of volume response at structure is institutional defense. The 200 WMA at ~127 is acting as a floor underneath price. My read: Bottom is likely in. Even if it's not, this is a highly asymmetric setup. Risk is defined below 121.24, and minimum upside expectation is a retrace to POC around $195. That's roughly 1:4+ R:R from the key level. I'll update this in real time as price develops. Post your plans below if you're taking this one.

0

0

1-30 of 161

powered by

skool.com/the-trading-desk-2388

Swing trade U.S. stocks & crypto around your 9–5 in ~10 minutes a night with a rules-based no-chase method so you stop staring at charts.

Suggested communities

Powered by