First NPN Experience

Wanted to follow up and offer an overview of my first npn purchase, as discussed with Robert, in hope that there are some learning/teaching points for discussion. This deal was back in 2018, and I had become interested in NPN's after doing a course with Scott Carson. I enjoyed his course and learned a lot, and was eager to get my feet wet. I formed an LLC and scoured some tapes from various brokers, and eventually found a cherry pick opportunity for an sfr in Saint Louis, MO. The note was a CFD (Contract For Deed) and the home was a small, older, but attractive brick home with a nice front porch, 3/2, with garage in back, and on a reasonably attractive street. The UPB was approx $32K and the FMV was around $45-$50K based on comps. ..I made a bid and we ultimately closed at 40% UPB, or about $13K. I was excited and we started the diligence period. We obtained the collateral file and pulled O&E reports and checked utilities and tax accounts, and things seemed to be in reasonable order. The owners were a couple who operated their own hair salon. ..We also reviewed their credit reports. We ultimately learned that the husband had recently passed away in an accident, so the wife was on her own. ...That's obviously a tough situation, and maybe should have been a red flag, but the actual monthly payment wasn't too high, and the arrears weren't too bad. My approach is patient and compassionate, so I was optimistic we could work with her. We had the loan boarded with Madison Management and they were very helpful and sent the borrower welcome letter and conducted the reach out. ...Initially things seemed promising as borrower was communicative. We wanted to be compassionate, and with Madison's help, we wrote off some of the arrears and re-structured the note to reduce the payment and bring her current. ...Again, my wife and I were optimistic about the workout and hoped to let it perform and season for awhile. Unfortunately, after a couple months, borrower had problems and payments became late and partials. ...So, again, given borrower's personal circumstances, we wanted to try to work with her. We executed a second re-structure in hopes she could make it work. Unfortunately, problems cropped up again within just a few months, and we began to realize things weren't going to be easy.

Borrower just called me an "Angel from Heaven" 👼

I helped one of our non-performing accounts negotiate a discounted payoff on Friday and received this glowing appreciation (email attached). It's pretty amazing how much we can impact our borrower's lives when we offer a little compassion & pass some of the discount along (this loan was bought very cheap because of the impact of AB 130 on 2nd liens in California). And even better - the client who I help close this deal for tripled their money on the deal 🤑

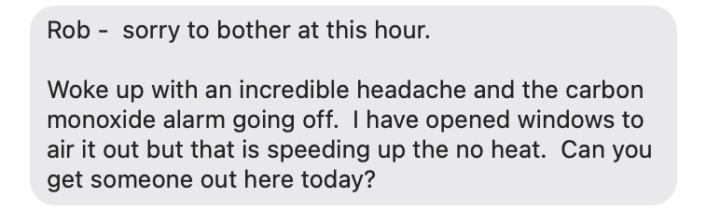

🚒🔥 at my Quadplex

The reason we're all here is because we think mortgage notes are the best way to invest in real estate. Yesterday reinforced this belief for me. Let me set the scene: I'm in an ultrasound appointment with my wife (baby #3 coming in April!) and I get a frantic text from Amber, the tenant living in the 2nd floor apartment of my mixed-use building in a town about an hour away. I had missed her text at 6:43am: "Rob - sorry to bother at this hour... Woke up with an incredible headache and the carbon monoxide alarm going off. I have opened windows to air it out but that is speeding up the no heat. Can you get someone out here today?" Her follow up text sent me into a panic. And after calls to the furnace repair company (that had cleared screwed something up when they tuned up the machine last month) & the utility company to turn off the gas I called my tenant back with the instructions: "evacuate the building" But when the phone went straight to voicemail, text messages left unread - my blood went as cold as the icy wind coming through the windows in her unheated apartment... I feared the worst: she was passed out from carbon monoxide poisoning, unable to escape the apartment. I dialed 911 and an ambulance, fire truck and police were shortly outside the apartment. Tried to call her again, RELIEF - she picks up & is on the way out of the apartment. The firefighters get inside the basement of the building and find the furnace spitting out flames into the surrounding area - lighting cobwebs and anything they touch on fire. "You got really lucky..." was all the fire chief could say over the phone while he caught his breath. The furnace is toast but everyone survived. And my tenant sent me a text memorializing the close call: "The FD said the heater is “a mess and probably should be replaced as the issue has to have been building for a while as the reading in the basement was at 70 ppm and 50 will kill you!” It’s down to 17 in the apt now and had been cleared for me to go back in."

