Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

The AI Advantage

72.2k members • Free

Tradeline Secrets

1.2k members • Free

AXCENTIS Credit Academy

43 members • $15/m

Coach Capital

2k members • Free

8 contributions to Tradeline Secrets

How I find "secret" lenders

This is another system no other lending company has. Its how I find "secret" lenders others don't have. And for the first time ever. I'm gonna share it with others in my VIP Skool. Still being worked on as we speak. Have been very busy but I do see everyone who has messaged me. And I see all your comments. Even though it takes me a while to respond. As long as your patient. I will get back with you. Thanks!

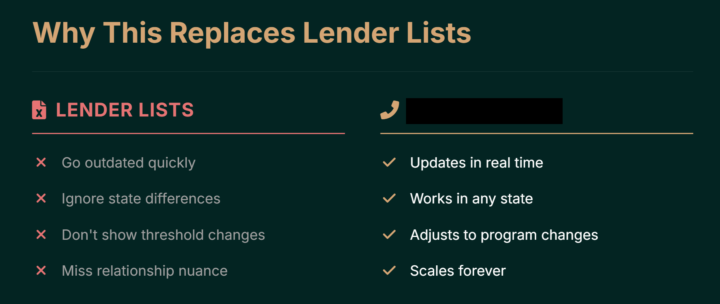

Why I Don't Compete With "Funding Gurus" Anymore

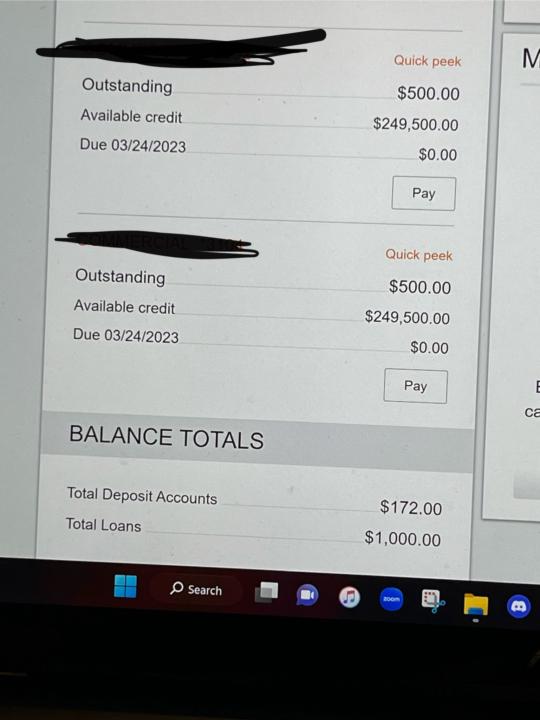

Same client. Two separate $250,000 business lines. That's $500,000 in straight cash buying power. Let me be clear about something: I'm not a credit card stacker. I'm a loan broker building a national syndicate. While most "funding gurus" are still teaching you how to get approved for a $5,000 Office Depot card... I'm placing clients into: - Six-figure business lines of credit - SBA acquisition loans through specialized partners - Commercial real estate financing - Business purpose mortgages Here's the difference in market positioning: The typical funding program sells you on business credit cards because that's all they know how to execute. I use 0% business credit as the entry point because of speed and accessibility—but that's just the beginning of what's possible when you understand the full lending landscape. My network includes: - SBA loan specialists who close acquisition deals - Commercial lenders who structure property financing - Private money contacts for deals banks won't touch - A growing syndicate of lending professionals across every major vertical Most "funding companies" teach the same recycled Paydex playbook because they've never actually worked in lending. I've been in this industry since 2016. I understand bank underwriting. I know what signals approval across personal credit, business credit, and institutional lending. This education isn't about credit cards. It's about understanding the entire funding ecosystem so you can access the right capital at the right time for the right purpose. - Need fast working capital? Business credit cards. - Need to acquire a business? SBA specialists in the network. - Need commercial property financing? I've got the referral. That's why VIP aren't just "credit stacking courses." They're designed to teach you how funding actually works across the spectrum—so you're not limited to one lane like every other program out there. The credit card stack is the hook. Still treating this like a credit card group? You're missing the point.

I spent 4 weeks writing credit repair letters

Alongside a repair expert with a consumer law background Who trains lawyers to sue debt collectors and win Its a simple framework. Made up of 3 parts. Damages, Facts, and Penalties. First you create damages. Damages is how we get paid in law suits. Create damages by answering these questions: What --> what happened? (effect of bad credit) How --> how made you and/or fam feel? (State facts prove this) Why --> why it happened? (blame CRA) Second come the facts or how the law was broken. All we do is detail what and how they broke the law. Create fact by answering these questions: What --> what law they broke? Why --> why they broke it? How --> how they broke it (step by step) When --> when is their deadline Finally come penalties so that we can collect damages. Let em know their situation And that we will litigate How --> How long you've been disputing these accounts? Why --> Why they must delete accounts (declare effect) --> sentence sums damages Red pill, blue pill --> present options (good or bad) So what's unique and different? 1. All of the letters are unique because the answers change! Therefore they do not get flagged and rejected. Like other templates. 2. Because I learned from someone who is basically a lawyer. He taught me the proper way to apply the law. Application is not the same as definition! Therefore I truly know the law. 3. Our letters follow a legal framework. Which means they will hold up in court (Damages, Facts, Penalties) 4. He taught me the dispute flows his attorney's use to sue and win. I have no intentions to sue. But I do have intention to win. 5. I focused on the one skill that matters. LETTER WRITING. Once you build solid letters you just plug into the dispute flow. Law training (dispute flow) is easy. There are many flows you can follow. P.S. - This post is enough to repair your credit on your own. Just answer the questions. Or consider hiring me and my team.

Have you heard of the Transunion "secret" lender?

If not then listen up. First its not a lender but actually an underwriter that offers this. With a 780+ and the right accounts. You can get up to 63k in 0% business financing with Elan Financial. This how I can get the right profile funded same day within 24 hours. Not always but now you know a secret of the trade. Key lesson? This is the benefit of working with a seasoned funding company. I have banks and lenders for various scenarios.

Webinar Recording

Incase you missed the Webinar....Here is the live recording. In this live session, I break down how business credit actually works and why most people get stuck chasing the wrong things. We cover: - What PAYDEX really is and why people obsess over it - The role personal credit still plays in business funding - Why net30s help, but rarely lead to real limits on their own - How banks actually look at business credit profiles - What separates small approvals from real business credit lines This isn’t theory or guru advice. It’s based on what actually gets approved. If you’re trying to build business credit or position yourself for real funding, this will save you time and mistakes. P.S. - this is my first time doing a webinar. Next time I plan to have slides but what are other ways I can improve? And what other topics should I go over? P.P.S. - I will also upload to my YouTube channel in case the video is deleted later.

1-8 of 8

Active 2d ago

Joined Dec 2, 2025

Powered by