🩺 Do I get more write-offs for my business if I have an LLC? Ask the Tax Doctor

📘 Book Answer: No. The IRS uses Schedule C for sole proprietors and single-member LLCs. 👉 The deductions are the same. 👇👇👇

🩺 Dr. Geno’s Take: An LLC doesn’t create extra write-offs—but it does matter.

✅ Legitimizes your business The IRS is always watching for illegitimate “businesses” used to chase big refunds.

🧾 Establishes a real operation An LLC + EIN shows structure, intent, and compliance.

🛡️ Protects your personal assets Separation matters.

⭐ Builds business credibility With banks, vendors, and clients.

There are many more benefits to having an LLC—but taxes alone shouldn’t be the reason you form one.

📞 Call or Text: (813) 462-2758 📅 Schedule a FREE video consultation: 👉 www.GenoBradley.com

Ask the Tax Doctor. Go with a Pro..... GBC Tax Pros

3

0 comments

powered by

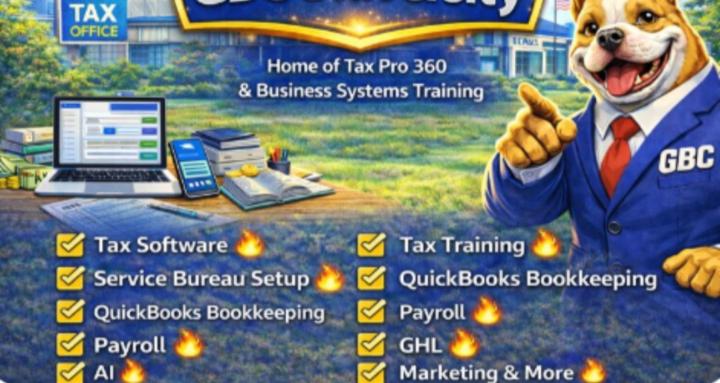

skool.com/gbc-university-6206

PTIN Setup🔥EFIN Setup 🔥 Service Bureau Setup🔥QuickBooks🔥Payroll🔥Go High Level🔥AI🔥Business🔥Course Builder🔥Marketing & More

Suggested communities

Powered by