Week in the Life of a Portfolio Manager (week #50 / 2025)

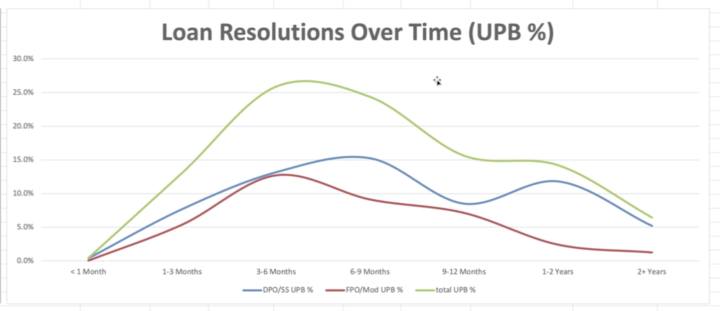

Happy Friday! Another week of full-time note investing work in the books! As you may know, we provide portfolio management & run loan sales for a handful of private clients. Our top client currently holds 2,716 mortgage notes, approximately 300 are cash-flowing and the vast majority are non-performing (NPL). FIXnotes' job is to get those NPLs back on track or sold. So to help the community run efficient operations of their own (or as a service for other investors), I'm going to start documenting our progress - giving you a peak inside a business that brings in $5MM+ per year in mortgage note revenue (2025 has been a banner year with over $8MM grossed). So what did we do this week? Year End Cash-Flowing Audit On a regular basis it's important to ensure that your performing loans are performing as expected. This month we did a heavy audit of all of our client's cash-flow and initiated a campaign to get any re-defaulted accounts reinstated. Essentially - that means we told the borrowers how much they needed to pay to get caught up, while extending an olive branch for a revised modification if necessary. Thanks @Bill McCafferty for heading up this initiative! Data-Mining for Current Vintage versus Historic Performance I spent many hours this week pouring over our latest portfolio performance (we call each portfolio a separate "vintage") and comparing this against past efforts gives us a good understanding of how the trade stacks up against our historic results. I prepared two reports (in Excel) including line graphs: "% of UPB Resolved" & "Cumulative Basis Recovered". Here's a little detail about each: % of UPB Resolved This report reveals the percentage of unpaid principal balance that was turned into successful loan modification or payoffs within distinct time periods measured from the data of acquisition. Month 0 has a handful of resolutions as the seller occasionally sends "interim payoffs" that clear after our contract cut-off date. Then we measure in 3 months chunks: Months 1-3, Months 3-6, Months 6-9 etc. We plot the results on a line graph to see how the portfolio performs over time against similar portfolios that were acquired in the past.

Poll

17 members have voted

Orlando, FL - Reperforming 2nd Mortgage Note Purchase - Collateral Assignment (Case Study)

I purchased this reperforming 2nd mortgage back in 2023 on a property in Orlando, FL. 8-months after I purchased the mortgage, I did a Collateral Assignment with one of my investors. Eventually selling the mortgage to the same investor. Here are the Deal Numbers: - Property FMV: $475k - 1st Mortgage Balance: $225K (Current) - Note Purchase Price: $28,425.91 (Purchase Yield 13.7%) - 2nd Mortgage Loan Balance Purchased: $50,943.06 - Borrower Payments Made: 4 - Borrower Payments Purchased: 356 - Monthly Loan Payment: $350.00 - Current Interest Rate: 7.2901% I collected 8-monthly payments of $350 (8 X $350 = $2,800 received), I then did a 2-Year Collateral Assignment with one of my investors. A Collateral Assignment of Mortgage is a legal agreement where an investor gets a security interest in another investor's mortgage loan and its underlying collateral (like property) to secure a loan between the two investors, essentially pledging the mortgage as collateral for a loan. - 2-Year Collateral Assignment Amount: $30,000 (Money lent to me, from my Investor) - Monthly Payments to my investor: 24 - Monthly Interest-Only Payment to my investor: $250 (10% Yield to my Investor) I used an existing Reperforming 2nd Mortgage as collateral to borrow $30k from my investor for a 2-Year period. The terms between my investor & I, were 24-monthly payments at 10% interest-only, which is $250 per month. After 24-months I owed my investor their full principal amount back, the $30k. For 24-months I collected a $350 payment from the borrower of the mortgage loan and paid my investor $250 a month. So, I still received $100 a month, after I paid my investor their $250 (24 X $100 = $2,400 received). I could have paid my investor back his full principal amount of $30k, when the Collateral Assignment was finished, but I decided to sell him the mortgage note instead. - Investor's Note Purchase Price: $36,908.72 (Purchase Yield 10%) - Since I owed my investor $30k, they only had to come to the closing with $6,908.72 - 2nd Mortgage Loan Balance Purchased: $49,516.68 - Borrower Payments Made: 36 - Borrower Payments Purchased: 324 - Monthly Loan Payment: $350.00 - Current Interest Rate: 7.2901%

1-17 of 17

skool.com/notes

The nationwide network for mortgage note investing: learn the best (and under-the-radar) way to profit from Distressed & Cash-Flowing Real Estate.

Powered by