Write something

Pinned

🏠 WELCOME TO SHIFTRICH - LET'S GET REAL 🏠

Drop your intro below: - First name + city - What brought you to house hacking - Your monthly rent payment - Calculate: Rent x 12 = How much you've paid landlords this year Example: "Thomas, Philly. Tired of making my landlord rich while staying broke. $1,800/month = $21,600 gone forever this year. Time to flip the script." No judgment - just reality. Every dollar to a landlord is a dollar that could've built YOUR wealth. Let's change that. Also please subscribe to the YouTube Channel: https://www.youtube.com/@BThomasCollinsII?sub_confirmation=1 Drop yours below ⬇️

Pinned

🚀 Start Here First — Your ShiftRich Roadmap Begins Now

New to ShiftRich Academy? Don’t just browse—this is where your journey from renter to confident owner starts. 👣 Step 1: Go to the Classroom tab and open the Start Here module.📚 Inside you’ll learn how to: - Use AI (especially ChatGPT) to find, analyze, and close house hack deals faster - Set up your deal calculators and market research tools - Access live calls, off-market lead sources, and community challenges - Map your path from 0 → 1 property in under 6 months using house hacking & creative strategies—even if your credit is low or your savings are small 💡 Required for Success:We rely heavily on AI in this community.👉 Download ChatGPT Plus ($20/month) so you can use the same tools and workflows we teach. This will save you months of trial and error. 🎯 This is your shortcut to financial freedom. The faster you complete this step, the faster we can help you close your first deal.

1

0

Pinned

💬 Thomas Q&A — Ask Me Anything!

Got a question about house hacking, creative financing, market analysis, or using AI to close deals faster? This is your spot. Here’s how it works: 1️⃣ Post your question right here in the Thomas Q&A category. 2️⃣ Be as specific as possible — numbers, scenarios, and goals help me give you better advice. 3️⃣ I’ll generally respond with a Loom video, plus a written transcript so others can use it as a resource later on. Pro Tip: The more you participate, the more you learn from other members’ questions — this is like free group coaching. So… what’s the ONE question holding you back from closing your next deal? Drop it below 👇

1

0

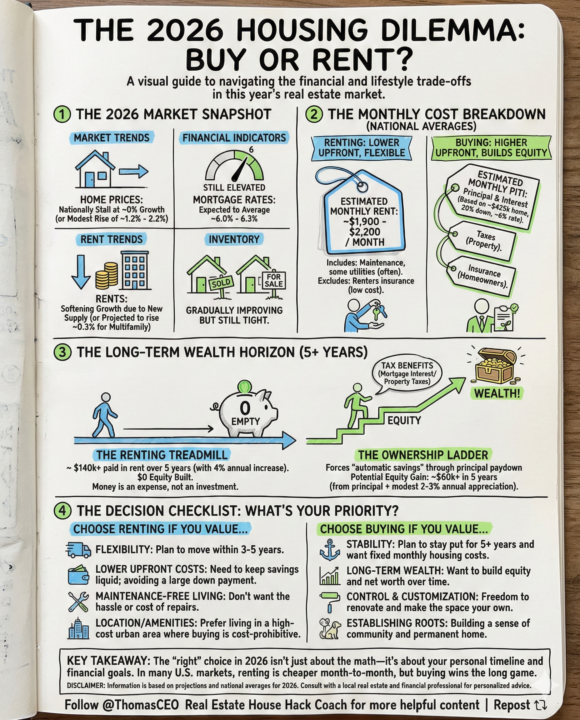

The 2026 Housing Dilemma: Buy or Rent?

The 2026 Housing Dilemma: Navigating the Buy vs. Rent Minefield If you feel paralyzed by the current housing market, you aren't alone. Welcome to real estate in 2026. We have officially entered a "new normal." The wild price swings of the early 2020s are over, but we haven't returned to the ultra-cheap borrowing days either. We are stuck in a holding pattern of stabilized—but high—prices and stubborn mortgage rates. For many, the ultimate financial question this year is: Do I keep renting, or do I bite the bullet and buy? There is no universal answer, but there is a framework for making the right decision for your finances. Based on my latest whiteboard breakdown (see the infographic above), let’s dive into the trade-offs of the 2026 market. The 2026 Reality Check Before making a decision, you need to understand the playing field. The 2026 market is defined by stabilization. According to current data, national home prices are largely stalling or seeing only very modest rises (around 1-2%). The frenzy is gone. However, the biggest hurdle remains mortgage rates, which have settled into the 6.0% – 6.3% range. On the other side, rent growth is softening due to new apartment supply hitting the market. This creates a unique dynamic where inventory for buyers is still tight, but renters have more options than before. The Monthly Crunch: The "Apples-to-Apples" Comparison Let's be blunt about the cash flow: In most U.S. markets right now, it is cheaper to rent on a monthly basis. When you look at national averages, renting offers a lower barrier to entry. You avoid the massive down payment and the surprise costs of maintenance (when the HVAC breaks, you just call the landlord). - Average Estimated Monthly Rent: ~$1,900 - $2,200 - Average Estimated Monthly PITI (Buy): ~$2,300 - $2,850 Note: PITI includes Principal, Interest, Taxes, and Insurance based on a ~$425k home with 20% down. If your primary goal is maximizing monthly disposable income today, renting looks very attractive on paper.

0

0

Why Your Wedding Date Might Be Costing You Seven Rental Units

The Marriage Penalty in Real Estate Most couples combine incomes to buy one home after marriage. This burns your FHA first-time buyer eligibility on a single liability generating $0 rental income. The Double Leverage Alternative: 8 Units vs. 1 Instead of buying together, each partner separately purchases a 4-unit property (quadplex) before marriage using FHA loans (3.5% down each). The Math: - Traditional Path: 1 home, 1 mortgage, $0 rental income - Double Leverage: 8 units, 2 mortgages, 7 tenant payments, ~7% combined down payment The Critical Requirements: 1. Snapshot Check: Credit score 580+, 2-year employment history (both partners) 2. The 75% Rule: Projected rental income must cover 75%+ of mortgage 3. Occupancy Sacrifice: Each partner lives in their own quadplex for 12 months minimum 4. Pro Tip: Use projected rental income from empty units to qualify for the loan After Year One: Your rental income eliminates mortgage debt from DTI calculations, enabling: - Option A: Move in together, rent all 7 other units (maximum cash flow) - Option B: Buy dream home with conventional loan, subsidized by 7 tenants Bottom Line: Return from your honeymoon with 7 tenants paying your mortgages, 2 appreciating properties, and tax benefits—not wedding debt and a single mortgage.

0

0

1-30 of 52

skool.com/shiftrich-academy-2627

Go from renter to owner in 6 months. No savings, no credit, no guesswork—just a proven system, tools, and coaching.

Powered by