Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Luminary Trading

149 members • Free

14 contributions to Luminary Trading

🔑 Weekly Prep: Set Your State, Story, and Strategy

Tradersthis week isn’t about predicting what the market will do. It’s about shaping who you will be as you face it. Most people start Monday scanning for news, levels, or opportunities. Winners start by scanning their state. 👉 Here’s your reframe for the week: It’s not about how many setups you see. It’s about how resourceful you are in waiting for the one that matters. NLP Focus Questions for You: - What do I want to experience this week calmness, precision, confidence? - Where do I want my focus to go the moment I open the charts? - If I were already the trader I want to be, how would I handle the first loss of the week? - What story do I want running in my head when price pulls against me? - What’s the single most important rule I will refuse to break, no matter what? - Direction for the Week: 📌 Write down your answer to at least one of these questions before the market opens. 📌 Read it every morning before you start trading. 📌 Notice how quickly your unconscious mind begins to follow the story you feed it. You don’t need to fight the market you need to align yourself. This week, trade like you’re already the version of you who’s consistent, patient, and powerful. You don’t find consistency. You create it.

New trader from MIAMI

Hi everyone’s my name. Is Jimmy i’m happy to be here and ready to learn.

Congratulations!!

Big congrats to @Sam Singh for the most active member on here during July. Will be receiving his prize starting today! Will be exciting to see your progress through August my bro 🔥🔥 Who's going to take the throne for August?? 🤔

🚩THE INVISIBLE HORSEMAN IN TRADING

These aren't mindset issues.They're hardwired glitches in human thinking documented by psychologists, neuroscientists, and behavioral economists for decades. You were born with them.And in trading, they get amplified. They twist your perception, hijack your decisions, and wreck your consistency without you even knowing it. Here are 19 of the most dangerous ones.Every trader battles them.The smart ones learn how to win. 1. Dunning-Kruger Effect You think you’ve got it… because you don’t know how much you don’t know. 2. Overconfidence Bias A few wins make you feel untouchable—right before the wipeout. 3. Confirmation Bias You only notice what proves you’re right and ignore everything else. 4. Anchoring Bias You lock onto your first level or idea—even when it’s invalid. 5. Availability Heuristic You assume what you see the most (like winning trades online) is the norm. 6. Hindsight Bias You pretend you saw it coming—but didn’t act when it counted. 7. Loss Aversion You fear losing more than you value winning—and it distorts every decision. 8. Representativeness Heuristic You treat one setup like another just because they look similar. 9. Gambler’s Fallacy You think the market “owes” you after a losing streak. 10. Status Quo Bias You’d rather stay in your current mess than change what’s familiar. 11. Endowment Effect You overvalue your own trade idea just because it’s yours. 12. Optimism Bias You believe you’ll beat the odds—without doing what the winners do. 13. Recency Bias You react to what just happened as if it erases the big picture. 14. Framing Effect You change your decisions based on how information feels—not what it is. 15. Self-Serving Bias You blame the market when you lose, but call yourself a genius when you win. 16. Bandwagon Effect You copy the crowd and call it research. 17. Illusion of Control You think you're controlling the market—when you're barely controlling yourself. 18. Neglect of Probability You ignore the odds and convince yourself “this one’s different.”

3 likes • Aug '25

Anchoring Bias is a doozy, So is Loss Aversion in live market vs let it run in backtesting, Representativeness Heuristic is hard because the fact two different things look VERY similar without seeing what's different, and Sunk Cost Fallacy is "similar" to what I've been dealing with in that aspect, as not because I've already suffered in it, but because I don't want to believe the quite literally perfect set up to be wrong.....when it is wrong. The others for me are N/A, These ones are pretty spot on minus subtle differences in one or two

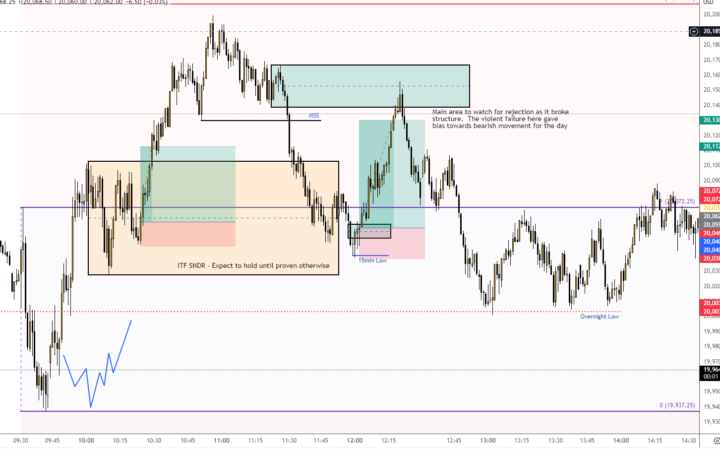

March 27th - 130pts

Beautiful read on price today and we called some beautiful moves both long and short. 15min opening range movement providing a lot of bias lately, closing above giving expansion in the am and then a nice move down (couldn't get involved and hold), but the best trade came from the lunch hour long!

1-10 of 14