Write something

🚀 The R&D Tax Credit: Yes, Contractor Costs Can Count (But Only If You Set It Up Right)

Most tax prep offices assume the R&D credit is “for manufacturers and labs.” If you’re building or improving tech-enabled tax workflows—and you pay contractors—you may be leaving money on the table. ✅ The Big Idea Contractor payments can be included in your R&D credit calculation as Qualified Contract Research Expenses—generally 65% of what you pay—if the work qualifies and the contract structure supports it. 🔍 What Contractor Work Can Qualify (Realistic for Tax Offices) Think innovation inside your firm, not routine tax prep: - Building/improving a client portal - Automating document intake + OCR categorization - Creating a workflow engine for returns/review/QA - Enhancing data validation (error detection, anomaly logic) - Security improvements (access controls, audit trails) - Integrations (transcript tools, e-sign, bookkeeping feeds) If it’s technical, involves uncertainty, and you’re testing/iterating to reach a better result → it may fit the R&D rules. 🚫 What Usually Doesn’t Qualify - Seasonal contractor prep work (returns, data entry, admin) - Marketing / market research - Training programs - General business process changes without “technical experimentation”

Marketplace Insurance = 1095-A Required (No 1095-A, No Smooth Return)

If a taxpayer had health coverage through Healthcare.gov (Marketplace) for the year, they need Form 1095-A to file correctly. 1095-A shows: - Monthly premium amounts - Any Advance Premium Tax Credit (APTC) applied Why it matters for us: - Missing 1095-A can delay processing and refund release - Incorrect 1095-A data can trigger IRS letters and repayment issues later How clients get it: ✅ Log in to their Healthcare.gov account ✅ Download Form 1095-A ✅ Confirm names, months covered, and dollar amounts before you finalize the return

1

0

Refund Offsets (Treasury Takes It Before It Hits the Bank)

If a taxpayer owes certain government-related debts, the IRS/Treasury can apply some or all of the refund to that balance before the deposit posts. That’s a federal offset. Common offset triggers: - Past-due child support - Unpaid federal or state taxes - Defaulted student loans - Other federal/state agency debts What to tell clients: - If an offset happens, they’ll receive a notice showing how much was taken and who it was paid to. - To check risk in advance, they can call the Treasury Offset Program: 800-304-3107 - Pro tip: Filing early doesn’t prevent an offset, but it helps you identify issues sooner and set expectations upfront.

3

0

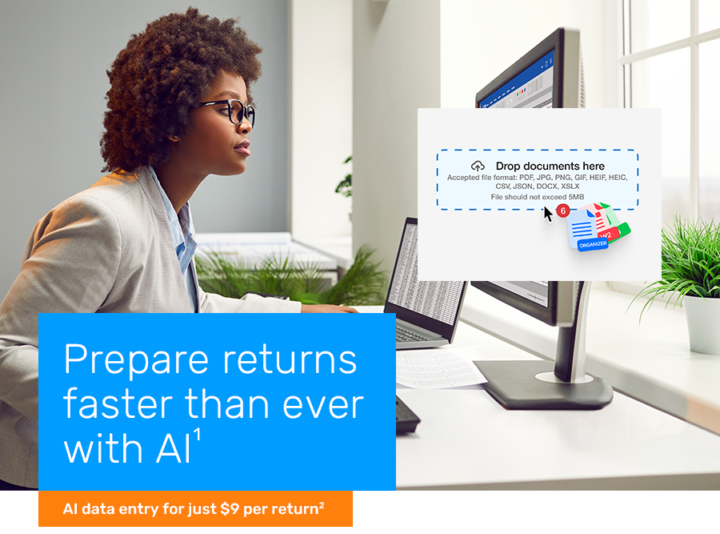

🚨 NEW for SBTPG Tax Pros 🚨

AI data entry is here for the season: Wizzy 2.0 (by SmartWiz) for $9 per return when paid from funded tax prep fees (Refund Transfer partners/qualified pros). ✅ What it does: ✔ Extracts data from W-2s, 1099s, organizers, expenses + more ✔ Organizes docs in a clean client workspace ✔ Pushes data into your return with One-Click Return ✔ Works in your current workflow (no extra software, no learning curve) Why you’ll care: 🔥 Less typing, more reviewing 🔥 Fewer re-key errors 🔥 More returns per day without adding staff Offer: Start with 11 returns for $99 and keep the $9/return pricing (available through 2026) when eligible and paid from funded fees.

2

0

🚨 Service Theft in Tax Business: How It Happens (Clients + Independent Contractors)

“Service theft” is when someone gets the work but you don’t get paid, or they use your systems/brand to profit off you. It’s more common in tax than people want to admit, especially during peak season. Protect your time and your name. 💼🔒 1) How tax clients steal services (real-life ways) ✅ The “Free Review” Trap They send docs and want you to “just take a quick look” at: - refund estimates - credits - filing status - deductions Then they disappear and file elsewhere with your guidance. ✅ The “Draft Me Something” Play They ask for a “draft return” or “estimate” to: - shop your numbers - compare fees - get a bank product elsewhere ✅ The “File It But I’ll Pay Later” Lie They rush you to submit, then: - stop responding - claim confusion - suddenly “don’t have it” ✅ The “Chargeback Queen/King” They pay by card, get service, then file a chargeback claiming it was “unauthorized” or “not delivered.” 2) How independent contractors steal services ✅ Taking your leads and poaching clients They use your pipeline to build their own list: - DM your prospects - collect direct payments - move clients off-platform ✅ Filing under your brand but skipping your process They rush returns, ignore intake, and create: - rejections - compliance gaps - messy client experience And guess who looks bad? You. ✅ Keeping the money, leaving you the liability They collect payment directly, but the business: - handles the complaints - fixes rejects - absorbs reputational damage ✅ Using your tools without permission They use your templates, scripts, worksheets, pricing structure, or training… then repurpose it as “their program.” 3) Red flags you should never ignore 🚩 - “I just need an estimate first” - “Can you tell me what I’ll get back before I pay?” - “Send the forms, I’ll sign later” - Contractor won’t document, upload, or follow checklist - Contractor always wants access but avoids accountability 4) How you protect yourself (simple + effective) Client Protection ✅ Paid consults only

1-30 of 41

powered by

skool.com/tax-bully-hub-1283

A hub for tax pros, credit experts, notaries & bookkeepers to grow, connect, and access tools, trainings, and templates to level up.

Suggested communities

Powered by