Write something

Remember this chart!

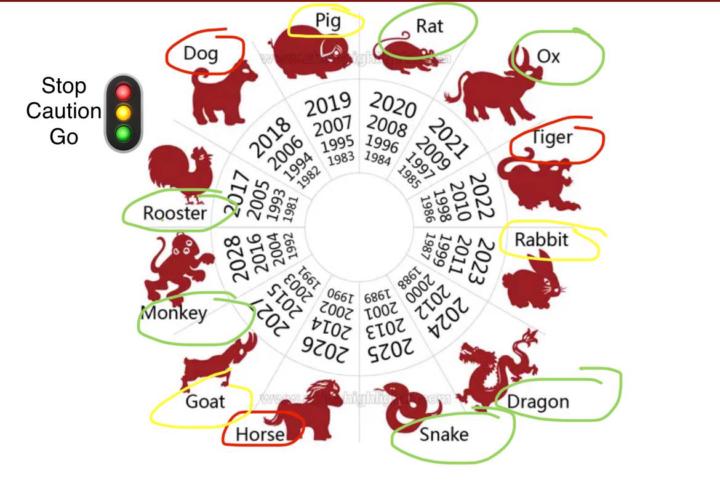

This image is the Chinese Zodiac cycle layered with a Stop / Caution / Go framework. Every year rotates through the same 12 animals. What changes is who’s winning, who’s early, and who’s late. - 🟢 Green (Go) years = expansion, momentum, risk-on behavior - 🟡 Yellow (Caution) years = chop, fakeouts, distribution - 🔴 Red (Stop) years = contraction, fear, resets Markets don’t move randomly — human behavior is cyclical. Liquidity, risk appetite, greed, and fear repeat… just under different narratives. Most people lose because they treat every year the same. Veterans adjust position size, time horizon, and aggression based on the phase. You don’t fight the cycle. You align with it. Remember this chart. It won’t tell you what to buy — but it will tell you how aggressive you should be when you do.

Where are you right now in crypto? 🔎

This helps me tailor lessons, posts, and live calls for you. Be honest — there’s no “right” answer here 👇

Poll

Cast your vote

1

0

Crypto doesn’t click until you understand this

Crypto isn’t just “buy low, sell high.” It’s a system. Before charts, indicators, or price predictions, beginners need to understand what actually moves crypto: 🔹 Narratives – Money flows where attention goes (AI, Layer 2s, memes, real-world events). 🔹 Liquidity – Prices move when money enters or leaves. No liquidity = no movement. 🔹 Timing – Even great projects go down at the wrong time in the cycle. Most beginners lose because they ask: ❌ “Is this coin good?” Better question: ✅ “Is money flowing here right now?” 📌 Crypto rewards people who follow capital + attention, not hype alone. Learn how money moves, and charts start making sense. This is step one before any strategy.

1

0

The Market Has No Feelings. Only Structure.

The market isn’t emotional. You are. Price doesn’t know: • your entry • your stop • your hopes • your fears It only responds to liquidity, positioning, and time. When the market feels “unfair,” it’s usually doing one thing: 👉 transferring money from impatient traders to patient ones. Your job isn’t to predict the next move. Your job is to be ready when the move comes. Today’s lesson: 📌 Detach from the outcome 📌 Respect the process 📌 Let probability do the work The edge isn’t secret indicators. It’s emotional control when nothing is happening. Stay sharp. Stay disciplined. You’re playing the long game. 🚀

0

0

Why the market feels weird right now (and why that’s normal)

Right now the market isn’t “broken” — it’s digesting. 📊🐂🐻⚖️ After strong moves, markets don’t immediately keep pumping or dumping. They pause, chop, and shake people out. This is where impatience gets punished. What’s happening: • Big players are waiting for clarity • Liquidity is being built on both sides • Weak hands are getting exhausted • Direction comes after confusion This phase is designed to make you: ❌ Overtrade ❌ Doubt your strategy ❌ Quit right before momentum returns What to do instead: ✔ Reduce position size ✔ Focus on clean setups only ✔ Journal what you don’t trade ✔ Study structure, not predictions 📌 The skill you build in slow markets is what pays you in fast ones. If you can survive boredom, you can survive volatility. You’re not behind. You’re training. Keep going. 🚀

1-23 of 23

powered by

skool.com/cryptoshuttle-trader-academy-1321

24hrs of crypto training 📈 Live recorded content + 90 Day Crypto Transformation now discounted for Skool

Suggested communities

Powered by