🎯 Friday Fuel-Up: Don’t Confuse Discomfort with Failure

There comes a point in every trader’s journey where things feel uncomfortable. Results slow down. Momentum shifts. Confidence wobbles. And suddenly the temptation to change everything starts creeping in. New indicators. New strategy. New rules. But here’s the truth most traders learn the hard way. Discomfort does not mean the process is broken. Growth in trading is rarely smooth. There are stretches where the edge feels invisible. Periods where patience feels harder than pulling the trigger. Moments where discipline feels boring compared to trying something new. That’s not a sign to abandon ship. That’s a sign you’re being tested. The market rewards consistency over emotion. It rewards those who can stay steady when results temporarily fluctuate. It punishes those who constantly reset the game every time it gets uncomfortable. Before changing the system, ask yourself... 👉Did I follow my rules 👉Did I manage risk correctly 👉Did I execute with discipline If the answer is yes, you’re exactly where you need to be. 🚀 Stay consistent. Stay patient. Let the probabilities work over time instead of reacting to short term noise. — Coach Stephen

🎥 Still Waiting for Trading Capital? Stop! (Recording Available)

Huge thank you to everyone who showed up for the session. The conversation was real, honest, and exactly what it needed to be. If you missed it or if you’re still sitting there thinking, “I’ll start trading when I have more money…” This replay is for you. We talked openly about: • What funded/prop firms actually are (no hype) • Why most traders fail evaluations • Who funded trading is for and who it’s not for • The discipline required to manage performance accounts • Whether waiting for personal capital is really the right move No sales pitch No fantasy numbers. Just clarity. If you’re serious about figuring out whether funded trading makes sense for you, watch the replay and take notes. Then come back with questions. — Coach Stephen

Step 3 Homework

Just finished Step 3. I went back through this week to practice making my supply and demand blocks like Kyle suggested. Let me know what I can improve on. Let's learn together :) Thank you! Feb 9th - Feb 13th SP 500 mini

3

0

GC Declines

Is anyone else unable to trade GC or MGC? My orders have been getting declined for the last few days but im trading everything else no problem.

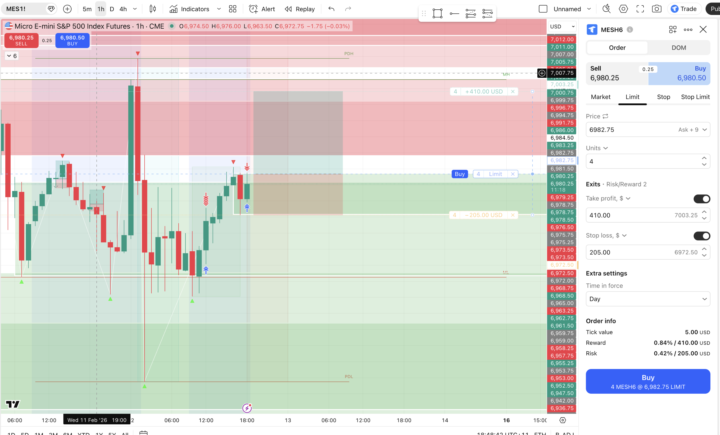

Is it supposed to say "sell limit" on a long limit order?

I did one yesterday on tradovate linked to tradingview and won a trade but i dont think money went through cos it said "sell limit" rather than "take profit"... in papertrading it says "take profit" when i use a limit order but when i use tradovate it is saying "sell limit". Will it still work as a sell limit? Image ONE is what it looks like when i pressed "create limit order" (which is what it looks like when i papertrade after i press buy) Image TWO is what it looks like after i pressed the buy button on tradovate, it turns take profit into sell limit Image THREE are my settings are my settings correct for this to work properly on Tradovate?

1-30 of 2,704

skool.com/investceo-with-kyle-henris-4723

Day Trading helped me create my dream lifestyle. This group is dedicated to help you do the same by giving you the roadmap that helped get me here.

Powered by