Activity

Mon

Wed

Fri

Sun

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

What is this?

Less

More

Memberships

Buy, Build, Sell ™ Businesses

850 members • Free

Acquisition CEO Group

430 members • Free

19 contributions to Buy, Build, Sell ™ Businesses

NEED ADDITIONAL SUPPORT FOR COMPANY ACQUISITION?

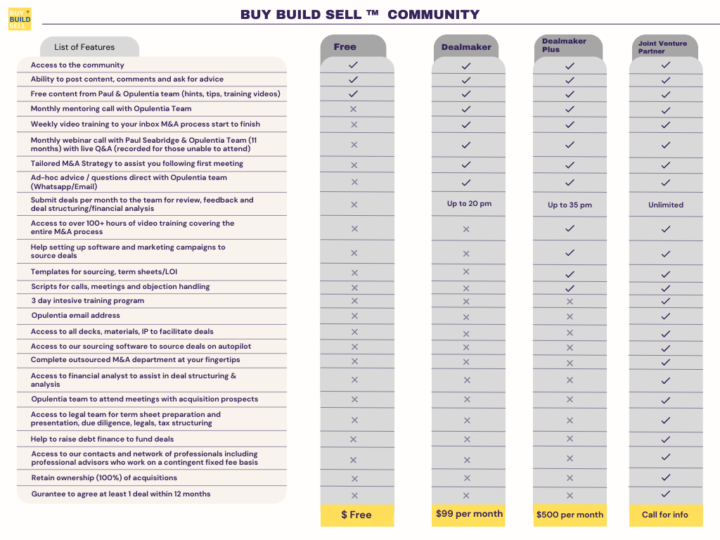

Hey Everyone, How are you getting on your deal-making journey? We are committed to our community being a member only – free to join the community. But for those advancing on their deal-making journey, there are three paid-for routes where the team at Opulentia can provide you with additional support, deal-making resources, and tools to facilitate multiple deals. The team had a chat with some of you and got suggested this idea so we now share it with everyone. 👉 If interested you can check https://www.buybuildsell.net/community or message Paul Seabridge for more info. Thanks!

Options Agreements and Virtual Mergers

One of the common objections we get when affecting a leveraged buyout is valuation. Business owners in the SME space sometimes have the misconception that businesses trade at 5-10x multiple of profit. The reality from over 100 of our own deals, research from Harvard, various business sale experts and Kingston University is most don’t actually sell and those that do transact at an average multiple of 2.52x. One reason for this misconception is generally the deals you hear about tend to be very large companies (that do sell for higher multiples) and also brokers that to justify their fees will “value a business” at a higher price than reality . The challenge with SMEs even good ones is they are highly risky and lack liquidity in their shares as they are private. Larger companies tend to have diverse income streams and geographical coverage so if one area of a large company is underperforming they still have plenty of parts to it that do perform. Take Virgin as an example they have a travel agency , airline , gyms etc. if a SME business owner has a chain of 3-4 gyms then they are very exposed to one country or region and the micro economic climate. Virgin operates globally in many sectors. Whilst we will always try to educate a business owner on valuation sometimes you just can’t get them to accept the reality if they do sell they will sell at 2-3 x. When we pitch an offer to acquire - if it doesn’t progress because of misalignment on valuation we will usually park it in the pipeline and revisit in 6-12 months when aspirations may be more realistic. Two deal structures that can however be used either at point of making an offer or in a revisit could be virtual merger or option agreement. Effectively your pitch is about creating a multiple arbitrage by putting them in a larger group that would justify a higher price. Let’s say you have a company in the recruitment industry as a stand alone £10m turnover and £1m profit - in our normal model the goodwill would be worth £2.5m.

When you buy with a 10% deposit

I have a few questions please: From what money does the seller pay capital gain tax and his lawyer when you buy with a 10% deposit? When do they have to pay the tax? At the end of the year? Does he pay tax for the 100% purchase price or only for the 10% deposit and the monthly consideration? I am thinking about deferred consideration with the monthly payment for 4 years? What do I tell him to do? Thank you very much!

Financial Statement Summary

A short note about the "Financial Statement"

KPIs behind buying 12 Businesses in 1 year

In 2022 we bought 12 companies, here are the main KPIs behind the acquisitions. 👉 Make sure to subscribe for more content.

0 likes • Nov '23

Great info! So Let's run the numbers backwards to find out how many outbound messages have to be sent to buy 12 companies: (some numbers guessed as the conversion rates at some steps were not provided) To buy 12 companies we need to do the financial analysis on 300-400 companies, to do financial analysis on 3-400 companies we need to have first calls with approx 600-800 sellers (assuming 50% of first calls result in a financial analysis), to have 600-800 first calls, we need 1200-1800 positive responses (assuming 50% of positive calls result in a first call), to get 1200-1800 positive responses, we need approx 2400-3600 total responses (assuming 50% of the responses are positive), to get 2400-3600 total responses we need to send out approx 30-45,000 outbound messages (assuming 8% response rate). To send 30,000-45,000 outbound messages, we would need to screen a list of 150,000-900,000? total businesses to find the 10-20%? that meet the acquisition criteria. Is that correct? Does that make sense? How much total time would it take to do this complete process? How many full time people would it take to do this? 10? 20? 50? more? What is acquisition cost/bought company? These numbers must be off somewhere.

1-10 of 19

@sven-heistad-6710

54 years old, lifetime serial entrepreneur, started 2 dozen business, now focused on acquisitions. Bought 1 $3M co, seeking more.

Active 592d ago

Joined Aug 7, 2023

Powered by