Activity

Mon

Wed

Fri

Sun

Mar

Apr

May

Jun

Jul

Aug

Sep

Oct

Nov

Dec

Jan

Feb

What is this?

Less

More

Memberships

💳MYFREECREDITSKOOL💳

1.2k members • Free

Main Way to Wealth

17k members • Free

5 contributions to 💳MYFREECREDITSKOOL💳

Authorized User & Tradelines

Any recommendations on how to find these if we don’t have family or friends who can help out?

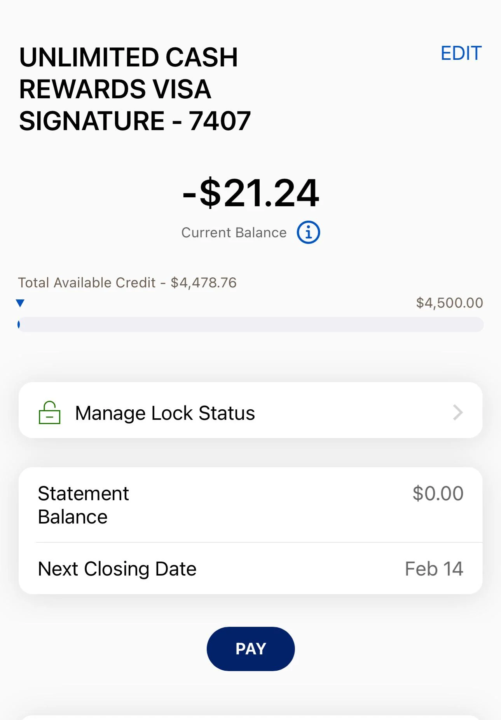

-21.24 Negative Bank Account

I have had my fair share of Christmas where I had no money in the account and felt like a failure. And told myself, I will never be in this situation ever again. I had to take control of my finances and sacrifice and put my head down and learn credit. If you are in this situation, remember nothing worth wanting will not happen without sacrifice. Share your 2026 GOAL and what are you ending 2025 year by doing ???????

What is your current job or job you left for Entrepreneurship

I want to genuinely know

2 likes • Dec '25

I’m currently a full-time entrepreneur. I run a professional dog walking business that’s been my main income foundation for years. Alongside that, I’m a YouTube creator and strategist. I built and monetized my own channel and now help others with YouTube strategy, content structure, and growth. I’m also launching my weight loss and mindset coaching business/ YT channel in January, based on my own 80 lb transformation. Right now I’m juggling client work, content creation, and building that brand for launch.

NFCU questions

I just watched the Navy Federal Road to 20K in 95 Days video and had a couple quick questions based on where I’m currently at. Here’s what I already have in place: - Flagship checking account - Savings account - CD account - Just approved for an unsecured Cash Rewards card for $2,200 two days ago - Pledge loan that is already over 90 percent paid down What I am still missing: - Authorized user account - Tradeline - Money market savings account - Direct deposit (I am currently self-employed and will be opening my S Corp and setting up payroll through Gusto next month to establish this) I understand the next step is to let this new Cash Rewards card age for about 95 days before requesting a credit limit increase and then moving pre-qualify for second card? My main questions are: 1. For those of us who don’t have family or friends with clean, strong credit, what is the best way to legitimately get an authorized user account or tradeline without risking our profile? 2. For the money market savings account, is it okay to open it with a balance under $2,500 for now, even if it is something like $100? Appreciate everything you are teaching in this space. Your roadmap finally made this feel structured instead of confusing.

4

0

What’s your main goal with your credit right now? 👇

💡If you had to choose one, what’s your top goal with your credit? ✅ Building it? ✅ Repairing it? ✅ Boosting your score? ✅ Buying a home? ✅ Buying a car? 👇 Drop your goal below 👇

1-5 of 5

@marlene-melendez-3059

Hello 👋 I’m Marlene.

YouTube Content Creator & Strategist.

Weight Loss Transformation Specialist.

Small Business Owner.

Active 9d ago

Joined Dec 3, 2025

Powered by