Write something

Hey Selina Lee, Trust funds 🚀

Hi Selina Lee! I just explored Trust funds , love what you’re building. I help community owners launch High-Engagement Skool communities, and I’ve got a 100% FREE full community setup no-strings attached just for you (normally $40). 👉 See the 2‑min rundown & book a slot: CommunityLaunch You’ll get: polished and structured, AI‑designed graphics, and a launch‑ready community in just 30 min. No pressure—just a smoother launch and tidy backend. (Heads‑up: this post auto‑deletes in 4 days, and I’ll quietly exit if you’re busy (I don't wanna spam or disturb your community, I respect the vibe 🙏). Want to chat later? Just reply “Let’s schedule” and I will stay here to help later.) Looking forward to helping Trust funds shine!⭐ —Shivraj

Retirement Financial Strategies - Sharing My Portfolio, Quantitative Trading Orders & Gold Trading Experience

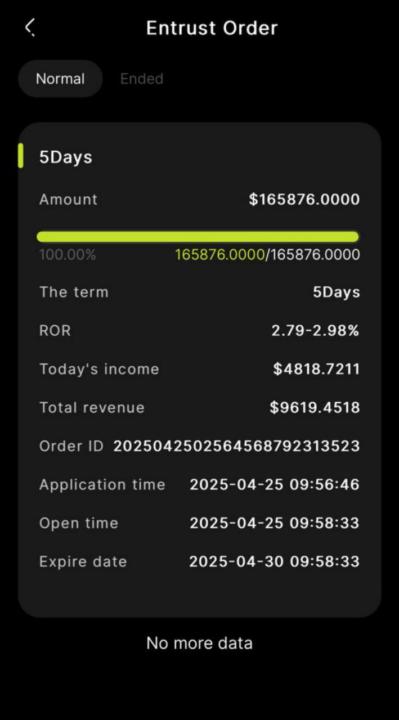

Hello everyone! 👋. Financial investments are always a key part of the road to pursuing retirement. Today, I would like to share with you some of my personal experiences and insights on my portfolio, quantitative trading orders and gold trading. My Investment Portfolio 💼. As retirement approaches, I have gradually diversified my funds into different asset classes to ensure steady asset growth and risk management. My current portfolio consists of: Cryptocurrencies: I hold a percentage of Bitcoin and Ether, which are digital assets that I believe have the potential to increase in value over the long term. Stocks & Index Funds: I primarily invest in a number of stable growth blue chip stocks and low-fee index funds designed to generate long-term returns. Real Estate: I have also invested in a few properties that bring in steady cash flow through leasing and appreciation. Gold: as a safe-haven asset, gold is an integral part of my portfolio. Quantitative Trading Orders 📈. I incorporate quantitative trading strategies to help optimize my investment decisions. Through data-driven algorithms and machine learning models, I execute a number of automated trade orders. These trading strategies focus on factors such as market trends, volatility, and trading volume with a view to maximizing returns and controlling risk. Gold trading 🏅. Gold has always been viewed as an asset that preserves its value, and I see it as a tool against inflation and market volatility. Not only do I invest through physical gold, but I also participate in some gold ETFs and gold futures trading. Gold's performance tends to reverse and strengthen when markets are unstable, so it occupies a prominent place in my portfolio. Core Idea to Share: Diversification is the key to wealth preservation and growth. Data-driven quantitative trading can help reduce human judgment bias and improve the efficiency of investment decisions. Gold is an important part of a stable portfolio, especially in times of economic uncertainty.

0

0

Welcome to the Trust Funds Community

Hi everyone!So happy to see you here ✨This group is dedicated to exploring how AI + Quantitative Trading + Trust Funds can work together to grow and protect wealth in smarter ways. 📌 What you’ll find here:✅ Smart AI-driven strategies✅ Global trust fund insights✅ Asset allocation tips✅ Case studies and tutorials✅ Weekly Q&A and discussions Whether you’re just starting or already investing, you belong here.👇Introduce yourself in the comments—who are you, and what are you aiming for? Let’s grow together 🚀

0

0

1-3 of 3

skool.com/cryptographic-community-6210

Focused on AI and quant trading for trust funds. Discover how smart algorithms help grow wealth steadily. Join us to explore the future of finance!

Powered by