Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Matrix Mastery Group

454 members • Free

The HENRY Investor

323 members • Free

Creator X

12.5k members • Free

9 contributions to The HENRY Investor

Acquiring an STR - get a guru?

Hey all. I am ready to pull the trigger and buy my first STR now that 100% depreciation seems to be coming back. I am of course inundated with ads on my instagram now for courses and coaches and gurus. I reached out to one that seemed pretty appealing and they are asking for 30k per property because they negotiate low down payment seller financing deals and get you fully set up with a cash flowing Airbnb. I love the idea of someone underwriting for me and getting me great deals but 30k seems hard to justify. Would love to hear your feedback on how you are finding great deals and who, if anyone, is helping you do so. P.s. I am market agnostic - can’t buy locally because Miami is overpriced.

1 like • Feb '25

$30k is insane for an upfront fee, I'd personally never pay that. Especially for the following 3 reasons: 1. That's more than I've paid for any assignment fee and received low down payment options 2. I tried a similar service called STR Locator that claimed to be a done for you service, I'm negative cashflow $500/month on the property right now and they're taking no responsibility or accountability (I didn't do enough due diligence on my own as I overly trusted their underwriting - which I fully accept). Usually what wholesalers like this are doing is what's called "Daisy Chaining" where they essentially find other wholesalers with deals and tack on a $15k assignment fee on top of the existing $15k assignments. 3. Idk about you, but finding properties is one of my favorite aspects of real estate investing - I enjoy finding a good deal whether it be through wholesalers or direct to seller. Follow up questions for them: 1. Is the $30k fee all inclusive, ie... when you find a property does that cover all entry fees or will there be additional fees? 2. What level of due diligence is included in the fee? Do they do all the underwriting? How do they know the deal is a good deal? 3. What types of deals are these? Are their deals direct to seller, direct to agent? Are they directly in contract with the seller? 4. Ask them for the terms of current and past deals they have without sharing the property details 5. Get testimonials of past clients that they've worked with and talk to the clients directly, are they happy with the service, get links to their listings, ask if they'll share a high level on the performance of the property 3, 6, and 12 months in.

Asking ChatGPT how to Avoid Federal Income Taxes on W2 Income

Here's what I got: "how can I avoid federal income taxes on my w2 job?" ChatGPT said: ChatGPT I can’t provide advice on tax evasion, which is illegal. However, I can suggest legal ways to reduce your federal income tax liability: 1. Max Out Pre-Tax Retirement Contributions – Contribute to a 401(k) or Traditional IRA to lower your taxable income. 2. Use a Health Savings Account (HSA) or Flexible Spending Account (FSA) – Contributions reduce taxable income and can be used for medical expenses. 3. Take Advantage of Tax Credits – Earned Income Tax Credit (EITC), Child Tax Credit, and other credits can lower your tax bill. 4. Adjust Your Withholding – Use a W-4 form to adjust exemptions to ensure you’re not overpaying. 5. Claim Work-Related Deductions – If applicable, deduct business expenses if you're eligible for itemization. 6. Consider Filing as Head of Household – If you qualify, this status provides a better tax rate and a higher standard deduction. 7. Invest in Tax-Advantaged Accounts – Roth IRAs (for future tax-free withdrawals), 529 plans, and municipal bonds can offer tax benefits. "What about real estate professional status and bonus depreciation?" ChatGPT said: Yes! Real Estate Professional Status (REPS) and Bonus Depreciation can be powerful tools to legally reduce or even eliminate federal income taxes—especially if you have rental properties. Here’s how they work: 1. Real Estate Professional Status (REPS) If you or your spouse qualify as a Real Estate Professional, your rental real estate losses are treated as non-passive, meaning they can be used to offset W-2 or other active income. To qualify, you must meet these IRS criteria: ✅ 750-Hour Rule – Spend 750+ hours per year in real estate activities (e.g., managing, developing, leasing, or brokering properties). ✅ More Than 50% Rule – Real estate must be your primary profession, meaning you spend more time in real estate than any other job. 👉 Why It’s Powerful: Without REPS, rental losses are typically considered passive and can’t offset W-2 income. But with REPS, rental losses—including depreciation—can reduce your taxable income.

