Write something

Amazon After Earnings: When Ratio Risk Beats Naked Risk

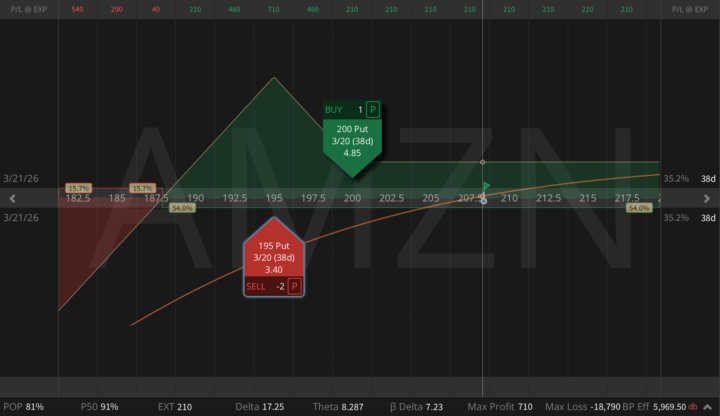

Last week we skipped trading AMZN earnings. Options were pricing 7.5%, reality was -14%, so short gamma was not the place to be. In my personal view it was only a repricing of capex and FCF timing, nothing more. AWS re-accelerated, ads keep growing >20%, NA retail margins are improving, but the market suddenly realized buybacks and FCF are pushed out by heavy AI capex. Post-earnings, the setup changed. The shock is out, downside skew is still rich, and fundamental downside convexity is much lower than before the print. That's why ratio risk now beats naked risk, so today I'm expressing this via a March put ratio:

1

0

Converting a SPY Put Ratio Into a Risk-Free Butterfly 🦋 (Again)

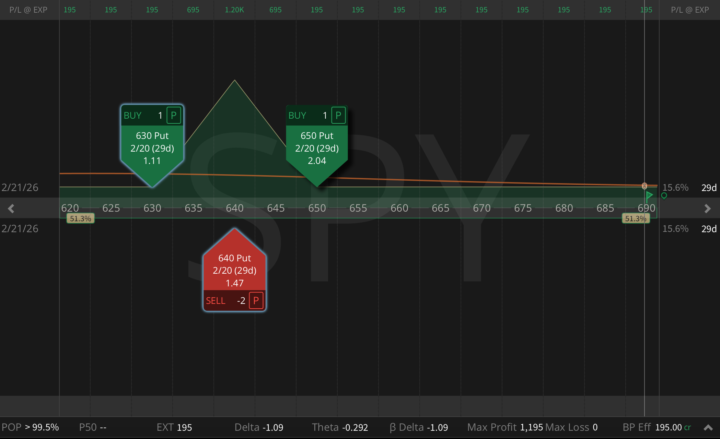

Tuesday was one of those sessions where headlines hit like market orders, and implied volatility reprices faster than most traders can think. The catalyst was political, but the effect was purely mechanical: demand for downside protection spiked, put skew steepened, and short-dated IV inflated as Trump escalated trade threats tied to his Greenland push. I opened a SPY 650/640 put ratio spread (1x2), 31 DTE, for a $306 credit. Why enter into a volatility spike? Because in these moments the options market often overpays you for two things at once: downside convexity (puts get bid aggressively) and crash insurance embedded in skew (OTM puts become disproportionately expensive). Then came the key adjustment. I just bought the 630 put for $1.11, and that single move converted the entire position into a risk-free butterfly. And once you complete a symmetric fly for a credit, the payoff becomes pure geometry: - Zero downside risk - Zero upside risk - Max profit: $1,200 (peaks near 640) - Min profit: $195 (everywhere else) - Probability of Profit (PoP): 100% This is the part most retail traders don't internalize: in high volatility, you're not predicting direction; you're engineering a distribution. When everyone's panicking, you can sometimes build free trades because the market overpays for convexity first, and then later hands you the wing cheap enough to lock the structure. I do this setup on SPY all the time, but you can structure it on any liquid ticker: QQQ, IWM, even single names with tight markets. The full playbook (when I complete the wing, and the management tree if price accelerates) is broken down step by step inside The Trading Plan

