Activity

Mon

Wed

Fri

Sun

Nov

Dec

Jan

Feb

Mar

Apr

May

Jun

Jul

Aug

Sep

What is this?

Less

More

Memberships

FREE Credit 2 Cash Mentorship

2.5k members • Free

SAVAGE CREDIT MENTORSHIP

28 members • $70/m

4 contributions to SAVAGE CREDIT MENTORSHIP

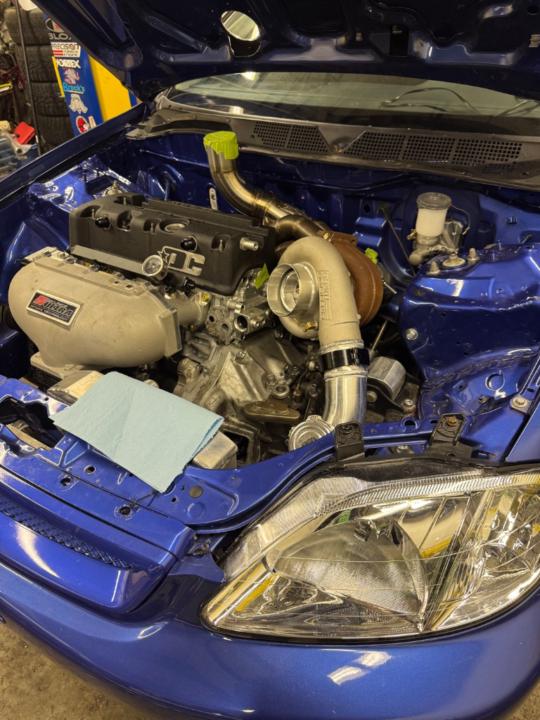

🚨NEW CAR ALERT🚨

What's going on here? 👀 about to show y'all why you need Good credit! All off the SWIPES NO OUT OF POCKET 💳🏎️

QUESTIONS/CONCERNS

How is everyone doing? if you need help with anything please reach out.

CREDIT MONITORING

what's up everyone this is the best credit monitoring service I know off other than Experian, use this link below when signing up to keep an eye on your credit. 💳💯🔥🏦 https://www.myscoreiq.com/get-fico-max.aspx?offercode=432139F1

If you have a 600 credit score, you can still get approved for several credit cards designed for fair credit.

If you have a 600 credit score, you can still get approved for several credit cards designed for fair credit. Here are some good options: 1. Capital One Platinum Credit Card - Key Features: No annual fee, automatic credit limit increases after 5 months. - Why: Great for building credit with fair credit scores. 2. Discover it® Secured Credit Card - Key Features: 2% cashback on dining/gas (up to $1,000 per quarter), no annual fee, and cashback match for the first year. - Why: Good for earning rewards while rebuilding credit. 3. OpenSky® Secured Visa® Credit Card - Key Features: No credit check, requires a refundable deposit, and reports to all three bureaus. - Why: Easy approval with no credit check. 4. Avant Credit Card - Key Features: Low annual fee (~$29), reports to all three bureaus. - Why: Designed for fair credit, with a simple process. 5. Credit One Bank® Platinum Visa® - Key Features: 1% cashback on eligible purchases, reports to all three bureaus. - Why: Good for earning cashback while rebuilding credit. 6. First Progress Platinum Elite Secured Mastercard® - Key Features: Low annual fee of $29, requires a refundable deposit, and reports to all bureaus. - Why: A solid secured card for building credit. 7. Milestone® Gold Mastercard® - Key Features: Reports to all bureaus, annual fee between $0–$99. - Why: A decent option for those with fair credit. 8. Indigo® Platinum Mastercard® - Key Features: Pre-qualification with no hard inquiry, reports to all bureaus. - Why: Easy approval for fair credit applicants. Tips: - Go for secured cards: Easier approval with a refundable deposit. - Pay on time: Helps improve your score and creditworthiness. These cards offer a good mix of rebuilding credit with minimal fees.

1-4 of 4