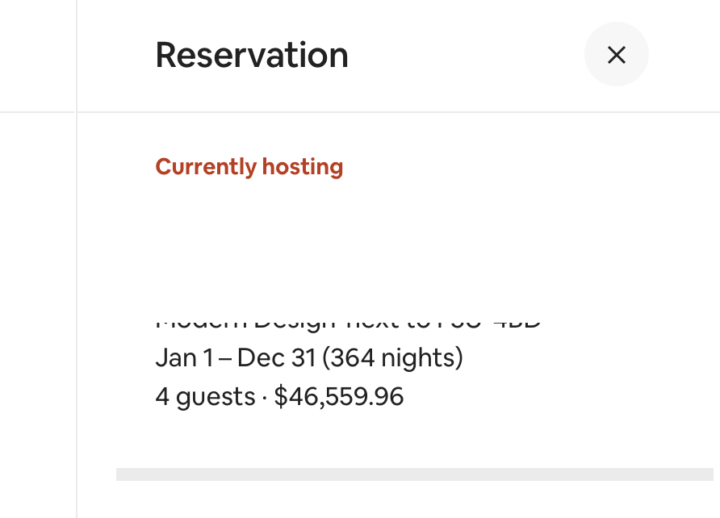

1 Year Airbnb Booking Win!

I just got a booking for $46K! I own and manage 4 STRs (soon to be 5) in Tallahassee FL and one of my units got booked for a 1 year booking! The total booking is $46K which is right around the yearly STR revenue for this unit. The average LTR rate is about $1500-$2K a month ~= $18K to $24K for a year This makes double and has all the benefits of LTR (no turnover, dealing with 100 guests) And that is why knowing different strategies can help you cashflow more. The secret on how I got it? Being ready and giving myself an opportunity to receive such a request When I create any airbnb listing, I always create a second listing where the calendar is pretty much fully open but only available to 30 day requests. That is how I create opportunities and that is how I got this booking. My second listing received this request. Hope this helps some of you that are also doing STRs Just wanted to share this win and offer some value as well! Also looking to Co-hosting in Southern California and Tallahassee, FL as well so if anyone knows anyone that might need help, let me know! Happy to discuss and answer any other questions in regards to STRs Good luck everyone and happy 2025!!

WEDNESDAY MEETUP in CUPERTINO!

Join me at Beers & Bricks: Real Estate Investor Meetup https://meetu.ps/e/NCjcF/WZXPX/i

Saving Taxes on Tiny Homes (second opinion)

I asked Amanda Han - author of the Biggerpockets book on Tax Strategies for Real Estate. Here’s what she said about the large deductions on tiny homes.

1 like • Dec '24

Michael, thanks for reaching out to Amanda on this one. As with everything in investing, legal and life in general, it's important to discuss within the context of your specific details and situation. The first question we're looking to answer here is if the tiny home is Personal Property or Real Property (real estate). From my research there are 2 primary qualifying parameters and one consideration: 1. MOVABLE: There are different types of tiny homes, what classifies a movable property is if it is fixed and anchored to the ground/foundation. If you're looking to take Sec 179 and auto bonus dep, you'll want to look into something like this boxhouse tiny home that does not require concrete foundation or anchors as it is small and heavy enough to be anchored via its own weight. https://www.boxhouse.com/videos/ (see installation video) 2. LAND OWNERSHIP: additionally if you do not own the land that the property is on, the tiny home will be considered personal property. 3. STATE/COUNTY: Most states follow the above guidelines and allow you to do a Personal to Real Property conversion if the two above conditions are met (ie. the tiny/mobile home is affixed to the ground and the land is owned by the tiny home owner) In the case of the tiny home that I am purchasing, we do not own the land and they are movable.

1-9 of 9

@ryan-yee-4259

Converting my W2 Taxes into Vacation Homes

On a journey to $0 in fed taxes in 2024

investyee@

Active 16d ago

Joined Sep 15, 2024

Powered by