Write something

If It's to Be, It's Up to Me

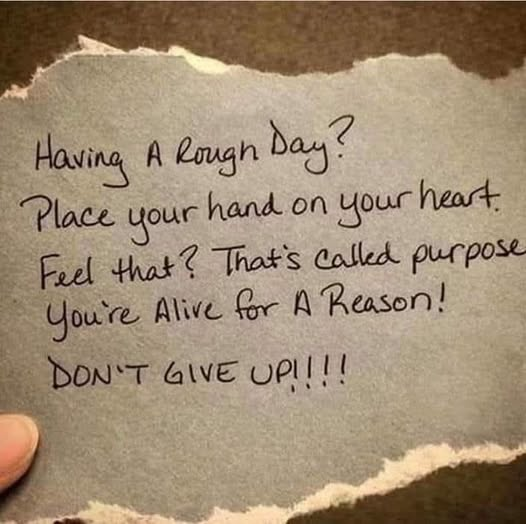

Never forget you are the CEO of your business. You are 100% in control of your attitude and activity. You are 100% responsible for your business’ failure or success. Are you dabbling with a hobby or is this a side-hustle you would like to see work out but not putting great effort and focus on? I sincerely hope not. You have to be 100% committed, take daily action and run this as a business to succeed. There are dreamers and there are doers. Which are you? Is your attitude, right? Is your activity level, right? Be awesome today! Your business depends on it.

0

0

Will My LLC really protect me from lawsuits?

When helping clients form businesses, often I get asked: "Will my LLC really protect me from lawsuits?" Here's the truth nobody talks about. An LLC creates a legal wall between YOU and your business. But here's what most people get wrong: • They think it's bulletproof armor (it's not) • They assume it protects personal assets automatically • They believe registration alone is enough The reality? LLCs provide LIMITED Liability Protection. Key word = LIMITED. Here's what it actually does: ✅ Shields personal assets from business debts ✅ Protects you from partner's mistakes ✅ Separates business lawsuits from personal lawsuits But here's what it WON'T protect: ❌ Personal guarantees you signed ❌ Your own negligent actions ❌ Mixing personal/business finances The biggest mistake I see? People form an LLC then treat it like their personal piggy bank. They don’t keep good records of money flowing in and out of the LLC account. You MUST: • Keep separate bank accounts • Maintain proper records • Follow formalities • Never co-mingle funds Remember: An LLC isn't a magic lawsuit shield. It's a business structure that requires discipline. The protection is in the PROCESS, not just the paperwork.

0

0

Special Message to Those That Follow Me on Skool

Consider this your personal invitation to join my Fast Track Capital Academy — a results-driven program designed to help entrepreneurs like you secure real funding, real fast. I’m Dan Ollman, a Certified Credit & Funding Expert with 20+ years of experience, and I’ve helped hundreds of business owners unlock capital and scale. Now, it’s your turn. https://www.linkedin.com/in/danollman/ Inside my Academy, you’ll get: ✅ Step-by-step, 1-on-1 guidance to build strong business credit with all three bureaus ✅ Access to your first $35K–$100K+ in cash credit lines—fast ✅ Proven strategies to secure 0% interest funding for 6–18 months ✅ True business credit under your Entity & EIN (not your SSN) ✅ Personal credit repair & enhancement to maximize your funding potential This isn’t just another cookie-cutter course. It’s a hands-on coaching program with custom strategies and 1-on-1 support—built for entrepreneurs who are serious about getting funded. Why choose this program? Because we don’t just teach theory. We focus on the three pillars of credit success: 1. Personal Credit Repair & Enhancement 2. Business Credit Establishment 3. Real Business Funding – Cash Credit Lines I PERSONALLY help all members so spots are limited. Most clients complete the program in just 3–5 months and walk away with the capital they need to scale. 👉 Don’t wait another day. Click below to join Fast Track Capital Academy and start building your funding pipeline now. 🔗 [Join the Academy Now] https://www.skool.com/fast-track-capital-academy-1577/about?ref=2c24e4c2909a456d8c58afea89d5f752 Let’s build. Let’s get funded. Let’s go.

0

0

Decoding Credit Card Rewards: Key Terms & Acronyms

The world of credit card rewards can seem daunting at first. With many acronyms and specialist terms in use, trying to speak with a points and miles aficionado can be like learning a foreign language. Luckily, there are no verbs to conjugate in this language—and as with learning any language, the more often you use it in your daily life, the quicker you’ll learn. Whether you’re dipping your toe in the world of points and miles or have already made your first award redemption, there’s a ton of credit card rewards lingo out there. So to save you from frantically Googling “SUB credit card meaning,” “what is HUCA” and other definitions, we’ve compiled the most common credit card acronyms and specialist terms all in one place. Treat this as your online points and miles dictionary that you can always refer back to. Continue Here: Decoding the Many Acronyms Used in the Points/Miles World

0

0

1-16 of 16

skool.com/fast-track-capital-academy-1577

Designed for serious entrepreneurs who want capital now. Real strategies & real cash funding. 1-on-1 sessions with a 20-Year Credit & Funding Expert.

Powered by