Write something

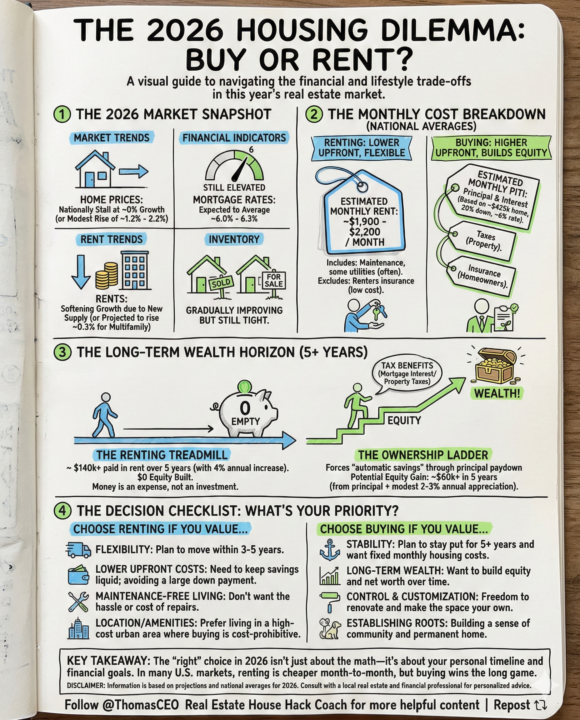

The 2026 Housing Dilemma: Buy or Rent?

The 2026 Housing Dilemma: Navigating the Buy vs. Rent Minefield If you feel paralyzed by the current housing market, you aren't alone. Welcome to real estate in 2026. We have officially entered a "new normal." The wild price swings of the early 2020s are over, but we haven't returned to the ultra-cheap borrowing days either. We are stuck in a holding pattern of stabilized—but high—prices and stubborn mortgage rates. For many, the ultimate financial question this year is: Do I keep renting, or do I bite the bullet and buy? There is no universal answer, but there is a framework for making the right decision for your finances. Based on my latest whiteboard breakdown (see the infographic above), let’s dive into the trade-offs of the 2026 market. The 2026 Reality Check Before making a decision, you need to understand the playing field. The 2026 market is defined by stabilization. According to current data, national home prices are largely stalling or seeing only very modest rises (around 1-2%). The frenzy is gone. However, the biggest hurdle remains mortgage rates, which have settled into the 6.0% – 6.3% range. On the other side, rent growth is softening due to new apartment supply hitting the market. This creates a unique dynamic where inventory for buyers is still tight, but renters have more options than before. The Monthly Crunch: The "Apples-to-Apples" Comparison Let's be blunt about the cash flow: In most U.S. markets right now, it is cheaper to rent on a monthly basis. When you look at national averages, renting offers a lower barrier to entry. You avoid the massive down payment and the surprise costs of maintenance (when the HVAC breaks, you just call the landlord). - Average Estimated Monthly Rent: ~$1,900 - $2,200 - Average Estimated Monthly PITI (Buy): ~$2,300 - $2,850 Note: PITI includes Principal, Interest, Taxes, and Insurance based on a ~$425k home with 20% down. If your primary goal is maximizing monthly disposable income today, renting looks very attractive on paper.

0

0

New things are brewing with ShiftRich... stay tuned

New things are brewing with ShiftRich... stay tuned

1

0

What's stopping you from getting started?

How can I help? I've been in your shoes, not sure what my next move should be. Stuck in the rat race... | That's why I built this community to help as many people as I can. So what's got you stuck?

0

0

House Hacking Still Works (Even With 6% Rates)

Everyone says real estate is dead. They're wrong. Smart investors are making money right now with house hacking and co-living. Here's how. House Hacking Gets Smarter Forget fixer-uppers. In 2025, the winners are buying move-in-ready properties that cash flow from day one. What's working: ADUs and basement apartments - Convert your basement or garage into a rental. Keep your privacy, add $500-$1,500 monthly income. Section 8 gold mines - Target areas with high Section 8 payment rates. Some investors are getting $500+ more per month per unit. Creative financing - Don't wait for rates to drop. Negotiate PMI removal and structure 15% down deals that still cash flow positive. Rent-by-the-room - Charge per bedroom instead of per house. Make more money on the same property. Real investors in Colorado are proving this works RIGHT NOW with 6% mortgages. Not in theory. In real life. Co-Living Goes Mainstream Co-living isn't just for broke millennials anymore. Big institutional investors are piling in because the numbers are insane. The money is better - Co-living makes 30-50% MORE than regular apartments. Same building, way more profit. Tech makes it easy - Smart locks, booking apps, and automated systems handle the day-to-day stuff for you. Cities want it - Places like Chicago and D.C. are converting empty office buildings into co-living spaces to solve housing problems. Why This Matters to You The game changed. Waiting for "perfect conditions" means you're sitting on the sidelines while others build wealth. House hacking + co-living = cash flow in any market. High rates? Doesn't matter. Housing shortage? That's your opportunity. Stop making excuses. Start taking action.

0

0

How to Finance Your House Hack in 2025

Think you need $100,000 to start house hacking? Think again. Here's how to get in with way less money. The Best Loan Programs FHA loans - Put down just 3.5% on properties up to four units. That's $10,500 on a $300,000 property. FHA 203k loans even give you extra cash to fix up the place. VA loans - If you served in the military, you can buy with ZERO down. No joke. No down payment, no PMI. USDA loans - Living in a rural area? Zero down here too. Works on properties up to four units. Conventional loans - Need just 3-5% down, and lenders now count your future rental income when deciding if you qualify. Creative Ways to Fund It Don't have enough saved? Get creative: Use your current home - Take out a HELOC (home equity line) on your current house to buy your next one. Find a partner - Split the property with someone else. They put up money, you manage it, both of you win. Crowdfunding - Pool money from multiple small investors through online platforms. Co-ownership - Buy with friends or family and share everything - the mortgage, the costs, the profits. Why 2025 Is Different Banks are finally getting it. They're counting your rental income BEFORE you even have tenants. That makes qualifying way easier than before. Plus, there are programs for ADU financing, short-term rental properties, and renovation loans all rolled into one. Bottom Line You don't need to be rich to start house hacking. You need the right loan and maybe some creative thinking. Start with as little as 3.5% down, or find a partner if you're broke. The money part isn't the hard part anymore. Taking action is.

0

0

1-30 of 40

skool.com/shiftrich-academy-2627

Go from renter to owner in 6 months. No savings, no credit, no guesswork—just a proven system, tools, and coaching.

Powered by