Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Exceligent Academy

48 members • Free

Dellgard Day Trading

14 members • Free

valuestockstoday

4 members • Free

The Trading Games™

94 members • Free

M

MikeCaymanTrades

51 members • Free

📚The Skool Bookshop

21 members • Free

Finance Flow Lab

75 members • Free

Memoir Skool

39 members • Free

The JOY Project

443 members • Free

2 contributions to Cryptoshuttle Trader Academy

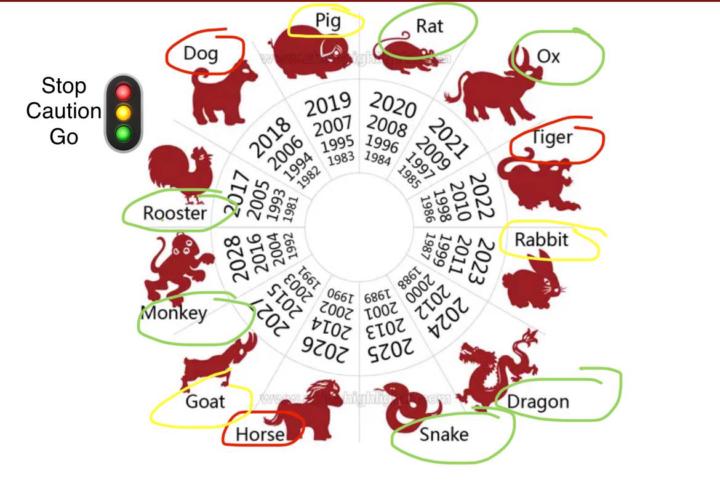

Remember this chart!

This image is the Chinese Zodiac cycle layered with a Stop / Caution / Go framework. Every year rotates through the same 12 animals. What changes is who’s winning, who’s early, and who’s late. - 🟢 Green (Go) years = expansion, momentum, risk-on behavior - 🟡 Yellow (Caution) years = chop, fakeouts, distribution - 🔴 Red (Stop) years = contraction, fear, resets Markets don’t move randomly — human behavior is cyclical. Liquidity, risk appetite, greed, and fear repeat… just under different narratives. Most people lose because they treat every year the same. Veterans adjust position size, time horizon, and aggression based on the phase. You don’t fight the cycle. You align with it. Remember this chart. It won’t tell you what to buy — but it will tell you how aggressive you should be when you do.

Why the market feels weird right now (and why that’s normal)

Right now the market isn’t “broken” — it’s digesting. 📊🐂🐻⚖️ After strong moves, markets don’t immediately keep pumping or dumping. They pause, chop, and shake people out. This is where impatience gets punished. What’s happening: • Big players are waiting for clarity • Liquidity is being built on both sides • Weak hands are getting exhausted • Direction comes after confusion This phase is designed to make you: ❌ Overtrade ❌ Doubt your strategy ❌ Quit right before momentum returns What to do instead: ✔ Reduce position size ✔ Focus on clean setups only ✔ Journal what you don’t trade ✔ Study structure, not predictions 📌 The skill you build in slow markets is what pays you in fast ones. If you can survive boredom, you can survive volatility. You’re not behind. You’re training. Keep going. 🚀

1-2 of 2

@usman-korede-7278

I'm James mick a CRM automation expert I help skool community owner and business owner increase engagement, streamline operations, and scale.

Active 3h ago

Joined Jan 18, 2026

washington