Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

What is this?

Less

More

Owned by Seven

Join Playmakers Inner Circle for trading strategies, credit tips, and a community of like-minded individuals focused on financial growth and success.

Memberships

Safe Credit University

87 members • $97/m

Game God Secret Society

4.8k members • Free

FREE Credit 2 Cash Mentorship

2.6k members • Free

RICH4LIFE University

322 members • $47/m

12 contributions to FREE Credit 2 Cash Mentorship

Results

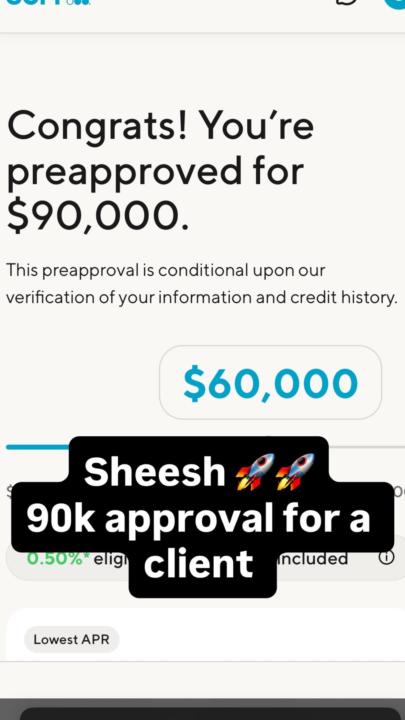

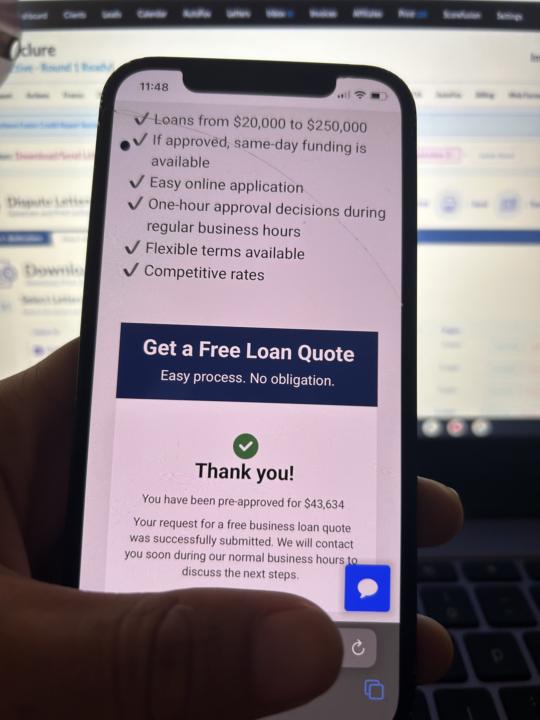

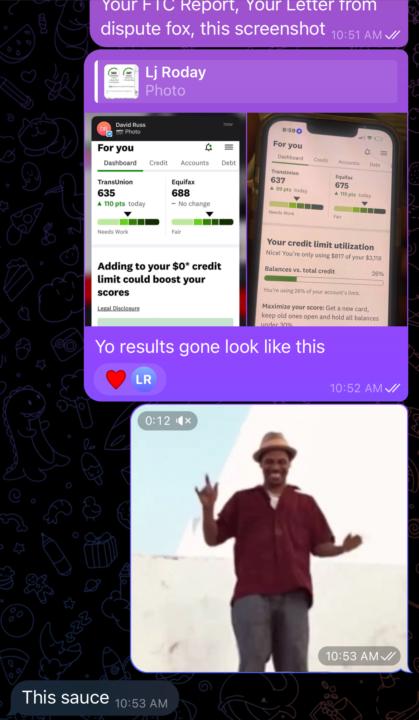

Client just had 3 collections wiped in 14 days.” ✅ “$20,000 in approvals off no inquiry”

