Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by Johnny

🚀 Fix credit fast, 💸 grow stacks, 🤖 tap fintech hacks. The $1 playbook is your cheat code to smarter money & financial freedom.

Memberships

Shake Hands with Destiny

174 members • Free

Learn Futures Trading (Course)

956 members • Free

2026 Options 101 Masterclass

1.6k members • Free

Tradeline Secrets

1.2k members • Free

AI Freedom Launch Accelerator

2.1k members • Free

Garage Truth – Learn-Fix-Grow

2.8k members • Free

Academy Six DM 2.0

499 members • $20

AICC House of Prompts

1k members • $9

CourseClout Free Community

537 members • Free

17 contributions to Credit & Fintech Playbook

💰 Easy Steps To Claim Your Settlement Money!

If you’ve been owed settlement money and don’t know where to start, this breaks it down into simple steps so you can finally collect what’s yours. Most people miss out because they assume the process is complicated it’s not. Once you follow these steps, you’ll know exactly where to go, what to submit, and how to make sure your claim is processed correctly. Don’t leave money sitting on the table.Don’t delay the process. And definitely don’t assume someone else is handling it for you. Follow the steps, submit your claim, and secure your settlement. It’s THAT simple 💸 If you need help, drop your questions below.

0

0

⚠️ SETTLEMENT DEMAND — DATA BREACH / PRIVACY VIOLATION 📄💰

⚠️ SETTLEMENT DEMAND — DATA BREACH / PRIVACY VIOLATION 📄💰 Attached you’ll find a template letter I built to help you submit settlement demands for data breaches, privacy violations, or unauthorized sharing of your personal information. Use this letter whenever a company loses your data, exposes your information, or fails to protect your privacy. Download it, fill it out, and secure your settlement. 💼✨

0

0

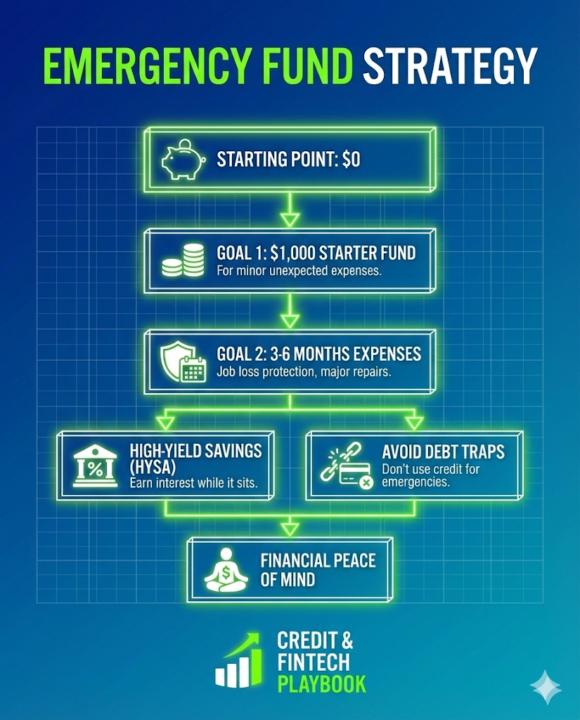

🔥 Emergency Fund Strategy

Most people don’t fail financially because of bad spending… They fail because they weren’t prepared for life’s surprise attacks 👇🏽💥 An emergency fund is your FIRST layer of financial protection — before investing, before business credit, before scaling anything. Here’s how to build it the SMART way: 1️⃣ STARTING POINT: $0 Everyone begins here. No shame. What matters is movement, not perfection 👇🏽✨ 2️⃣ GOAL 1: Build your $1,000 starter fund This covers: • Flat tires • Medical co-pays • Small repairs • Minor emergencies These moments are exactly where most people swipe a high-interest credit card and fall into the debt spiral. 3️⃣ GOAL 2: Save 3–6 months of expenses This is REAL protection against: • Job loss • Income dips • Family emergencies • Major home or car repairs This level of savings buys you TIME — the most valuable asset. 4️⃣ Use a High-Yield Savings Account (HYSA) Let your emergency fund earn interest while it sits. HYSA = safety + liquidity + passive growth. 5️⃣ Avoid Debt Traps If you fund emergencies with credit: • You pay interest • Your utilization spikes • Your score drops • Your stress increases Credit is a tool — NOT an emergency plan. 6️⃣ End Goal: Financial Peace of Mind A real emergency fund gives you: ✔ Confidence ✔ Stability ✔ Options ✔ Protection ✔ Freedom You’re not building savings… You’re building security for your future, your family, and your sanity

0

0

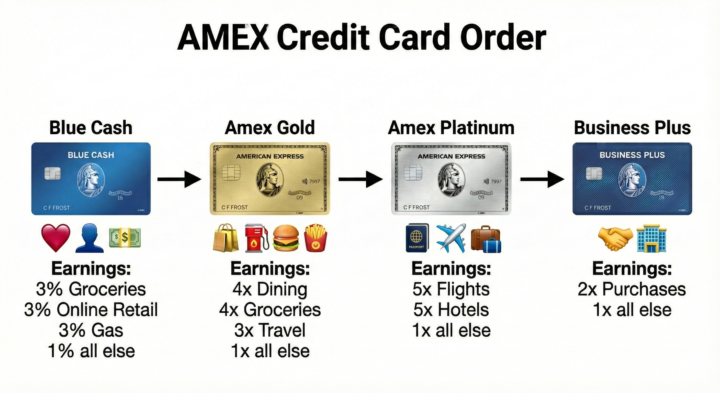

💎 The Amex Ladder Blueprint

https://docs.google.com/document/d/1AWgNgE-iZYApZa0Qf14OJYVJDiIQIqjAXkGaAamIJbo/edit?usp=drivesdk

0

0

1-10 of 17

@johnny-johnson-4288

🔑 Credit secrets + AI tools 🤖 + fintech hacks 💡 = wealth moves 🚀.

Join for $3 & transform how you build & manage money.

Active 17h ago

Joined Sep 17, 2025