Write something

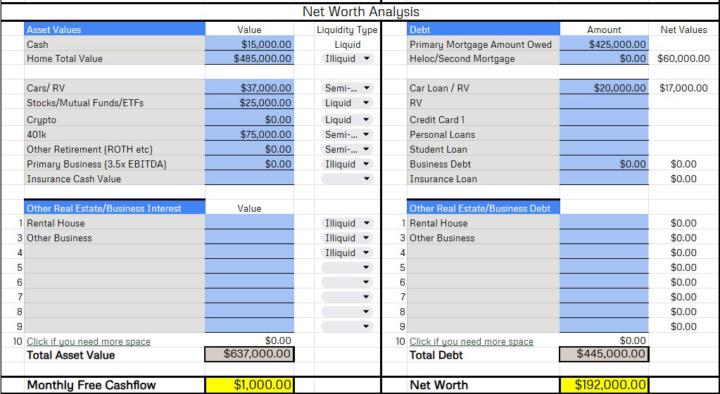

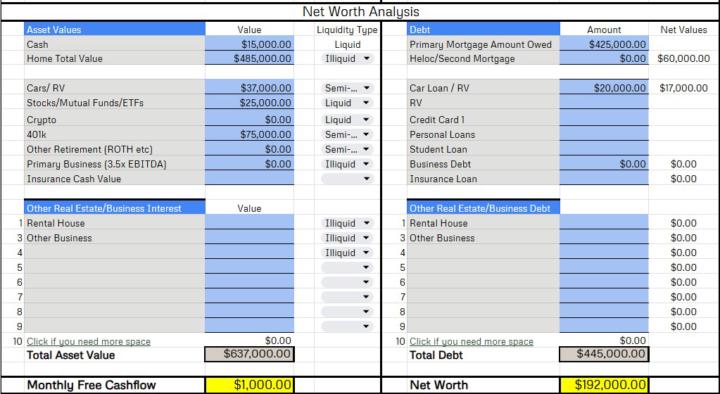

✈️How will your finances look after you stop flying?

Most pilots focus on income and upgrades, but rarely on: - How retirement income is taxed - What happens if you can’t fly anymore - How quickly a spouse’s financial reality can change Flying income looks straightforward. Retirement income often isn’t. Without clarity: - Assumptions fill the gaps - “I’ll deal with it later” becomes the plan - Families are left reacting instead of choosing The difference comes from: - Understanding income, taxes, and assets over time - Knowing what your family would actually rely on - Making decisions early, while options are still open Some pilots assume it will all sort itself out. Others choose clarity early. The difference? Peace of mind. Take this completed version of The Pilot Wealth Snapshot, giving you a clear picture of what your own numbers might look like.

0

0

✈️ Why so many pilots get “approved” then denied?

- You’re told you’re “pre-approved” - You start writing offers thinking you’re good to go - Then the deal falls apart at the closing table - And you’re left wondering what you missed What usually comes up when we look closer: - Pre-qualification and pre-approval get used interchangeably - They’re not the same thing - Pre-qualification: -A few questions -Maybe a credit pull -Minimal document review - A real pre-approval: -Credit pulled -Income docs reviewed -Assets verified -An underwriter has actually reviewed your file Why this matters: - Your offer is taken more seriously - Earnest money is protected - Fewer last-minute surprises before closing If you want a fail-safe pilot pre-approval—the kind I’d trust with my own earnest money, take a look at the pre-approval checklist PDF attached to this post before writing offers.👇🏼

0

0

✈️ Is it possible to turn your 30-year mortgage into a 15-year mortgage?

Absolutely, it just doesn’t happen automatically. You turn a 30-year mortgage into a 15-year by paying it like a 15-year, even if the loan term itself doesn’t officially change. Why would a pilot consider it?Because paying it down faster means less interest, more equity, and faster financial flexibility (especially helpful with our irregular schedules, upgrade goals, or future base changes). Here’s what actually makes it work: ✅ 1. Make higher monthly payments (the biggest factor) To mimic a 15-year payoff, you must pay the 15-year equivalent monthly amount, which is typically 20–40% higher depending on your rate. You don’t need to refinance to do this — you can simply pay extra toward the principal every month. ✅ 2. Add principal-only payments Even if you can’t commit to the full 15-year payment every month, you can still shorten your payoff by: - Adding a fixed extra amount each month - Rounding up (e.g., $2,345 → $2,500) - Throwing in contract/bonus/per diem surplus money - Using extra flying months or premium trips as lump-sum payments These go directly toward principal, not interest — and that’s what accelerates the payoff. ✅ 3. Use windfalls that pilots actually get Pilots have unique opportunities for lump-sum payments: - Profit-sharing checks - Holiday incentive pay - Training pay differences - Per diem surpluses - Line bidding months with extra hours - Upgrades or seat changes Even one or two large annual principal payments can cut years off a 30-year mortgage. ✅ 4. Refinance into an actual 15-year mortgage (optional) This locks in the faster payoff with a lower rate, but it also locks you into the higher payment. Some pilots prefer flexibility — paying like a 15-year without the required commitment. If your income fluctuates due to reserve, bidding changes, or training months, the flexible approach may make more sense. ✈️ So, is it possible? Yes. Pilots routinely turn a 30-year mortgage into a 15-year payoff by: ✔ Adding extra principal each month

0

0

Man, with what we make… I should be able to afford a whole lot more than I do

A few months ago, I was sitting in a crew room listening to two pilots talk about bases, upgrades, and pay bumps. Nothing unusual. But then one of them said: “Man, with what we make… I should be able to afford a whole lot more than I do.” That line stuck with me. Because honestly… I'd had the same thought before. Have you ever looked at your pay scale, your base, your schedule, and quietly wondered: Am I actually building wealth the way I SHOULD be at this stage of my career? If you’ve ever had that question — so did I. And I started noticing something interesting: Two pilots with the same paycheck can have completely different levels of affordability, savings, and long-term stability… depending on seat, base, and timing. When I started comparing real data across FO → Captain paths…The differences were honestly surprising. So I put together something special: A fully filled-out example of the tool The Pilot Wealth Snapshot so you can see EXACTLY what your own numbers could look like Zero Forms. Zero spreadsheets. Just clarity.

1

0

Did Your Mortgage Payment Just Jump for No Reason?

If your payment suddenly went up and your rate didn’t change, it’s usually not a scam. It’s often your escrow account. Your monthly mortgage payment often includes: - Principal - Interest - Property taxes - Homeowners insurance When taxes or insurance go up, your escrow account may come up short. The servicer has two choices: - Ask you to write a lump‑sum check, or - Spread the shortage (plus new higher estimates) over the next 12 months That’s when payments jump. What you can do: - Ask for the escrow analysis - Shop your insurance if it spiked - Sometimes you can choose to pay the shortage upfront to reduce the monthly bump Has your mortgage payment ever jumped unexpectedly? What happened in your case?

0

0

1-9 of 9

skool.com/the-pilot-mortgage-hangar

The premier financial ecosystem for pilots — integrated mortgage, energy, and wealth solutions for the aviation community.

Powered by