National Listing of All US Mobile Home and RV Parks

Update 2-6-26 shout out to @Christopher Brown who found the updated link Came across this resource while doing some research. According to data obtained from the U.S. Department of Homeland Security (HIFLD) and as of Fri, Sep 20, 2024, there are 56,094 Mobile Home and RV Parks in the U.S. Site names, addresses, and contact phone numbers: https://www.arcgis.com/home/item.html?id=ed1e173a494249a4b784d645eba49e6f&sublayer=0#data

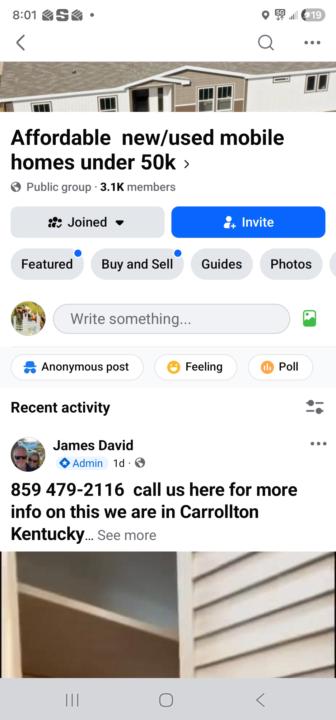

Used home question

Does anyone know if this company/site/person is legit, please?

How to Approve the “Right” Resident?

I’m in a season of turnover within my park as well as trying to sell off a couple POH. I’ve been experiencing a bit of stress trying to find and qualify the “right” resident that isn’t going to cause issues with neighbors and generally take care of their place - All the stuff ya’ll know is a pain to deal with if they don’t. Questions: How do you guys handle resident screenings? How do you keep your emotions out of it while still spending the time it takes to find good tenant that is going end up being a thorn? 🤔 Many thanks! Jason

Investing Hype vs Real Life

Saw this come in this morning. I’m sure many of you here invest across different asset classes. I’ve noticed a surge in courses and promotions around multifamily lately — probably more than any other asset class. I’ve been investing in real estate and attending seminars since 1996, and I’ve lived through a few cycles. One thing I’ve learned: once you build a solid base, don’t jeopardize it chasing the next shiny opportunity. That said, after a couple months in this group, I’ve found the knowledge being shared to have real value. There’s strong engagement and a lot of real-world experience here. This is how we all rise together. Referring back to the headline, I’ve heard that many multifamily syndications have struggled to meet investor payouts. It makes me wonder if excitement and competition pushed some groups to overpay. Hopefully that’s just noise and not a larger trend. I believe the mobile home park asset class we focus on has gained significant attention over the past decade, and that will likely continue. With more capital chasing deals, I do wonder whether we’ll start seeing portfolios listed at “crazy” prices. Time will tell. Either way — underwrite conservatively, protect your basis, and don’t overpay. There are a lot of syndications out there fueled by rookie hype. Know your markets, stick to fundamentals, and protect what you’ve built.https://www.credaily.com/briefs/multifamily-housing-demand-drives-investor-interest/

4

0

Mike Pansolini Interview

Had a GREAT time hearing about how Mike Pansolini left his W2 and is now on a mission to help others reach Financial Freedom in the MHP space.

1-30 of 215

skool.com/mobilehomepark

🚀 Cut out the noise. Built for action-takers: connect with top MHP pros, access pro-level tools, and tap into real deal flow with a networking map.

Powered by