🩺 Can I write off my car? Ask the Tax Doctor | Dr. Geno

📘 Short Answer: Yes — but you need a plan. There are several IRS-approved methods to deduct vehicle expenses, and once you choose a method, there are rules you must follow going forward. 📘 The Main Methods Explained 🚗 Mileage Method ✔️ Easy and quick ✔️ No commitment to one specific vehicle ✔️ No depreciation recapture issues later ✔️ Clean when you sell or trade the vehicle ❗ Requires good mileage logs 🧾 Actual Expenses / Depreciation Deduction is spread over multiple years Includes gas, insurance, repairs, depreciation Requires strong documentation Business-use percentage matters every year 💥 Section 179 + Bonus Depreciation Can create huge write-offs upfront Great for high-profit years ⚠️ Leaves minimal deductions in future years ⚠️ Can trigger recapture if business use drops or the vehicle is sold Best used strategically, not emotionally 🩺 Dr. Geno’s Take: The question isn’t “Can I write it off?” The real question is which method fits your income, profits, and long-term plan. What helps one year can hurt the next if it’s not planned correctly. This is tax strategy, not just tax prep. 📞 Call or Text: (813) 462-2758 📅 Schedule a FREE video consultation: 👉 www.GenoBradley.com Ask the Tax Doctor. Go with a Pro. GBC Tax Pros. https://genobradley.com

4

0

🩺 Do I get more write-offs for my business if I have an LLC? Ask the Tax Doctor

📘 Book Answer: No. The IRS uses Schedule C for sole proprietors and single-member LLCs. 👉 The deductions are the same. 👇👇👇 🩺 Dr. Geno’s Take: An LLC doesn’t create extra write-offs—but it does matter. ✅ Legitimizes your business The IRS is always watching for illegitimate “businesses” used to chase big refunds. 🧾 Establishes a real operation An LLC + EIN shows structure, intent, and compliance. 🛡️ Protects your personal assets Separation matters. ⭐ Builds business credibility With banks, vendors, and clients. There are many more benefits to having an LLC—but taxes alone shouldn’t be the reason you form one. 📞 Call or Text: (813) 462-2758 📅 Schedule a FREE video consultation: 👉 www.GenoBradley.com Ask the Tax Doctor. Go with a Pro..... GBC Tax Pros

3

0

Easy Ai Image Generation

Go to Ai system....... (chatgpt, gemini, whatever you use) Use this prompt 👇👇👇 Create a caricature of me and my job based on everything you know about me. ⁉️when you are done............ show me what it made for you

Tax Tuesday | Did You Know?

How do you notify the IRS that your address has changed? Option 1️⃣📄 — File With Your New Address Use your new address the next time you file a tax return.✔️ This updates IRS records automatically. Option 2️⃣📞 — Contact the IRS Directly Call the IRS at 1-800-829-1040.✔️ You’ll need to verify your identity and your old address.⚠️ Be prepared for long wait times. Option 3️⃣📑 — Let a Tax Pro Handle It Call or text (813) 462-2758 and we can:✔️ File Form 8822 (Change of Address) for you✔️ Or show you exactly how to file it yourself 📢 If this was helpful, please share! #TaxTuesday #TaxTips #IRSHelp #TaxProfessional

1-27 of 27

powered by

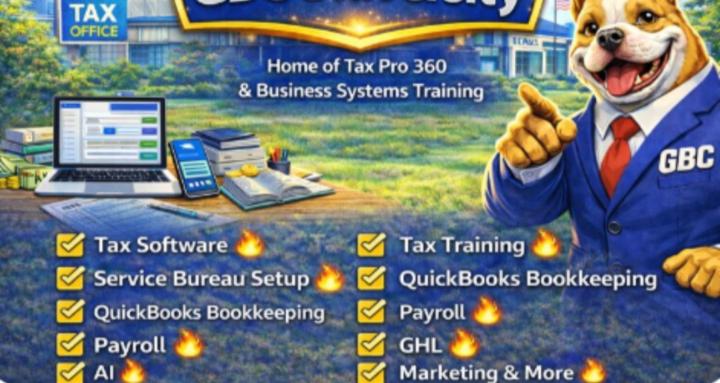

skool.com/gbc-university-6206

Tax Business Setup🔥Service Bureau Setup🔥QuickBooks Bookkeeping🔥Payroll🔥GHL🔥AI🔥Business Administration🔥Course Builder🔥Marketing & More

Suggested communities

Powered by