Activity

Mon

Wed

Fri

Sun

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

MTR Office Hours

765 members • Free

strIQ Squad

197 members • Free

The AI Advantage

74.9k members • Free

Dopamine Digital

5.4k members • Free

Free Home Cleaning Courses

1.5k members • Free

Tradeline Secrets

1.5k members • Free

AI Automation Society

267.5k members • Free

🏠 Lower Taxes w/ Ryan

1.3k members • $1/year

Grow Your Skool

5k members • Free

15 contributions to The HENRY Investor

Bilt

How’s everyone’s experience with the Bilt credit card? What are the pros and cons? I read that it can also be used for mortgage payment.

Virtual Assistant Tasks

What are some things that you give your Virtual Assistant within your business? I struggle to come up with worthwhile and repeatable tasks currently and would like to hear from others that doesnt necessarily have an active business What do you entrust them to do to help buy back your time and make things easier?

1 like • Feb '25

@Michael Hyun a lot of my time is spent on calling and it's either one off situations which need a lot of context or calls regarding sensitive information (credit card information, SS#) that I need to disclose which is kind of difficult. Some things I have that ive been trying to have my VA do is some accounting and data entry stuff.

Asking ChatGPT how to Avoid Federal Income Taxes on W2 Income

Here's what I got: "how can I avoid federal income taxes on my w2 job?" ChatGPT said: ChatGPT I can’t provide advice on tax evasion, which is illegal. However, I can suggest legal ways to reduce your federal income tax liability: 1. Max Out Pre-Tax Retirement Contributions – Contribute to a 401(k) or Traditional IRA to lower your taxable income. 2. Use a Health Savings Account (HSA) or Flexible Spending Account (FSA) – Contributions reduce taxable income and can be used for medical expenses. 3. Take Advantage of Tax Credits – Earned Income Tax Credit (EITC), Child Tax Credit, and other credits can lower your tax bill. 4. Adjust Your Withholding – Use a W-4 form to adjust exemptions to ensure you’re not overpaying. 5. Claim Work-Related Deductions – If applicable, deduct business expenses if you're eligible for itemization. 6. Consider Filing as Head of Household – If you qualify, this status provides a better tax rate and a higher standard deduction. 7. Invest in Tax-Advantaged Accounts – Roth IRAs (for future tax-free withdrawals), 529 plans, and municipal bonds can offer tax benefits. "What about real estate professional status and bonus depreciation?" ChatGPT said: Yes! Real Estate Professional Status (REPS) and Bonus Depreciation can be powerful tools to legally reduce or even eliminate federal income taxes—especially if you have rental properties. Here’s how they work: 1. Real Estate Professional Status (REPS) If you or your spouse qualify as a Real Estate Professional, your rental real estate losses are treated as non-passive, meaning they can be used to offset W-2 or other active income. To qualify, you must meet these IRS criteria: ✅ 750-Hour Rule – Spend 750+ hours per year in real estate activities (e.g., managing, developing, leasing, or brokering properties). ✅ More Than 50% Rule – Real estate must be your primary profession, meaning you spend more time in real estate than any other job. 👉 Why It’s Powerful: Without REPS, rental losses are typically considered passive and can’t offset W-2 income. But with REPS, rental losses—including depreciation—can reduce your taxable income.

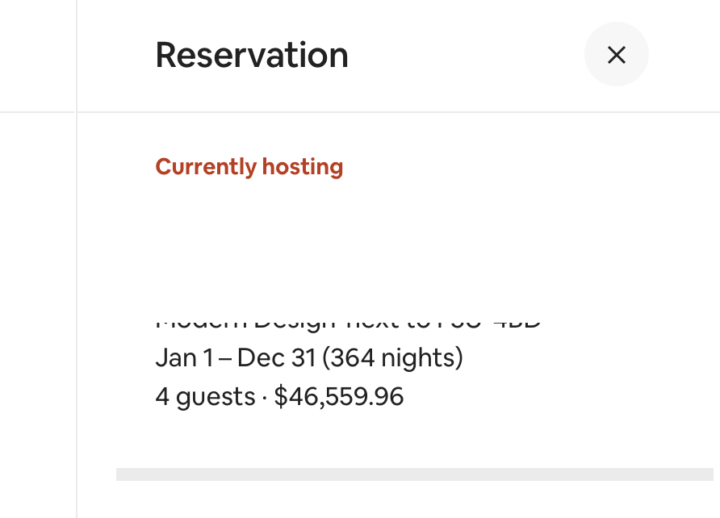

1 Year Airbnb Booking Win!

I just got a booking for $46K! I own and manage 4 STRs (soon to be 5) in Tallahassee FL and one of my units got booked for a 1 year booking! The total booking is $46K which is right around the yearly STR revenue for this unit. The average LTR rate is about $1500-$2K a month ~= $18K to $24K for a year This makes double and has all the benefits of LTR (no turnover, dealing with 100 guests) And that is why knowing different strategies can help you cashflow more. The secret on how I got it? Being ready and giving myself an opportunity to receive such a request When I create any airbnb listing, I always create a second listing where the calendar is pretty much fully open but only available to 30 day requests. That is how I create opportunities and that is how I got this booking. My second listing received this request. Hope this helps some of you that are also doing STRs Just wanted to share this win and offer some value as well! Also looking to Co-hosting in Southern California and Tallahassee, FL as well so if anyone knows anyone that might need help, let me know! Happy to discuss and answer any other questions in regards to STRs Good luck everyone and happy 2025!!

NEED ACTION: Any feedback on Skool?

Would people prefer a different platform? I'd be great to get some feedback!

1-10 of 15

Active 7d ago

Joined Sep 16, 2024

Powered by