Write something

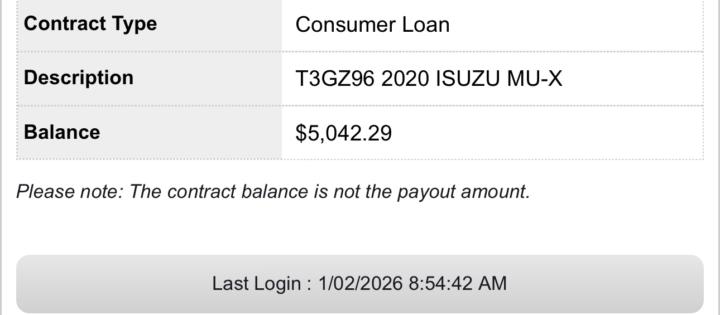

$5k left to GO! Payoff sooner then we thought!

Quick honest check-in, crew ❤️ We just knocked the car loan down to $5,072 remaining. Only $5,572 to pay it out completely and wipe it clean. Every single weekly payment was a small step. Some weeks felt slow, some felt heavy, but they all added up. Now we’re staring at the finish line so close I can taste it. This is what consistent pushing looks like. Not magic. Not overnight. Just refusing to quit, one grind at a time. We’re not there yet… but damn, we’re close. And every dollar closer means one step nearer to the house keys and the life we’re building for the kids. If you’re in your own grind right now debt, goals, habits just know: The finish line is real, and every tiny push gets you closer. Keep going. We’re in this together. 💪 What’s your “so close” moment right now? This feels like a massive step to get a house this year 💪 No pressure just sharing wins and fuel when you feel it. Proud of every one of you still showing up. Let’s finish strong.

3

0

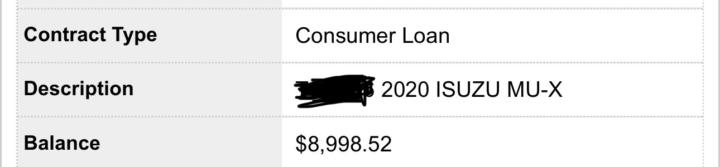

Less then $9000 on the car loan 🥹

Such a beautiful thing to see. Every pay, every fortnite lower & lower. Under 10k in just over 12 months starting at over 40k borrowed. After this has been smashed out, house saving compounding starts aggressively…. 206 is the year 🤝 Appreciate all the motivation on this journey, this is my story & I’m thankful to have a great community to see the process start to finish 👌

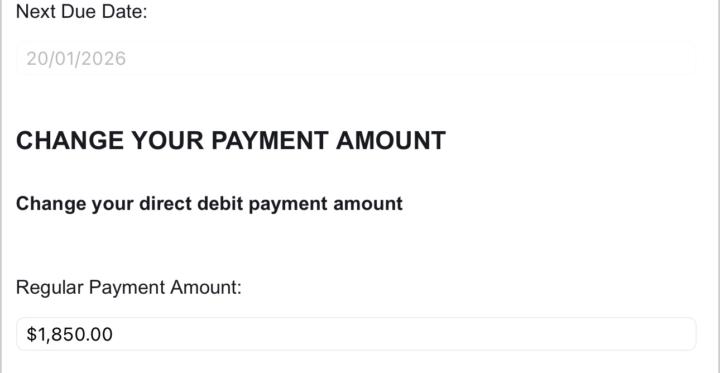

Big win alert, fam! 🚀

Just locked in another payment of $1,850 on the car loan… which drops the balance to under $9k (exactly $10,842 right now, but after this hits, we’re talking just under 9k left!). Started at $42,000 on 23rd October 2024 with that 10.5% beast. That means we’ve already smashed over $32k off the principal in this time. (Saving more in interest) Insane progress when you step back and look at it! I’m genuinely proud of what we’re achieving here one intentional payment at a time. No shortcuts, just consistent action. This car loan is on its last legs, and I’m so excited to keep pushing until it’s gone for good. Freedom is coming fast & then onto getting this first house 👌👌 If you’re grinding your own debt payoff, share your latest small (or big!) win below. We’re all in this together celebrating every step forward. One payment closer. Let’s go! 💪🔥

The $42k Car That Almost Cost Me My House

G’day crew 👊 When we found out we were having a bub, we realised our old car just wasn’t safe anymore. So we did the research, crunched the numbers, and went for a MUX big, reliable, perfect for family road trips and camping, and still on the cheaper side. We took a $42,000 loan. I thought I was being smart: paying almost double each payment, smashing it down fast. But here’s what I didn’t realise back then: Banks look at the original loan amount when calculating your borrowing power not how much you’ve paid off. That $42k loan ate over $160,000 of my potential house borrowing power. Even though I paid it down super quick, it didn’t matter. Lesson hit hard. Now in February? Car will be paid off completely ( 17 months total ) Then we go full send on the house deposit. Looking back would I do it differently? Probably. But honestly? I’m glad I didn’t. We love the car. It’s the best we’ve ever had. And now I know better. So if you’re a dad thinking about a new car right now pause. Run the numbers on how it affects your house dream. Sometimes the “smart” purchase is the one that waits. What about you? Ever had a big purchase bite your borrowing power? Or nailed the balance between family needs and future freedom? Drop your story below let’s learn from each other 💪

2

0

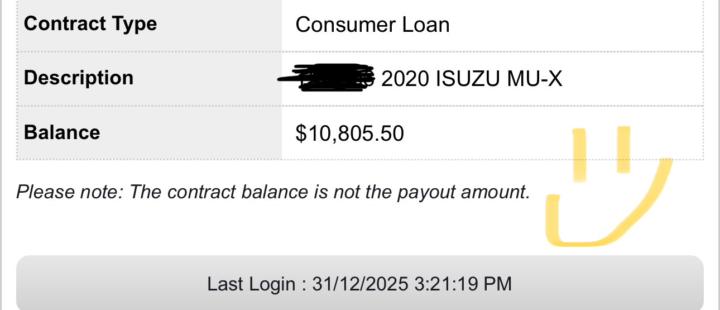

Every week we closer 🤝

Each week we are closer to our goal. First get rid of the car Debt Then save save save for house deposit 🔥 Loan started at $42,000 14 months ago.. grateful for the progress we have made let’s keep it going. Gone by Feb 👌

3

0

1-6 of 6

powered by

skool.com/matthew-alchins-1-dad-3441

Girl dad grinding for freedom real life vlogs, tech tips, family hacks, daily 1% wins. Positive, uplifting, no BS. Let’s level up together 💪🔥

Suggested communities

Powered by