I’m setting up payroll for January 1 (first time ever doing this).

I’m sharing this openly because I know a lot of you are either right behind me — or quietly dreading this step. This is brand new territory for me.I’ve never paid employees before. Until now, Monument Glamping was scrappy, seasonal, and simple. My previous business (curriculum publishing) was the same. As this business has grown — and frankly outgrown publishing — it became obvious that payroll needed to grow up too. So I finally crossed that line. 💠 WHAT I HAD TO WORK THROUGH (THE REAL CHECKLIST) • Deciding when to start (January 1 = clean reset) • W-2 employees vs contractors (especially cleaners — this matters more than people realize) • Pay periods that are predictable and easy to explain • How fast payroll gets processed after a pay period closes • Collecting W-4s from everyone (non-negotiable) • Reasonable compensation for owners working in the business • Making sure payroll syncs cleanly with QuickBooks • Choosing a system that wouldn’t turn payroll into a second job I didn’t want clever.I wanted boring, compliant, and repeatable. 💠 WHY I CHOSE GUSTO I landed on Gusto not because it’s flashy, but because it removes friction where mistakes get expensive. Here’s what mattered to me: • Full-service payroll (they handle filings) • W-2 employees and owners handled cleanly • Automatic tax calculations and payments • Employee self-service portal (pay stubs, W-2s, updates — fewer emails to me) • Easy W-4 collection and storage • Direct integration with QuickBooks • Clean audit trail (important for financing or exit) • Scales without needing to switch systems again soon I can set it up now, test everything, and not run payroll until January.That mattered. 💠 MY ACTUAL PAYROLL SETUP (FOR TRANSPARENCY) • Payroll starts January 1 • Semi-monthly pay periods:– 1st–15th– 16th–end of month • Paychecks issued within 4 days of each pay period closing • All cleaners will be W-2 employees with W-4s on file • Wendy and I will each be paid $40,000/year as salaried employees– Wendy: Operations Manager– Me: CEO

0

0

Thursdays call

Thanks everyone for Thursdays call and Ty @Chris Jeub for the referral for the draftsperson that is one of the biggest things I've been looking for. I will start in January getting a site plan and start working On my business plan. That is going to be my action goal for 1st qtr 2026. It helps to announce it for some accountability

Brian Linton Opportunity

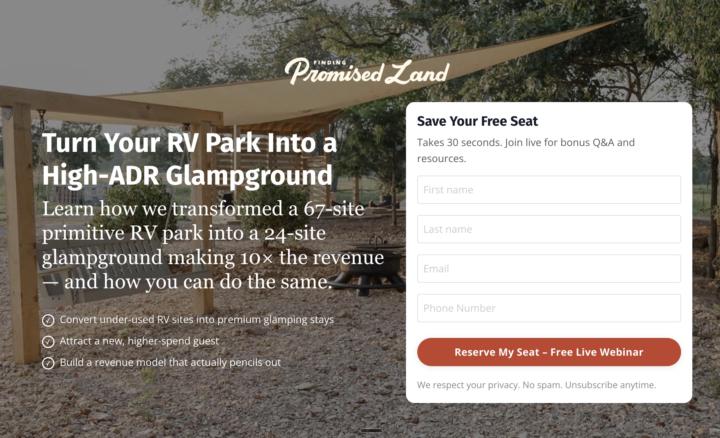

If interested, sign up for this free class by Brian Linton. @Lance Turner has consulted with him personally and speaks highly of him. I won't be able to make the actual webinar, but I signed up anyway to make sure I get a recording to watch later. I suspect this will be similar to the Bolt Farm session last month, and perhaps similar to what I have planned for January (heh). We're all working to help others get their glamping operations going. I'm sure the free lesson will be helpful. Here's a link: https://learn.findingpromisedland.com/rv-park-to-glampground-webinar

Happy Monday, Ikigai Weirdos!

So this morning Todd Wynne-Parry texted me a little diagram I had never seen before — the four-circle “ikigai” framework. Naturally, I fell straight down the wormhole. Research mode activated. But the more I dug, the more something surprising hit me: This thing describes exactly what we’re trying to build here in YLIG. Ikigai is basically the center of the target — the overlap of: - What you love - What you’re good at - What the world needs - What you can get paid for And suddenly I thought… "wait a minute." Isn’t that the whole point of what we’re doing as land developers, dream-chasers, freedom-builders? We’re not just trying to build glamping sites or short-term rentals. We’re trying to build lives that sit closer and closer to that bullseye — purpose, capability, contribution, and income all lined up. So here’s your Monday nudge: If you’re in this group, you’re already one of the “ikigai weirdos.” You’re someone who refuses to settle for the life everyone else sleepwalks through. You’re aiming for that center. Let’s keep moving toward it together. Happy Monday, friends — let’s build.

Tonight's Online Mastermind

This morning was a first: The bank took me out to coffee. I guess that's where I'm at now-a-days! My financing is coming into play and I'll share details with you tonight. Along with... - The new Explorer + Master Track in our membership - News from the Todd Wynne-Parry hunt & tour of Aramark - My email to the county concerning the 14 foot setback they want me to spend $1500 surveying to prove them wrong (grrrr) Come ready to share your latest news. The group is intended to keep us all pushing our development dreams forward. See you at 7pm tonight! Chris

1-30 of 140

skool.com/gold

A community of landowners who see their land as GOLD — revenue-generating assets. Glamping, ADUs, STRs, etc. We're all building value in our land.

Powered by