Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

FIBONACCI SKOOL

219 members • Free

Alpha Grid

50 members • Free

RoxeTrader

14 members • Free

ETAforex

65 members • Free

Trade From Zero

124 members • $19/month

The Options Academy

125 members • Free

TradingEDU w/ Chaymeriyia

296 members • Free

Precision Entry

15 members • Free

Simple Option Trading

387 members • Free

1 contribution to Options Jive

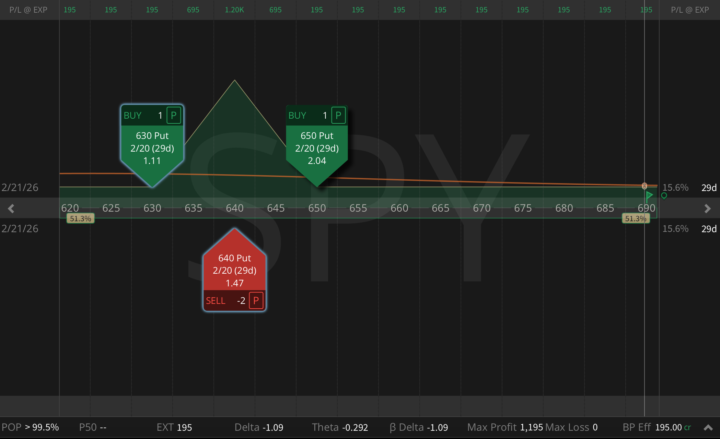

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

Tuesday was one of those sessions where headlines hit like market orders, and implied volatility reprices faster than most traders can think. The catalyst was political, but the effect was purely mechanical: demand for downside protection spiked, put skew steepened, and short-dated IV inflated as Trump escalated trade threats tied to his Greenland push. I opened a SPY 650/640 put ratio spread (1x2), 31 DTE, for a $306 credit. Why enter into a volatility spike? Because in these moments the options market often overpays you for two things at once: downside convexity (puts get bid aggressively) and crash insurance embedded in skew (OTM puts become disproportionately expensive). Then came the key adjustment. I just bought the 630 put for $1.11, and that single move converted the entire position into a risk-free butterfly. And once you complete a symmetric fly for a credit, the payoff becomes pure geometry: - Zero downside risk - Zero upside risk - Max profit: $1,200 (peaks near 640) - Min profit: $195 (everywhere else) - Probability of Profit (PoP): 100% This is the part most retail traders don't internalize: in high volatility, you're not predicting direction; you're engineering a distribution. When everyone's panicking, you can sometimes build free trades because the market overpays for convexity first, and then later hands you the wing cheap enough to lock the structure. I do this setup on SPY all the time, but you can structure it on any liquid ticker: QQQ, IWM, even single names with tight markets. The full playbook (when I complete the wing, and the management tree if price accelerates) is broken down step by step inside The Trading Plan

1-1 of 1

Active 10d ago

Joined Dec 27, 2025