Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Owned by MzSunshine

Start your own profitable medical courier business in the next 30–60 days — even if you're starting from zero.

Memberships

Women’s Wealth Academy

281 members • Free

Ivy Wealth Academy

1.7k members • Free

The Entrepreneur Hub 🐐 (Free)

8.1k members • Free

Sweetz Digital HQ

1.6k members • Free

Skoolers

190.3k members • Free

Medical Courier Hub

537 members • $28/month

Credit On Point

769 members • Free

Pandora's PLR Box

15 members • $17

Business Ideas

788 members • Free

5 contributions to GBC University

Mandatory Annual Tax Bank Compliance Training

⏰SBTPG reviewed our business this year and DID NOT APPROVE REFUND ADVANCES! ⏰They did approve us to use REFUND TRANSFERS (Take the fee from the refund) ⁉️⁉️⁉️BE SURE TO UPDATE YOUR FLYERS and SOCIAL MEDIA POSTS⁉️⁉️⁉️ 1. Watch the video...............⏰Comment Done⏰ 2. Click here to complete your W9 & Direct Deposit info here https://forms.gle/PGjAVsMBzhAyN2Uq9

Sale Ended / $2 Complete Tax Business System🔥 NEW MEMBERS ONLY OFFER 🔥

SALE ENDS TODAY 12/30🔥 NEW MEMBERS ONLY OFFER 🔥For a very limited time, (Tax Pro 360) is dropping from $27 → ONLY $2 😳💥This is the gateway to launching a real tax business the right way. NEW MEMBERS:👉 Grab the link, join the Skool, and unlock the course for just $2. We’ll see you inside. 💼✨ CURRENT COMMUNITY MEMBERS: 👉 Use this offer to add new people to our community and build YOUR TAX TEAM. This is the perfect way to bring in partners, preparers, and earn overrides. 📈🤝 Tax Pro 360 Includes: ✅ PTIN → EFIN → Bank Product roadmap ✅ How to set pricing & get clients ✅ Client count income examples ✅ Scripts, setup tools & confidence boosters 💰⚡️ 💰⚡️No barriers. No excuses..........Just growth.

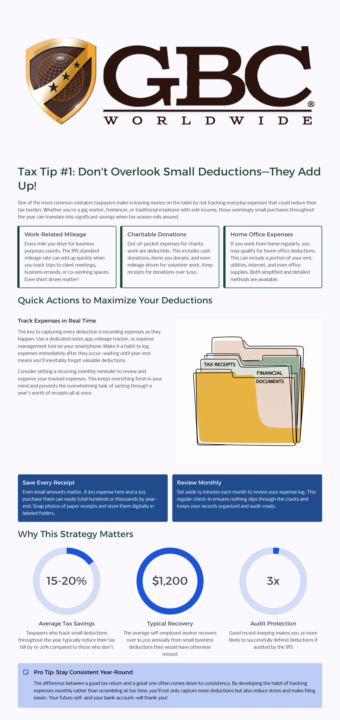

Tax Tip #1

Tip #1: Don’t Overlook Small Deductions—They Add Up! Many people miss out on tax savings by forgetting to track small expenses throughout the year. For example, did you know you can often deduct things like work-related mileage, out-of-pocket charitable donations, or even certain home office expenses? Quick action: - Keep a simple log (on your phone or a notebook) of any work or charity-related expenses as they happen. - Save receipts, even for small amounts—they can really add up at tax time! Why it matters: - Every little deduction can help lower your tax bill or boost your refund. - Good records make filing easier and help if the IRS ever asks for proof. Stay consistent—review your expenses each month so nothing gets missed when it’s time to file!

Welcome to GBC University!

GBC University is a online learning community dedicated to building communities of excellence, 1 person, 1 family & 1 business at a time..........Keep getting better everyday! 👇👇👇

1-5 of 5

Active 3d ago

Joined Sep 19, 2025