Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

Retire On Margin

157 members • Free

OptionProfits

498 members • Free

9 contributions to Retire On Margin

🔥 $3,369 Income - 17/17 Wins - 100% Profit! 🔥

Some of you asked me about the market crash and being scared... We made $3,369 this month. 17 trades. 17 wins 🔥 0 losses 🔥 How much did you make from my trade ideas? Are you a member? If not, what are you waiting for? Can another $3,369 per month help you? The price is about to jump, and based on these results, I should price it 10x more. Join - https://www.skool.com/retire-on-margin-9223/classroom Ziv

No Trade Ideas Today - Here's Why

I follow Tasty and they say take trades 45 days to expiration. I tweaked it to take trades 40-60 days to expiration. We are 35 days to exp now so I do nothing for 2 weeks and let time decay do its thing. That's how I roll and no gambling involved. There's around $3,000 income for the trades of this month (and the same for months before that) This is what I do and slowly but surely my account grows every month with less stress. That is my money to keep (no Nav Erosion like YieldMax that I love btw) This is me going every day to the market and getting paid using the same skill that I teach you so you can do the exact same thing. Have the education - join the course and learn how to pay all your monthly bills. That's my goal - to pay all my monthly bills. Nothing more, nothing less. Not 10k/month nonsense hype. Prices for the paid stuff going up on March 1st so I'm letting you know in advance. Have a great Valentine's Day and buy yourself the present of a forever income skill. Ziv

🔥 02/06/2025 Trade Idea 🔥

Hello everyone, Volatility is very low this morning so only 1 trade today for everyone to see here. We have 6 other trades in the classroom area posted this week. I trade when the reward is worth the risk. $KR - $65.58 - selling $60 puts - $140 income (2 contracts) - $3,600 BP - Mar 21st

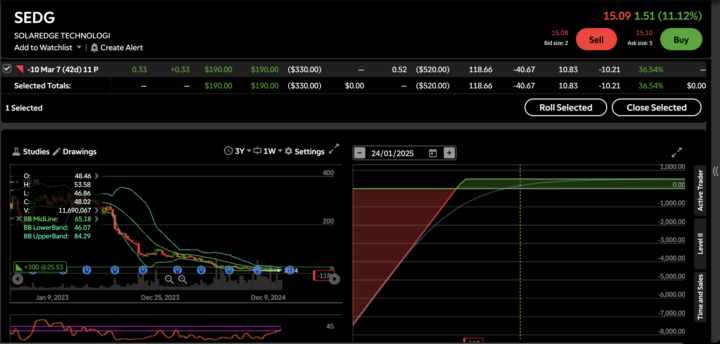

💡 Selling Cash-Secured Puts on $SEDG 💡

📈 Trade Overview: I sold 10 cash-secured put contracts on $SEDG: - Strike Price: $11 - Premium Received: $52 per contract - Total Premium: $520 - Days to Expiration (DTE): 42 days 📊 Calculating ROI: Each contract requires $1,100 in collateral (strike price × 100 shares). For 10 contracts, the total collateral is $11,000. ROI=Total Premium ReceivedTotal Collateral×100\text{ROI} = \frac{\text{Total Premium Received}}{\text{Total Collateral}} \times 100ROI=52011,000×100=4.73%\text{ROI} = \frac{520}{11,000} \times 100 = 4.73\% That’s a 4.73% return in just 42 days! Annualized, this would equate to approximately 41% ROI if repeated consistently. 🚀 💡 Why I Took This Trade: 1. Strong Support: $SEDG shows solid technical support near the $11 level, reducing the risk of the stock dipping below this strike. 2. Risk-Adjusted Return: The premium offered a good risk/reward balance, especially with the relatively low probability of assignment. 3. Capital Efficiency: Selling puts keeps me in control. If assigned, I’m comfortable owning $SEDG at $11/share, a discount from current prices. 🧠 Key Learnings: - Selling cash-secured puts is a fantastic way to generate income while positioning to own shares at a discount. - Always calculate ROI and assess risk before entering any trade. 🚀 February Progress Update: 💰 Premium Collected: $1335 / $2000 Goal ✅ Keeping the momentum strong!

1-9 of 9

Active 34d ago

Joined Dec 6, 2024

Powered by