Write something

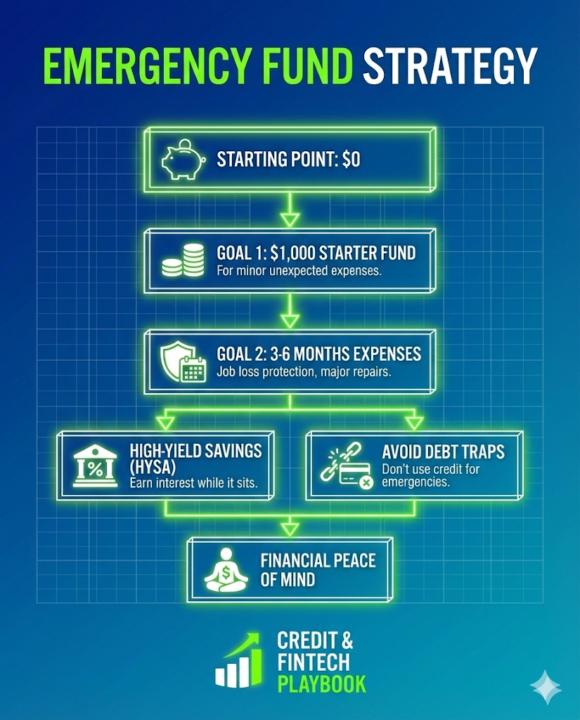

🔥 Emergency Fund Strategy

Most people don’t fail financially because of bad spending… They fail because they weren’t prepared for life’s surprise attacks 👇🏽💥 An emergency fund is your FIRST layer of financial protection — before investing, before business credit, before scaling anything. Here’s how to build it the SMART way: 1️⃣ STARTING POINT: $0 Everyone begins here. No shame. What matters is movement, not perfection 👇🏽✨ 2️⃣ GOAL 1: Build your $1,000 starter fund This covers: • Flat tires • Medical co-pays • Small repairs • Minor emergencies These moments are exactly where most people swipe a high-interest credit card and fall into the debt spiral. 3️⃣ GOAL 2: Save 3–6 months of expenses This is REAL protection against: • Job loss • Income dips • Family emergencies • Major home or car repairs This level of savings buys you TIME — the most valuable asset. 4️⃣ Use a High-Yield Savings Account (HYSA) Let your emergency fund earn interest while it sits. HYSA = safety + liquidity + passive growth. 5️⃣ Avoid Debt Traps If you fund emergencies with credit: • You pay interest • Your utilization spikes • Your score drops • Your stress increases Credit is a tool — NOT an emergency plan. 6️⃣ End Goal: Financial Peace of Mind A real emergency fund gives you: ✔ Confidence ✔ Stability ✔ Options ✔ Protection ✔ Freedom You’re not building savings… You’re building security for your future, your family, and your sanity

0

0

The Luxury Hotel Write-off

Fly first-class to Paris. Check into the Four Seasons. Call it a “business retreat.” Flight + hotel + meals = deductible under IRC §162. IRS pays for your luxury reset.

1

0

1-2 of 2

powered by

skool.com/credit-fintech-playbook-2832

🚀 Fix credit fast, 💸 grow stacks, 🤖 tap fintech hacks. The $1 playbook is your cheat code to smarter money & financial freedom.

Suggested communities

Powered by