Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Selina

Focused on AI and quant trading for trust funds. Discover how smart algorithms help grow wealth steadily. Join us to explore the future of finance!

Memberships

High Vibe Tribe

79.7k members • Free

Retirement CASH FLOW

499 members • Free

AI Automation Society

257.3k members • Free

AI Automation (A-Z)

131.7k members • Free

Kourse (Free)

113.9k members • Free

Selling Online / Prime Mover

36k members • Free

2 contributions to Trust funds

Retirement Financial Strategies - Sharing My Portfolio, Quantitative Trading Orders & Gold Trading Experience

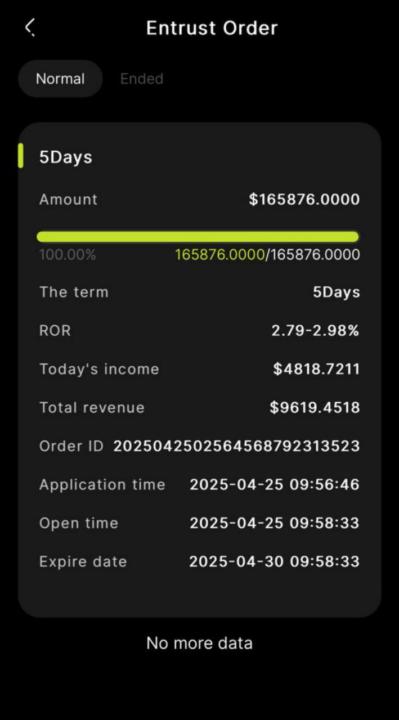

Hello everyone! 👋. Financial investments are always a key part of the road to pursuing retirement. Today, I would like to share with you some of my personal experiences and insights on my portfolio, quantitative trading orders and gold trading. My Investment Portfolio 💼. As retirement approaches, I have gradually diversified my funds into different asset classes to ensure steady asset growth and risk management. My current portfolio consists of: Cryptocurrencies: I hold a percentage of Bitcoin and Ether, which are digital assets that I believe have the potential to increase in value over the long term. Stocks & Index Funds: I primarily invest in a number of stable growth blue chip stocks and low-fee index funds designed to generate long-term returns. Real Estate: I have also invested in a few properties that bring in steady cash flow through leasing and appreciation. Gold: as a safe-haven asset, gold is an integral part of my portfolio. Quantitative Trading Orders 📈. I incorporate quantitative trading strategies to help optimize my investment decisions. Through data-driven algorithms and machine learning models, I execute a number of automated trade orders. These trading strategies focus on factors such as market trends, volatility, and trading volume with a view to maximizing returns and controlling risk. Gold trading 🏅. Gold has always been viewed as an asset that preserves its value, and I see it as a tool against inflation and market volatility. Not only do I invest through physical gold, but I also participate in some gold ETFs and gold futures trading. Gold's performance tends to reverse and strengthen when markets are unstable, so it occupies a prominent place in my portfolio. Core Idea to Share: Diversification is the key to wealth preservation and growth. Data-driven quantitative trading can help reduce human judgment bias and improve the efficiency of investment decisions. Gold is an important part of a stable portfolio, especially in times of economic uncertainty.

0

0

Welcome to the Trust Funds Community

Hi everyone!So happy to see you here ✨This group is dedicated to exploring how AI + Quantitative Trading + Trust Funds can work together to grow and protect wealth in smarter ways. 📌 What you’ll find here:✅ Smart AI-driven strategies✅ Global trust fund insights✅ Asset allocation tips✅ Case studies and tutorials✅ Weekly Q&A and discussions Whether you’re just starting or already investing, you belong here.👇Introduce yourself in the comments—who are you, and what are you aiming for? Let’s grow together 🚀

0

0

1-2 of 2

Active 95d ago

Joined Apr 13, 2025

New York

Powered by