Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Basquiat University

1.3k members • Free

1 contribution to Basquiat University

🚨 Is the AI Sector Entering Bubble Territory?

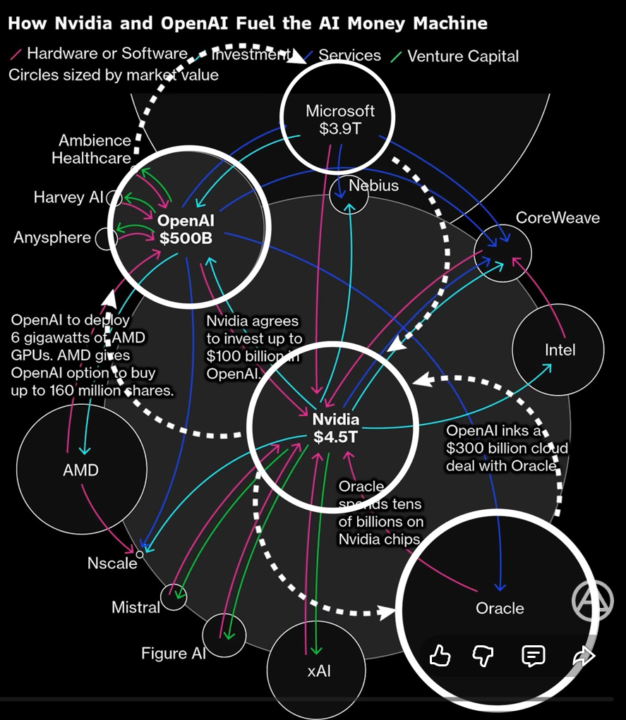

The AI boom has created massive excitement — and massive concentration — in today’s markets. But beneath the surface, we’re seeing signs that resemble previous speculative bubbles. Here are key points to be paying attention to: 📌 1. Extreme Concentration in the S&P 500 Today, the top 5 companies in the S&P 500 make up nearly 30% of the entire index, an unprecedented level of dominance: - Nvidia — 7.6% - Apple — 6.6% - Alphabet — 4.9% - Amazon — 3.6% - Microsoft — ~7% This means the performance of just a handful of companies is driving the entire market. 📌 2. Circular Funding With Little Real Value Generated The recent flow of money between major AI players looks less like innovation and more like a closed-loop money machine: - Big tech companies invest in AI startups. - Startups spend billions buying Nvidia chips. - Nvidia invests back into AI companies. - Cloud providers sign huge compute deals with AI labs. - Valuations skyrocket without clear long-term profitability. This circular flow creates the illusion of value, but in reality, much of the money simply moves in circles — not into real economic output. 📌 3. Multi-trillion Dollar Valuations Built on Future Hopes Nvidia at $4.5T, Microsoft nearing $4T, and OpenAI rumored around $500B — these valuations assume: - AI adoption will be immediate - Monetization will be massive - The tech will deliver exponential productivity gains But actual AI revenue today is still tiny compared to the hype. 📌 4. Historical Parallels: Dot-Com Bubble 2.0? We’ve seen this movie before: - Money chasing promises - Rapid capital recycling - Sky-high valuations detached from fundamentals - Investors afraid to miss out When too much capital chases too few proven ideas, corrections become inevitable. 🔥 Bottom Line: AI will shape the future — but the investments driving today’s prices may be moving faster than real-world value creation. Stay informed. Stay grounded. And stay disciplined.

1-1 of 1

@vincent-muthugumi-1318

A begginer investor with an aim to build a bumper portfolio step by step as I seek knowledge on wealth growth and management.

Active 11d ago

Joined Nov 22, 2025