Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Owned by Shawn

💸 Empowering Agents to Dominate the MLS, Understand Lender Dynamics & Appraisals = The Edge that Elevates Realtors & Value. Via Art of Appraisal 📈

💸 Empowering Agents to Dominate the MLS, Understand Lender Dynamics & Appraisals = The Edge that Elevates Realtors & Value. Online modules Feb '26.

Memberships

The Skool Hub

4k members • Free

Amplify Views

27.9k members • Free

The YouTube that Sells

69 members • Free

The AI Advantage

69.2k members • Free

Free Skool Course

30.6k members • Free

Creator Profits

17k members • Free

YouTube For Beginners🏆

103 members • Free

Your Great Reset

4 members • Free

Real Estate Video Blueprint

729 members • Free

13 contributions to 🥇 Real Estate Value Edge USA

Confidence is Your Currency -Tell me Otherwise

🔥 Ever walked into a client meeting feeling 90% ready? That 10% gap is what costs agents deals, pricing confidence, and referrals. Here’s how top agents close that gap — and why confidence pays more than commissions. 💰

0

0

💎 The Real Estate Value Edge

Empowering Agents to Create Value Where Agents Learn More, Earn More 💰, and Lead with Confidence 🔹 THE WHAT — Your Shortcut to More Closings, Higher Prices & Happier Clients This isn’t another “coaching group.” 👉 It’s a practical community built for Realtors who want to create real results — faster, easier, and smarter. Inside The Real Estate Value Edge, you’ll learn exactly how to: - Speak about value with confidence that commands higher prices - Guide clients instead of defending numbers - Turn clear conversations into closings and referrals - Multiply your reputation — without multiplying your workload - Prepare yourself and your clients for the appraisal process - Identify common repair items - Know when your clients should reach out to a trusted valuation or legal expert 🎯 Simple, smart, and built to make you the most trusted professional in your market. 💡 THE WHY — Because Knowledge Makes You Money When you understand how value really works, you stop chasing business and start attracting it. Your clients trust you more. Your listings get priced right. Your properties sell faster — and often for more. Your referrals skyrocket because deals showcase your professional value. 💥 More knowledge = more confidence. More confidence = more conversions. The Edge teaches you how to do exactly that — step by step. 📍 THE WHERE — Inside The Real Estate Value Edge Skool Community Welcome to your one‑stop resource hub for Realtor success. Everything is organized, fast, and ready for you to apply today: 🧭 Quick lessons (under 10 minutes) — Learn it, use it, close with it. 🧠 Value scripts and cheat sheets — Say the right thing. - And what not to say. 🔥 Proven strategies — Pricing, positioning, and client clarity. 💬 Community collaboration — Learn with and from driven agents & experts. This isn’t endless training. This is instant empowerment. ⚙️ HOW EASY IT IS — Your 5‑Minute Path to Results 1️⃣ Join The Real Estate Value Edge community 2️⃣ Choose one short lesson or resource that fits your next deal

0

0

🎯 Curious how top Realtors use insights like this to stand out with clients, create lasting trust and referalls?

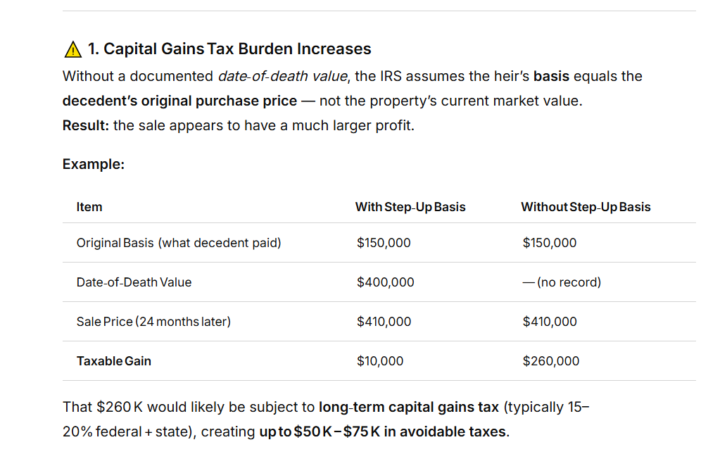

⚠️ 1. Capital Gains Tax Burden Increases Without a documented date‑of‑death value, the IRS assumes the heir’s basis equals the decedent’s original purchase price — not the property’s current market value.Result: the sale appears to have a much larger profit. Example: Item With Step‑Up Basis Without Step‑Up Basis Original Basis (what decedent paid) $150,000 $150,000 Date‑of‑Death Value $400,000 — (no record) Sale Price (24 months later) $410,000 $410,000 Taxable Gain $10,000 $260,000 That $260 K would likely be subject to long‑term capital gains tax (typically 15–20% federal + state), creating up to $50 K – $75 K in avoidable taxes. 🧾 2. No IRS‑Recognized “Fair Market Value at Death” Proof If audited or questioned, heirs cannot substantiate the stepped‑up value without an appraisal dated near the decedent’s death. CPA documentation becomes speculative, and the IRS may reject estimated comparables. ⏳ 3. Lost Estate‑Planning Protection Even if the property is sold within 24 months, the IRS allows the estate or heir to use date‑of‑death value only if it’s properly determined and supported by credible evidence (IRS Publication 551, Basis of Assets; Topic 701). Without an appraisal, you miss that protection window — and retroactive appraisals done too late can be challenged. Plus, tetrospective appraisals are often after the property has been sold and the appraiser does not have access to the property. 📖 Source - IRS Publication 551 (2023) – Basis of Assets, Section “Property Received as a Bequest, Inheritance, or Gift.”https://www.irs.gov/publications/p551 - IRS Topic 701 – Sale of Your Home (for capital‑gain exclusion context). In short:Failing to get a step‑up basis appraisal after someone passes can turn a near‑zero tax event into a five‑figure tax liability.A single certified valuation preserves the family’s equity and ensures compliance before selling the home. I am not an attorney or CPA.

0

0

Ready to bring in top dollar, avoid costly delays, attract more clients, & build a referral base that keeps growing?

Get the edge every high‑performing agent needs. Appraisers complete hundreds of assignments every year, which means they study how buyers and sellers actually behave — because buyers and sellers are the market. Through proven, data‑rich, and supportive valuation techniques, appraisers extract measurable insights from every transaction, turning market behavior into actionable analytics that define true value — not guesswork. When you understand how appraisers interpret the market, you can price with precision, position listings for maximum return, avoid setbacks that stall closings, and build credibility that drives referrals. Learn to think like an appraiser — list and sell with confidence born from data.

0

0

1-10 of 13

@shawn-foppe-6418

Author & coach with 27+ yrs field work & 11,000+ valuations—lender/non-lender expertise, trusted locally, credible valuation guidance for all parties.

Active 28m ago

Joined Jan 5, 2026

INTP

Powered by