Write something

Loan opportunity

Hello, I'm a Real Estate Private Lender, I fund to close deals, fund Fix and Flips, Mortgage loans, Real Estate investment Capital, constructions, Individual loans etc. I give out loans ranging from the minimum amount of 20k to a maximum amount of $10M and my interest rate is 6-12%. Kindly dm or shoot me an email [email protected] if you're in anyway interested in getting funded ASAP. Private Money | Hard Money | Commercial Real Estate Loans | Business loans | Personal Loans all available.

Grants

I’m freeman from Dallas, I’m a professional grant writer a lawyer and a real estate agent, i help small business owners, veterans and students navigate the possibilities of getting a better life by introducing some private grants out there funding for $15.000–$250.000, most of these grants are just sited by. waiting for people to come collect it . Thanks for having me as i look towards in helping my friends out there. Contact WA +1 (581) 344‑4234

2

0

Grant update

Are you working on an idea that could create real impact? Applications are now open for the All types of Grant. supporting innovative projects that drive positive change in [sector/community/region] follow our verified communities on telegram or DM For more info https://t.me/+-MQZ69hqgPsxZmNk

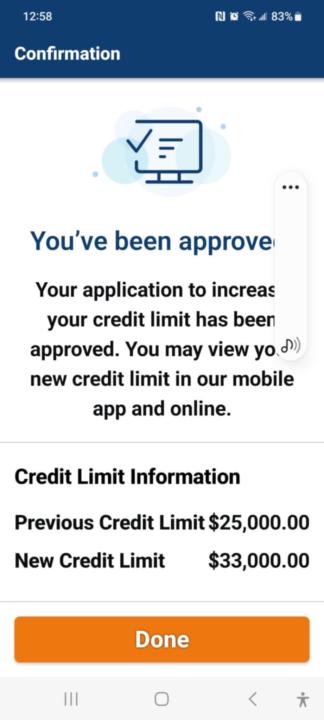

Navy Federal Credit Union CLI (Platinum Card)

NFCU had an app update on my phone, so I did it and went to see if I need to use my pin or fingerprint to access. Once in my account, I said let's see if they will increase my card limit (all CRAs are frozen). BAM...$8K increase in less than 2 minutes, went from $25K to $33K! In app, no hard pull. 🤑💯🙏🏽

1-30 of 294

skool.com/conecto-de-credito-1071

Financial literacy, How to repair your own credit

Powered by