Pinned

Welcome to the Salt Money Community for Passive Income Growth

We're so happy you found this community. Please take a few moments to introduce yourself by commenting on this post, sharing your favorite or ideal way to earn passive income and let us know a fun fact about you. Next steps after that: 1. Add [email protected] to your email address book, so you don't miss any of our messages/posts. 2. Head over to the Classroom tab and learn how to grow passive income the fast way.

Pinned

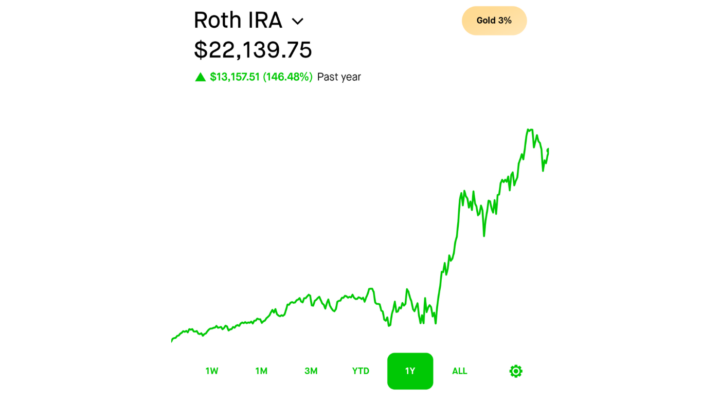

120% of Mostly Passive Income in One Year - Here's How:

I started learning about selling stock options in April of last year. I had no idea how impactful this new skill would become. My Robinhood retirement portfolio is up over 146% year-over-year. Without the use of stock options it would likely be up only 10-15%. It takes a little time to understand and implement option selling in a healthy way. A solid strategy can make or break whether we earn or lose money in the stock market. It is the same with selling options. I want to support you in engaging with the stock market in a healthy way. Everyone can learn to utilize the opportunities it provides, while avoiding the pitfalls. That's why I created the Option Selling Bootcamp in the Classroom tab. You can access it for a low one-time price, or by upgrading to our premium tier. Are you ready to take your financial freedom to the next level?

Pinned

What is the best way to create passive income with no (significant) savings?

The best way to build passive income from scratch depends on several factors. Our credit score, skills, savings (if any), as well as prior experience all play a role. Why is the credit score important? It is only important in the US or in a country with a similar financial system. Without an average or better credit score it becomes a lot harder to get a real estate or business loan. Don't have a good credit score? No problem, there are still many ways to build passive income (I'll share one below). Passive income is not a get rich quick scheme. We need a solid strategy as well as good execution paired with patience to see results. When I bought my first real estate property, I did not have a good enough credit history nor a stable enough income to get a decent loan from a bank. My parents agreed to co-sign with me, since I had a proven track record with them on being true to my word. This might seem like a handout to some, but they did not help at all with paying my loan or other expenses. I was old enough to manage these responsibilities on my own. I do not recommend co-signing, even if family members are involved. This option should be reserved for very special and low risk circumstances. But I want to share it here as example. Sometimes we have to find an unusual path to acquire the first asset that can generate passive income for us. I did not buy my first property for the purpose of creating income. It was just a practical option I had seen work well for my parents. If I was trying to earn passive income from real estate today, I would look for an affordable property (maybe a condo) which is just good enough for me to live there. I would find a way to buy it for a good deal and rent all rooms except for mine out to roommates. There are two strategic reasons for doing it this way: 1. Banks are more likely to give you a good loan on a property you plan to occupy yourself. 2. Roommates help with freeing up cash flow, so I don't need to use all of my active income for paying bills.

On my way to a Mastermind Event with Dean Graziosi

I'm on my way to a mastermind event with knowledge business owners. We get to hear from Mr. Dean Graziosi in person and other influential thought leaders. It is really good to discuss our wins and struggles with like-minded people. Being on a similar journey is encouraging and often very insightful. Have you already found people who are on a similar growth journey as you? If not, I would encourage you to keep looking for them. It might take a while to locate a suitable group. Sometimes a it requires a commitment to do so, either time-wise or financially. It does not have to be a group like this one. I personally just started meeting with one like-minded individual every Wednesday morning at 6.33 AM a few years ago. We still meet about four years later and the size of our group has grown to four (we try to keep it small intentionally). This helped us both make tremendous progress on our journeys. It prevented us from giving up when that was the easiest option. Please let me know what growth journey you are currently on and how you can help. You can either use the comments or send a DM (must follow to do so).

Weekly Portfolio Update

I like to give an update on our main stock portfolio sometimes, where we sell options to significantly improve investment returns. The portfolio balance is down 3.88% on the week $14,544 in options premium collected (this means withdraw-able cash deposited into the account) $9,217 in realized options P/L (from options expiring worthless or closed) Took assignments on $HIMS and $HOOD puts this week. Sold the shares on $HIMS, but still holding $HOOD with new covered calls. Let's keep the wheel going! Wanna learn how to do this? Check out http://optiontunity.com #RoadTo1M

1-30 of 34

powered by

skool.com/salt-money-passive-income-4848

Passive income is the key to true financial freedom. If you're ready to save time and money creating your first or next income stream, this is for you

Suggested communities

Powered by