Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Retire On Margin

157 members • Free

12 contributions to Retire On Margin

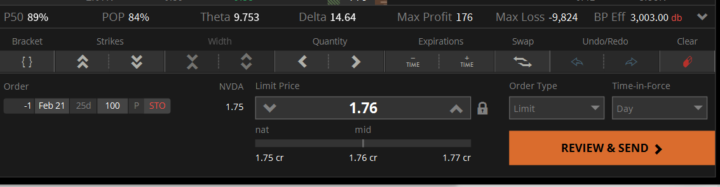

$NVDA Trade Idea 01/27/2025

I couldn't pass on the $100 put for almost $180 in income and about a 20% drop from here. If I do get assigned I'll own 200 shares of NVDA with an average price of 110 minus income so around $107 and I'll be happy with that. 3.5 weeks to go, I'm not worried.

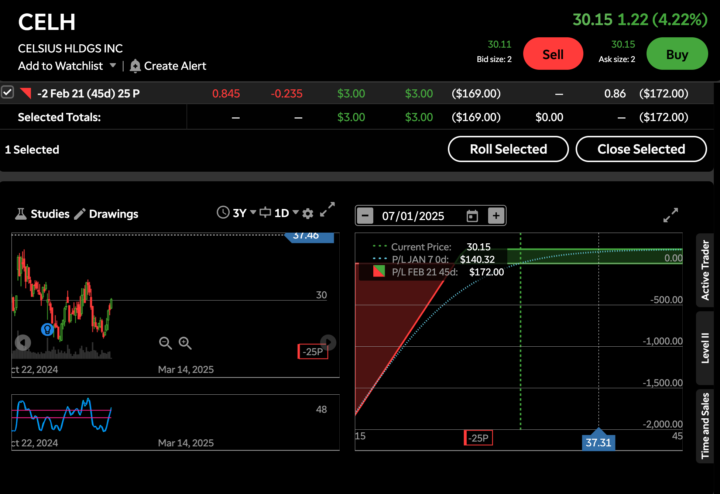

CELSIUS HLDGS INC trade Idea

🔥 **Selling Cash-Secured Puts on $CELH:** A Strategic Play for Premium Income! 🚀 Today, I sold **2 cash-secured puts** on $CELH with the following details: - **Strike Price:** $25 - **Days to Expiration:** 45 - **Premium Received:** $0.86 per contract - **Total Premium Collected:** $172 ### Why This Trade? 💡 **Attractive Entry Point:** Celsius Holdings ($CELH) is a promising growth company in the health and wellness sector. Owning it at $25 aligns with my risk/reward strategy. 🛡️ **Downside Protection:** With $0.86 in premium received, my breakeven price drops to **$24.14** ($25 - $0.86), providing a cushion against price dips. 💵 **Steady Income Opportunity:** Earning $172 in premium for 45 days delivers a solid return while keeping risk manageable. --- ### **Possible Outcomes:** ✅ **Price Stays Above $25:** The puts expire worthless, and I keep the $172 premium as profit. 📉 **Price Falls Below $25:** I get assigned the shares at $25, but my breakeven is **$24.14**, setting up for potential future gains or selling covered calls for additional income. 💡 Options trading is about creating steady income while managing risk effectively. This trade showcases the power of cash-secured puts in wealth-building! 📊 **Goal Progress:** January Target: ($1645 / $2,000) --- #OptionsTrading #CashSecuredPut #CELH #PassiveIncome #StockMarket #Investing #FinancialFreedom #OptionsStrategies #TradingJourney

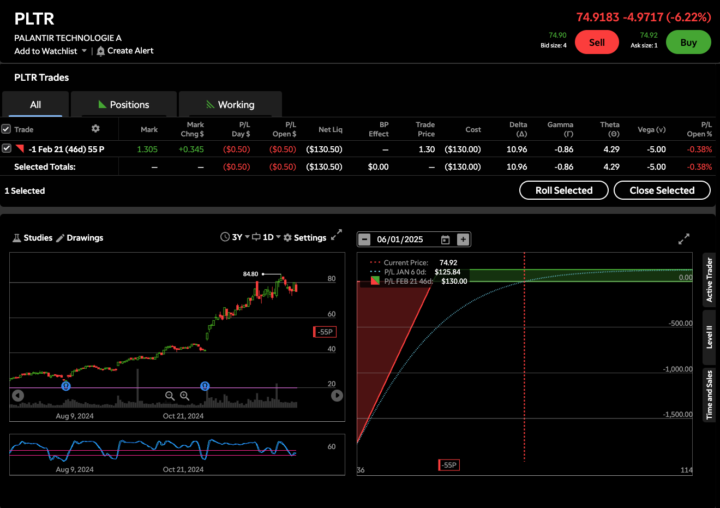

PLTR trade idea

🔥 Selling a Cash-Secured Put on $PLTR: A Strategic Move for Steady Income! 🚀 Today, I sold a cash-secured put on $PLTR with the following details: - **Strike Price**: $55 - **Days to Expiration**: 46 - **Premium Received**: $1.30 per contract --- ### **Why This Trade?** 💡 **Attractive Entry Point**: Palantir ($PLTR) is a high-growth company with strong fundamentals. Owning it at $55 aligns with both value and potential upside. 🛡️ **Downside Protection**: With $1.30 in premium received, my breakeven price drops to $53.70 ($55 - $1.30), offering a safety cushion against price fluctuations. 💵 **Income Opportunity**: Earning $130 per contract for 46 days provides a solid return while keeping risk manageable. --- ### **Possible Outcomes**: ✅ **Price Stays Above $55**: The put expires worthless, and I keep the $130 premium as profit. 📉 **Price Falls Below $55**: I get assigned the shares at $55, but my breakeven is $53.70, positioning me well for future gains or selling covered calls for additional income. --- 💡 **Options trading is about managing risk and generating consistent returns. This trade demonstrates the power of cash-secured puts for wealth-building!** #OptionsTrading #CashSecuredPut #PLTR #PassiveIncome #StockMarket #Investing #FinancialFreedom #OptionsStrategies #TradingJourney

🔥 01/07/2025 Trade Ideas 🔥

Hello everyone, Today's trade idea plus 2 more in the classroom area where we collect $200 and $145 in income on 8 ATR index and small account trade 🔥🔥🔥 NVDA - $141.44 price - selling $120 puts - $181 income - $4,200 BP - Feb 21th exp. (notice a pattern here? we did same trade last month and collected income so I repeat what works) Join us in the classroom area and start the year strong - https://www.skool.com/retire-on-margin-9223/classroom

🔥12/19/2024 Trade Ideas 🔥

Good morning everyone, 8 ATR keeps us in this game long-term. Quick one: I will sell $560 puts on SPY for tomorrow (Dec 20th) at whatever price. Yesterday, it was $150. In the classroom area, I did another one with 3X the income. But in general, you can grab any of the indexes at the opening bell - SPY, QQQ, IWM it doesn't matter the income is super high and the 560 SPY is about 7 ATR. Also, this is a rare case where the /ES futures have maybe 1.5X more income than SPY compared to 5X on average. Tells me prices are very expensive due to Vix jumping and I'll take advantage of that by selling puts on SPY. Buying Power needed is only 8k compared to 55k on Robinhood. Let that sink in It won't last long as futures are already green and up 0.7%. I mentioned yesterday this was nothing just to flush retail before monthly expiration and up we go for the next month imho.

1-10 of 12

@yog-lal-3323

Been trading options for a few years, looking to up my game and connect with like minded traders

Active 308d ago

Joined Dec 5, 2024

Powered by