Write something

🎯 Curious how top Realtors use insights like this to stand out with clients, create lasting trust and referalls?

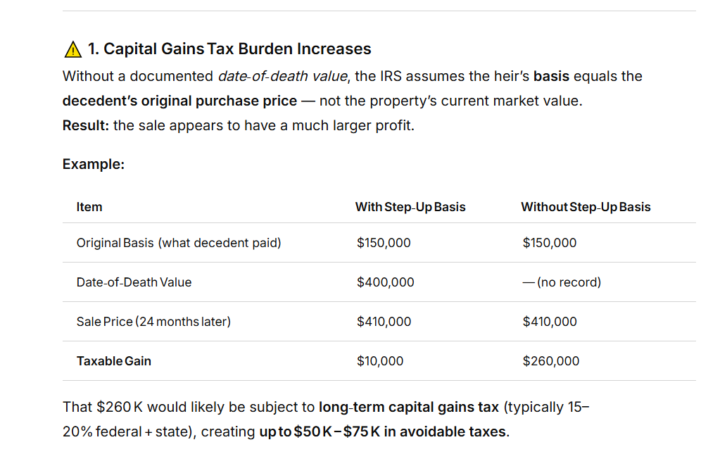

⚠️ 1. Capital Gains Tax Burden Increases Without a documented date‑of‑death value, the IRS assumes the heir’s basis equals the decedent’s original purchase price — not the property’s current market value.Result: the sale appears to have a much larger profit. Example: Item With Step‑Up Basis Without Step‑Up Basis Original Basis (what decedent paid) $150,000 $150,000 Date‑of‑Death Value $400,000 — (no record) Sale Price (24 months later) $410,000 $410,000 Taxable Gain $10,000 $260,000 That $260 K would likely be subject to long‑term capital gains tax (typically 15–20% federal + state), creating up to $50 K – $75 K in avoidable taxes. 🧾 2. No IRS‑Recognized “Fair Market Value at Death” Proof If audited or questioned, heirs cannot substantiate the stepped‑up value without an appraisal dated near the decedent’s death. CPA documentation becomes speculative, and the IRS may reject estimated comparables. ⏳ 3. Lost Estate‑Planning Protection Even if the property is sold within 24 months, the IRS allows the estate or heir to use date‑of‑death value only if it’s properly determined and supported by credible evidence (IRS Publication 551, Basis of Assets; Topic 701). Without an appraisal, you miss that protection window — and retroactive appraisals done too late can be challenged. Plus, tetrospective appraisals are often after the property has been sold and the appraiser does not have access to the property. 📖 Source - IRS Publication 551 (2023) – Basis of Assets, Section “Property Received as a Bequest, Inheritance, or Gift.”https://www.irs.gov/publications/p551 - IRS Topic 701 – Sale of Your Home (for capital‑gain exclusion context). In short:Failing to get a step‑up basis appraisal after someone passes can turn a near‑zero tax event into a five‑figure tax liability.A single certified valuation preserves the family’s equity and ensures compliance before selling the home. I am not an attorney or CPA.

0

0

Stop guessing. Start proving. Get you Real Value Edge.

“Diligence beats guessing every time — and a $600 pre‑listing appraisal can make you look like a rock star. 🌟” 📞 Realtor Calls Appraiser Realtor: Hey, just wrapped a listing appointment — the seller’s home is… unique. Appraiser: (laughs) Everyone says that! 😄 What are we working with? Realtor: No bedrooms on the main level. Appraiser: Let me guess — lakefront, probably custom, bedrooms below grade with a walkout and a water view? Realtor: 😮 You nailed it! And they haven’t updated anything since 1990. Every comp that’s sold recently is highly remodeled. Sellers still think the view alone will carry the price. Appraiser: Classic “view premium” talk. 🌅 Views help, but buyers still compare functionality, layout, and condition. In our market, no main-level bedrooms = smaller buyer pool. Appraisers factor everything — not just the view. Realtor: Good point. So, where do I even start on pricing? Appraiser: Two options: 1️⃣ Do all the data‑driven comp research yourself. Probably take you 3-5 hours and your still making an educated guess. 2️⃣ Or pay $600 and I’ll deliver a, unbiased market value. You'll get a 35+ page report and see the comparables used and the subject's story that supports it market value. Realtor: Honestly, I can’t find any comps within one mile and six months anyway. Appraiser: (grins) Yeah, because real‑world appraising doesn’t always fit those tight lender boxes. We go further out — geographically and historically — to find credible support. Diligence beats guessing, every time. Realtor: Sounds like a plan. Send me your fee and availability — they want to list this month. ⏩ Fast forward:The pre‑listing appraisal comes in $28K higher than expected. The home goes under contract in 14 days for full list price. 🎉 💡 Moral: That one $600 appraisal made the Realtor look like an expert, earned trust, boosted commission, and likely secured three future referrals from that lakefront neighborhood. Poll questions. Select all the apply.

Poll

Cast your vote

0

0

1-4 of 4

skool.com/gettheedgenow

💸 Empowering Agents to Dominate the MLS, Understand Lender Dynamics & Appraisals =

The Edge that Elevates Realtors & Value. Online modules Feb '26.

Powered by