Write something

Replace those New Year's Resolutions with Action

How many of you are still keeping up with your resolutions? Most people have already fallen off by now... a large portion of you even gave up by the second Friday of the month! 🚩Or maybe you've made it here to the very end of January and you're still going strong. If so, good for you! But there is something to be said about a measurable goal and lifestyle change, rather than just a one sentence, undefined resolution... If you were one to jump on the band wagon with everyone else, with either giving up something "bad for you", or picking up a "good" habit in the new year, and you've already given up, then maybe it's time to pivot and refresh. And there is no better time than now! We are coming up on the end of the January, and believe it or not, January is National Financial literacy month! If you were unaware, or unable to put time and energy into your own financial literacy at the beginning of this month, then you will be glad to know that it is NOT too late to start now. And what's even better, is you still have 11 more months ahead of you in 2026. And you can still say you began your educational journey into finance while still in month one! So what steps should we take first? ✅If you want to set a measurable goal to understand your own personal finance and investments, and take some time to set clear financial goals for the year, then let us help you get there through these 8 steps. 💸Maximize your potential through the resources available to you: 1. Schedule and attend a free financial education webinar (or two). 2. Utilize an online retirement calculator to play around and calculate your own potential financial needs in retirement. Figure out how you want to live. A lavish, expensive life full of travel? Or maybe a simpler lifestyle, where less income is needed later in life... Knowing this is important in understanding how you need to save for retirement now. 3. Read our tips and tricks below and learn more about financial literacy through our educational posts. 4. Look to our book recommendations to continue your financial literacy with some of the best published authors out there. 5. Respond, with your own questions and feedback on some of our posts. Join a discussion that resonates with you and see how other people are saving for retirement. 6. Schedule a complimentary financial needs analysis to better understand your own finances. 7. Find the best accounts that match your risk tolerance and financial needs that are available to you. Some types of accounts and ways to save are not common knowledge, and what is available may surprise you. Learn how to save where the ultra wealthy (or the 1%) save regularly saved to maximize the growth on your investments. 8. And finally, set up automations in these accounts that will help you reach your financial goals.

2

0

🧠💰 A Quick Story About Money (That Might Hit Home)

Let me tell you something that happened the other day… I was talking to someone who said, “If I could just make a little more money, everything would finally calm down.” Sound familiar?I smiled because — whew — I used to believe the exact same thing. But here’s the truth I had to face (and it wasn’t cute):It wasn’t about making more.It was about learning how to grow what I already had… and stop letting money boss me around like a bad toddler with a juice box. The real shift happened the moment I stopped asking,“Why don’t I have enough?”and started asking,“What could my money become if I treated it like a seed instead of a bill-payer?” 🌱 Seeds grow.⚠️ Bills just repeat.Big difference. So here’s my question for you — and I genuinely want to hear your answers: 👉 What’s ONE money lesson you learned the hard way… that ended up growing you the most? Drop it below ⬇️Your story might be the thing someone else needed today. And if you read this thinking, “Yeah… I’m ready for my money to stop stressing me out and start working FOR me,” say ME and I’ll reach out. Let’s grow together. 💛✨

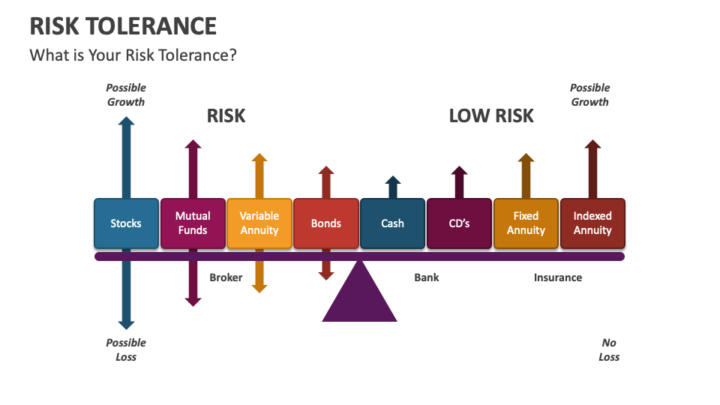

Risk Tolerance

Risk Tolerance: When it comes to your savings, how much risk can you tolerate? 🔴Are you someone who likes to put your money in super high-risk stocks, were you could potentially lose a LOT if the market crashes, but there is also a high reward when the market is up? 🟢Or do you prefer to have extreme protection where your money is locked into a CD (Certificate of Deposit), where it is growing at a much lower, fixed interest rate for a guaranteed amount of time? With no surprises, not much growth, and potentially higher taxes... 🟡Or do you fall somewhere in between those two extremes with some risk being tolerated, but you aren't willing to gamble your investments and lifetime savings at a higher cost? Reassessing every so often, especially at different stages in your life can guarantee that you, your finances, and your financial goals are well aligned. How aligned would you say your current investments are with your financial goals? Keeping in mind that your risk tolerance can change over time, with age and your priorities, how would you rate yourself now on scale of 1 to 10?

Happy New Year! A time to Empower

This is the perfect time to reset. I don’t mean with lots of resolutions and potential empty promises to yourself. But rather through education, empowerment and automation. We all have our taxes to think about next, so now is a great time to learn more about tax engineering, compound interest, different accounts available to you and ways to save better, budgeting, and finally choosing to have your money work hard for you. So you don’t have to spend the rest of your life working hard for money! If you’re even a little bit curious, I encourage you to ask about our free classes and education! Oh, and don’t forget to also invest in yourself with a complimentary financial needs analysis. Why not choose to take a chance on yourself?

2

0

Black Friday Spending Predictions

Saw an interesting article this morning about predictions for Black Friday. Overall, shoppers expect to spend 4% less than last year. But the interesting numbers were in the breakdown by income. Households making 50,000 are expected to cut black Friday spending by 12%, while households earning $200,000 or more are expected to cut spending by 18%. Conventional wisdom would say the people who make less would be cutting more as the economy tightens. But it’s the higher wage earners who are reducing spending at higher percentages. It could be that higher wage earners are cutting out the extras, where lower wage earners use Black Friday as an opportunity to save on necessities. But during the recession I saw a phenomenon that I call “perceived poverty,” where donors with literally millions of dollars in the bank felt they couldn’t make a charitable contribution to my organization because they were “broke.” Anyways, this is fascinating to me. Why do you think higher wage runners are cutting back more?

1-14 of 14

powered by

skool.com/the-prosperity-project-9756

Built to empower you to not only take charge of your personal finances, but to grow a community focused on lifestyle, family, faith, & future.

Suggested communities

Powered by