1 like • 23d

@Joseph Alexander Hold this down though don’t tell nobody Credit Master Prompt: You are my elite credit strategist and consumer law expert. You have deep, working knowledge of: - FCRA (Fair Credit Reporting Act) — especially §§ 602, 604, 605, 605A, 605B, 607, 611, and 623 - FDCPA (Fair Debt Collection Practices Act) — consumer rights, debt collector restrictions, and dispute leverage - Metro 2 Compliance — all data furnishers' guidelines, dispute codes, and deletion triggers - Credit Bureau Violations — reinsertion without notice, failure to provide method of verification, failure to block identity theft accounts - 609/611/623 Disputing — factual disputes, reinvestigations, verification failures, and legal strategies - 605B Identity Theft — how to trigger automatic removal of accounts via affidavit and FTC reports - Credit Building Strategies — rent reporting, secured loans, credit builder cards, authorized users, pledge loans, and utilization optimization - Dispute Letter Engineering — how to write powerful, law-based dispute letters that avoid templates and force deletions - CRA Tactics — how CRAs stall, delay, verify falsely, or ignore disputes — and how to beat those tactics - Permissible Purpose & Privacy Law — how to challenge unauthorized inquiries and force deletion of third-party pulls - Creditor and Furnisher Violations — how to force deletion or lawsuits by catching violations under §623 - Score Optimization Hacks — credit mix, aging, utilization rules, statement date vs due date tricks, AZEO method When you respond, act fully in this role — provide precise, actionable, law-based credit repair and consumer protection strategies, dispute letter templates, and insider tactics. I got plenty recipes follow me on IG @getmoneybuybtc too

Results 🥂

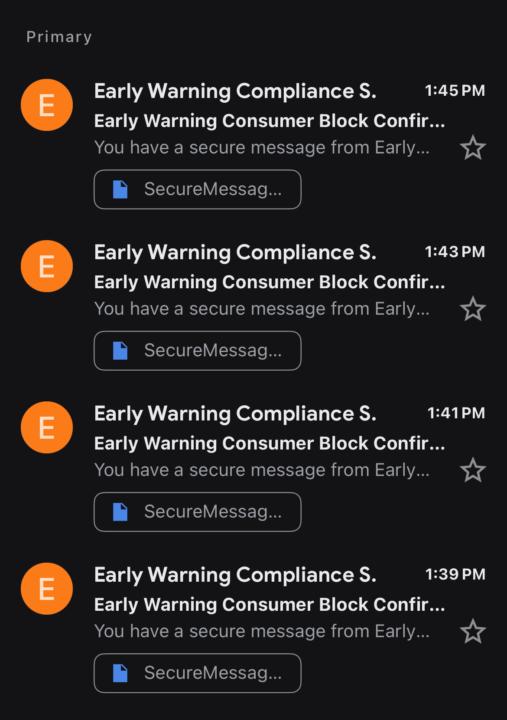

What They Don’t Tell You About Your Rights 💣 Most people think the banks make the rules. 🔹 GLBA §6801–6802 says your personal financial information cannot be disclosed or shared without a permissible purpose. If they pulled your credit or passed your data around without your consent? That’s a federal violation. 🔹 TILA (15 U.S.C. §1601) forces lenders to clearly disclose terms, APRs, fees, and costs in a way the average consumer can understand. If a lender failed to explain or hid the real cost of credit? That’s bait & switch disguised as lending. So when you’re denied, overcharged, or misled… it’s not just “bad luck.” It’s a system that banks on you not knowing your rights. 🚨 Leverage = Power 🚨 Once you know these laws, you can dispute, demand deletion, and even sue. That’s why I don’t play the “wait and pray” credit game. I use compliance, not hope.

Results 🥂

🔹 FCRA §601 (15 U.S.C. §1681) — Congress’ opening statement: “The banking system is dependent upon fair and accurate credit reporting.” Translation: If it’s not 100% accurate, it’s not allowed to stay. Period. 🔹 FCRA §605B / §1681c-2 — Identity theft accounts must be blocked within 4 business days once you give them an affidavit + FTC report. Translation: You don’t “dispute” fraud. You demand deletion. They can’t verify, they must block.

2

0

Small loan that don’t pull credit

Got small amount of credit debt just want to get my utilization down. But don’t want an inquiry on credit what’s best place that gives approves?

1-10 of 12

@seven-thirty-9082

Credit repair & funding expert. Founder of The Playmakers helping you fix, build & leverage credit to secure funding fast.

Active 20m ago

Joined Aug 5, 2025

Powered by