Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

YouTube For Beginners🏆

133 members • Free

Global TAXpreneur CEO Academy

9 members • Free

Bizlaunch.io

538 members • Free

6 Figure Coach Live

234 members • Free

Traffic Sales and Profit

4.2k members • Free

6 contributions to Global TAXpreneur CEO Academy

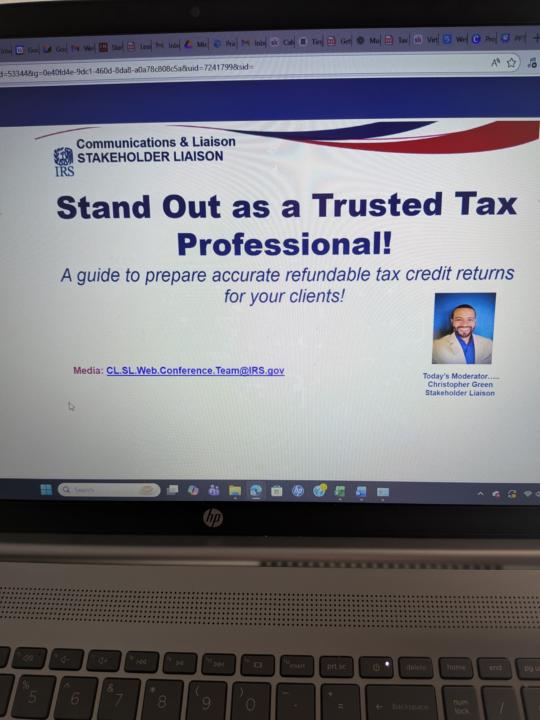

Tax Pros Stay Ready so you don't have to get ready

The IRS urges qualified tax professionals to set up an IRS Tax Pro Account and encourages taxpayers to access their IRS Individual Online Account. When both have accounts, they can complete online third-party authorizations, such as powers of attorney and tax information authorizations, entirely online. This helps reduce processing times and eliminates the need to fax, mail, or upload documents. To approve an authorization request, the taxpayer logs into their IRS Individual Online Account, checks a box, and submits the authorization request to the IRS. Most authorizations are processed immediately, though some may take up to 48 hours. Tax Pro Account Through TPA, the tax professional can also view their client’s individual tax information and act on behalf of them. Using TPA, tax professionals can: - Request and receive an individual CAF number online, in real time. - Withdraw active authorizations instantly. - Make payments, set up or manage payment plans, and view taxpayer information within the scope of an authorization. IRS Individual Online Account With an IRS Individual Online Account, taxpayers can securely access their federal tax information and receive notifications from their tax professional.

0

0

Your ChatGPT Caricature

1. Go to chatgpt 2. Copy and paste this promo: "Create a caricature of me and my job based on everything you know about me." 3. Then upload a photo to chatgpt and see the amazing results that it creates I want to see yours!!! 🤩

Grasshopper

Hello Nicole, how are you? Have you had any problems with grasshopper? I tried to setup an account and my card incline stating they suspected fraud.

Taxpayer Confidentiality

The Treasury Department announced it is canceling all contracts with Booz Allen Hamilton (often simply called Booz Allen) for failing to protect sensitive taxpayer information. The department said it is terminating 31 contracts, totaling about $4.8 million in annual spending and roughly $21 million in total obligations. The decision follows the Charles Littlejohn tax leak, one of the most serious breaches of confidential taxpayer data in U.S. history. Littlejohn, a former IRS contractor employed through Booz Allen Hamilton, stole and disclosed tax returns and return information, including Donald Trump’s, between 2018 and 2020.

0

0

1-6 of 6

@sheronda-ervin-9830

Federally Licensed Tax Expert resolving tax problems for business owners and Certified Business Coach for tax professionals.

Active 9d ago

Joined Dec 12, 2025

Houston