Taking Action

Things are moving along, I just set up my Tradingview account. I've been familiarizing myself with TV and and studying charts and candlesticks. Ready for what's next.

1

0

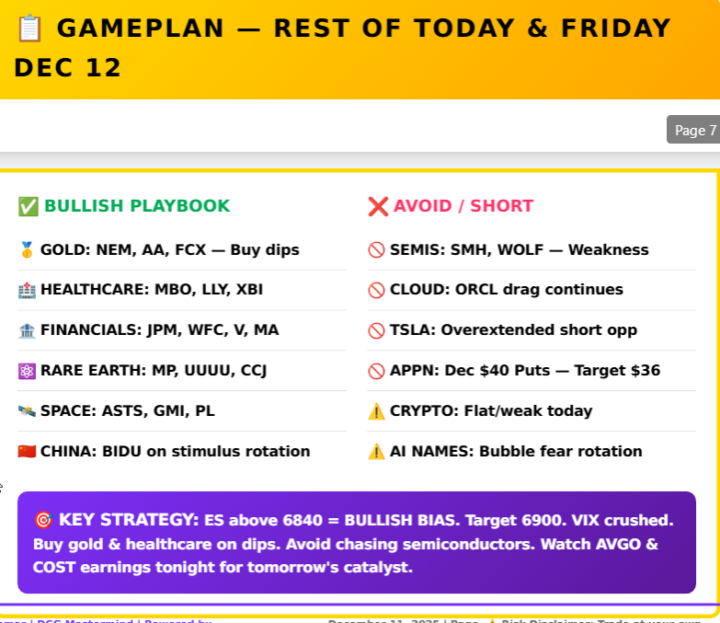

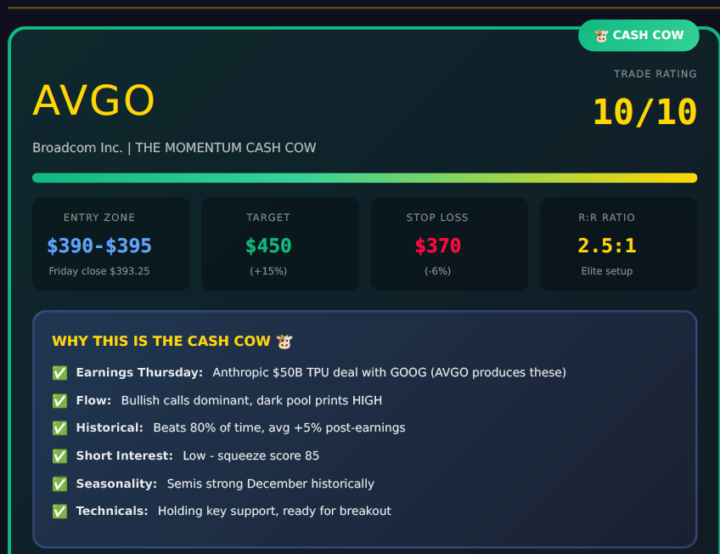

DCG Quant Flow Report — December 10, 2025 | 12:10 PM PST

Prepared by: DCG Command CenterFocus: Institutional rotation, order flow, and high-conviction momentum trades in U.S. stocks and crypto for the next 12 hours 🧭 Macro Summary – Market Context Federal Reserve Update (11:00 AM PST) - Fed cuts rates by 25bps (to 3.5%-3.75%), confirming the 3rd rate cut of 2025. - Powell: “Rates are now in a plausible range of neutral.” - Treasury Bill Purchases: Fed will buy $40B of T-bills over next 30 days, effectively initiating stealth QE ("reserve management purchases"). - Outcome: Market interprets this as dovish liquidity expansion → Stocks, gold, crypto, and financials ripping. - Net takeaway: Rate cuts + T-bill purchases = “Reflationary Liquidity Regime” Post-Fed Reaction - S&P 500 (ES_F) up +0.7%, on track for record high by year-end. - VIX collapsed to 16.4, intraday -3.5%. - Breadth: 85% of S&P components positive → broad-based accumulation. - Dollar (DXY) lower → tailwind for commodities + crypto.

1

0

FROM $5 TO $95 IN ONE SESSION

Today someone was: Sitting in traffic Attending meetings they hate Waiting for their next paycheck AFJK went from $5 $95 That's a 1,800%+ move. One. Single. Day. Let me break this down for you... $500 position = $9,500 $1,000 position = $19,000 $2,500 position = $47,500 Just being in the market creates an opportunity.. Just saying, presence counts in trading, you will get lucky somedays your in the market. #DcgMastermind Where luck meets opportunity..

5

0

1-30 of 48

skool.com/ai-trading

🔹 Learn to trade crypto & options with AI. Share prompts, get weekly trade plans, and join live trading sessions.

Powered by