Activity

Mon

Wed

Fri

Sun

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

What is this?

Less

More

Memberships

Buy Box Club

85 members • Free

Wholesale Real Estate

2.9k members • Free

Money Broker Society

5.9k members • Free

Real Estate BFF

136 members • Free

WholeScaling Free

837 members • Free

Flip Flop Flipper Real-Estate

3.8k members • Free

REIPRENEURS: Wholesaling Group

1.7k members • Free

Results Driven® Community

4.8k members • Free

No Fluff Real Estate

1.9k members • Free

14 contributions to Wholesaling Real Estate

🏠 Need Creative Investor Insight – HOA Foreclosure in Indianapolis

Hey everyone, I’m working on a situation I’d love some feedback on from investors who’ve done creative or save-the-home type deals before. Here’s what I’ve got: 📍 Indianapolis, IN 46208 🏡 4 bed / 2 bath – approx. 1,600 sqft 💰 Zestimate: ~$216K (Assessed: $180K) 💵 Remaining loan balance: $55,689 🚨 HOA foreclosure amount: $4,750 The seller really wants to stay in the home, but the HOA has started foreclosure over unpaid dues. There’s solid equity here, and I’d like to find a way to stop the foreclosure, protect the owner, and still make it a win-win. A few ideas I’m considering: - Subject-To or Wraparound Mortgage: Bring HOA current and take over payments, possibly letting the seller buy back later. - Shared Equity Agreement: Cover the default in exchange for a percentage of equity or future sale profits. - Lease-Option Structure: Reinstating the HOA, then leasing it back to the owner with a buy-back plan. - Private Lending / JV: Partner steps in to fund the arrears and secure position against title. I’m still learning the best way to structure this safely and ethically, so if you’ve handled something similar especially HOA foreclosures I’d love your input. Any guidance, examples, or creative strategies are greatly appreciated 🙏

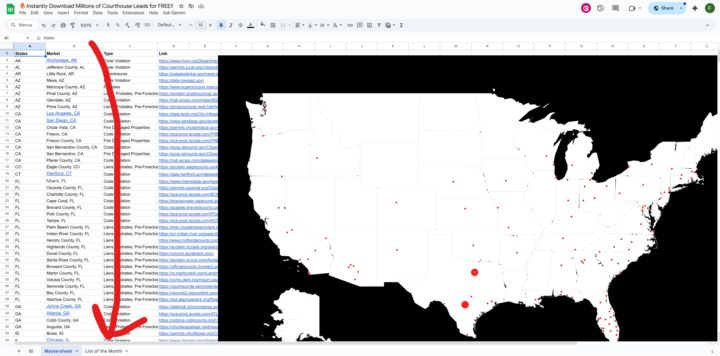

Absentee Owner Skiptraced List for Knoxville! (List of the Month)

Go here and start marketing➡️ #Government Lists Every month, I pull a random list from XLeads.com and skip trace it to share completely free with our community. This month (November), I’m giving away an Absentee Owner List for Knoxville, TN! Enjoy—and as always,Happy Marketing! 🎯

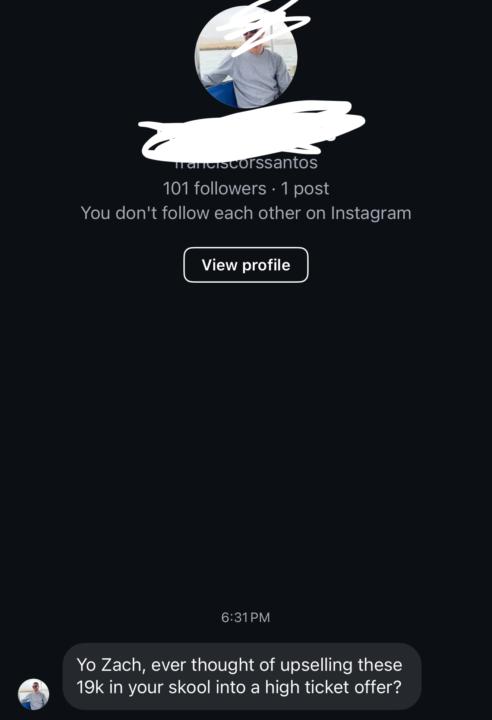

NO!!

Yall need to stop DMing me, I ain’t selling anything. The mission for FreeWholesaling.com clear. You’re not a dollar sign here you’re a wholesaler! 💪 If I catch any of y’all selling coaching in here yall going to get instant banned

JV - call my lists

UPDATE - WE HAVE OUR 3 CALLERS FOR NOW!!! I have 120k skip traces I can do a month. I am going to take on 3 cold callers that want to work with me and JV. Use my system and skip traced leads and I will Dispo your deals. Prefer Florida and Alabama to start. 💪🔥

𝙏𝙃𝙀 𝙂𝙍𝙄𝙉𝘿 𝙒𝙄𝙇𝙇 𝙉𝙀𝙑𝙀𝙍 𝙎𝙏𝙊𝙋‼️😤💌📮

Planted 350 seeds today 🌱 #𝙋𝙧𝙤𝙗𝙖𝙩𝙚𝙃𝙪𝙨𝙩𝙡𝙚 🦾🙏🏾

1-10 of 14

Active 1d ago

Joined Dec 17, 2024

Powered by