SPY Call Ratio: Trading When the Market Gives You Almost Nothing

Let's be very clear about the current environment. The market is not blessing us with classic short-premium opportunities. Implied volatility is compressed. Realized volatility is low. Option sellers are fighting for scraps. And historically, this is exactly when traders get hurt. There are volatility regimes that have repeatedly proven to be toxic for naive premium selling: - Low VIX combined with elevated SKEW - High VVIX / VIX relationships The message is the market is calm on the surface, but convex tail risk is being quietly priced underneath. This is not the environment for short straddles, naked strangles, or heavy short gamma exposure. These structures look safe, until they aren't. And when they break, they break fast! So What Do We Do When Volatility Is Low? I do less, not more. And when I do trade, I remove the downside first. That is the key principle. In low-volatility regimes, the objective is not to maximize premium, but to stay alive while extracting small, structural edges. This is where call ratio spreads become extremely valuable. Why call ratios are the tight tool here? A properly constructed eliminates downside risk entirely, sells overpriced upside volatility, benefits from time decay, does not require a bearish view, and survives quiet, grinding markets. In other words: it allows us to stay engaged without selling our soul to tail risk. - My trade structure: SPY Feb 20, 43 DTE, Buy 1 x 715 Call, Sell 2 x 720 Calls. - Net Credit: $101, Probability of Profit: 82%, Max Profit: $601, Theta: +$5.4 This structure is intentionally placed above spot, where call demand is strongest, and where upside fear is most overpriced. Despite low realized volatility, upside calls remain rich. This is classic late-cycle behavior: fear of missing out, not fear of loss. I sell that fear. Downside risk is removed, this is the most important part. No matter what happens on the downside, there is no gamma crash risk. In today's regime, that alone is worth giving up premium. However, this trade does not have a capped upside loss! This is not a "set and forget" trade. It is a campaign component, exactly as outlined in the Trading Plan.

Microsoft Is No Longer an AI Hype Trade, but It's Still an Opportunity

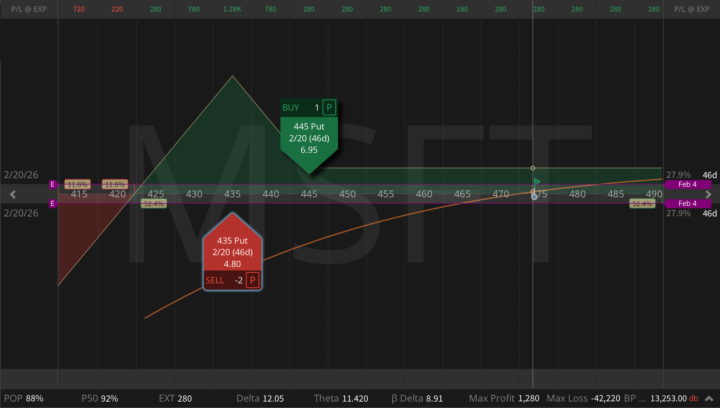

Microsoft is quietly transitioning from an AI hype stock into an execution-constrained business, and the options market has probably not fully priced that shift yet. The key insight most investors are missing is that AI capex is no longer limited by capital or demand, but by electricity, grid access, and deployment timelines. This is a bottleneck. This creates a narrow window where expectations compress faster than price moves, the exact environment where option sellers get paid. Volatility is elevated (IV Rank 29), but nowhere near panic. So, below is the structure I'm using to exploit that disconnect. Asymmetric MSFT Put Ratio Spread: Buy 1 x 445 put, Sell 2 x 435 puts for $280 net credit, >88% Probability of Profit, max profit $1.28k near 435, positive theta and slight bullish delta, risk only on sharp break below 430. The preferred approach is to exit before the January 28 earnings release, or intentionally hold through earnings to capture IV crush if you accept gap risk. This trade is designed to monetize elevated downside volatility while keeping risk not directional. If the short puts are breached, the position is managed according to the Trading Plan.

0

0

My Personal 2026 Market Playbook as an Options Seller and Hedge Fund Manager

As we start 2026, I want to share a few very personal market views and investment ideas I'm going to actively explore this year. This is not a recommendation and not a directional forecast. It's simply how I currently see market structure, volatility, and opportunity from the perspective of an active options seller and short-volatility hedge fund advisor. 1) Metals: the parabolic move may be behind, but volatility lingers Gold and silver already had their most emotional, parabolic phase. The important nuance is that implied volatility rarely normalizes as fast as price action does, and that lag is where options sellers get paid. So, I'll be very active in GLD, SLV, PALL, and URA, both in my personal portfolio and in our hedge fund. The specific edge I'm watching is post-spike IV that stays sticky after the trend fades, especially when the surface flips into volatility backwardation. That's a perfect setup for short-dated and 0-DTE premium harvesting. 2) Crypto: stagnation is the edge My base case for crypto is not another explosive trend, but prolonged consolidation. That's exactly why IBIT, the iShares Bitcoin Trust ETF with liquid options, is so interesting. Implied volatility remains structurally rich, often well above realized volatility. I don't trade crypto directionally, but I sell premium strategically. Compared to the industry's obsession with upside narratives, this approach is far less exciting, but it creates a much more consistent income engine. 3) Rate cuts shift income opportunities If rate cuts continue, my famous "yield engineering" trades like SPX box spreads and risk-free butterflies become less attractive. At the same time, they open a different door. Lower rates support REITs (Realty Income - O - remains my personal favorite), utilities (XLU), healthcare (XLV, UNH), and dividend growth ETFs (SCHD). I consistently combine these with aggressive call writing, creating my Triple Income Strategy. This approach targets an additional 11-18% per annum, with extremely low volatility and zero vega risk!

1-13 of 13

powered by

skool.com/options-jive-1159

STOP trading market direction. Start using options strategies to turn volatility into steady income. We sell premium, and think in probabilities.

Suggested communities

Powered by